AI Agent Market Plunges 77%, but Could a Comeback Be Ahead?

AI agent tokens are facing a sharp market downturn, sparking concerns over long-term viability. Could innovation and investment fuel a comeback?

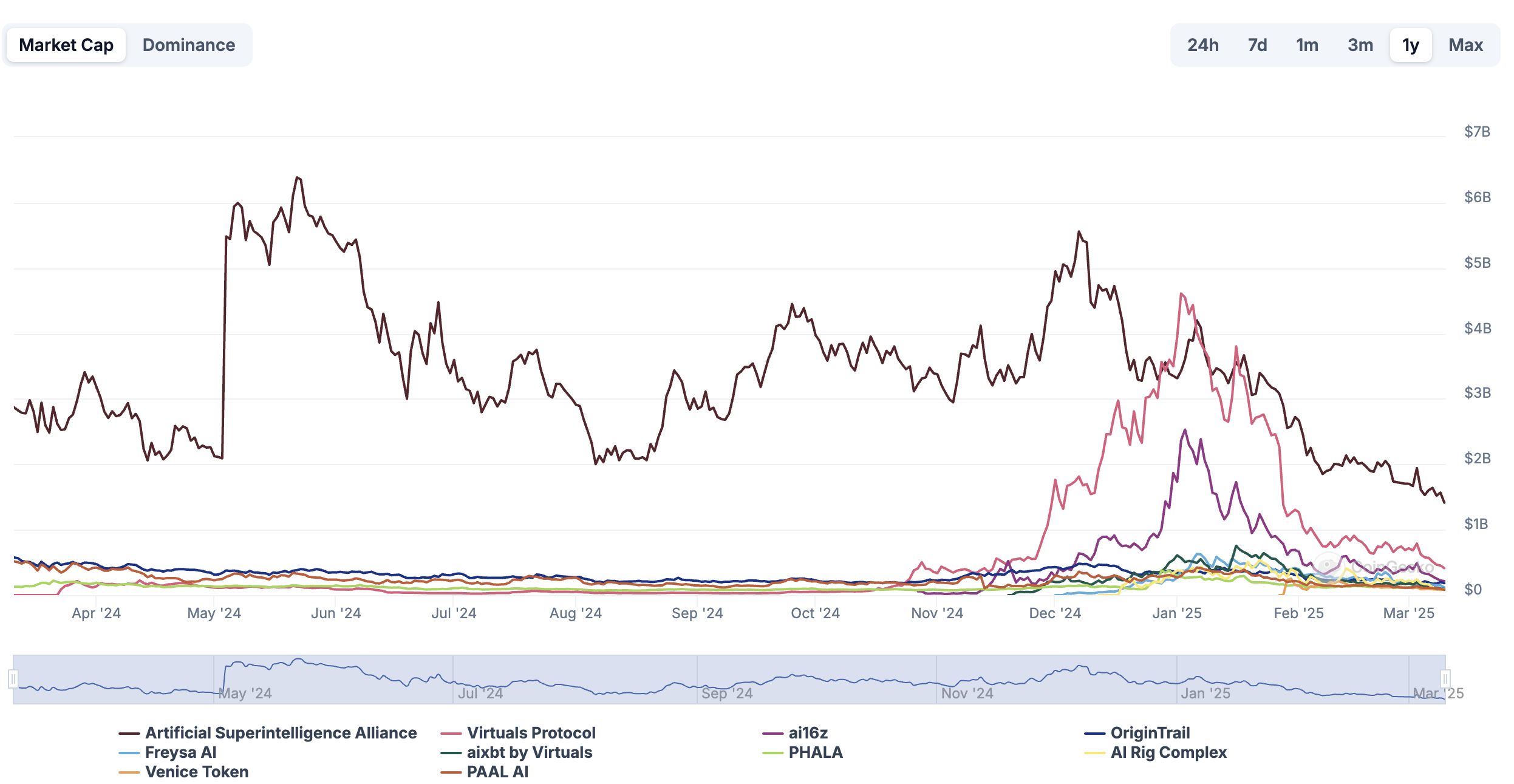

The artificial intelligence (AI) agents crypto sector is facing continued losses, with its total market capitalization dipping below $5 billion amid a broader decline.

The ongoing slump has raised concerns about the sector’s stability, sparking debate regarding its long-term potential.

AI Agents Face Major Market Slump

This downturn follows a period of rapid growth. The majority of the top AI agent tokens saw substantial gains, peaking between December and January. Nonetheless, that momentum has now reversed.

AI Agents Market Performance.

AI Agents Market Performance.

The decline has affected nearly all AI tokens, with most following a similar trajectory in the crypto market.

“The sector has declined 77.5% from its peak,” Whale Insider posted on X.

According to the latest data, the sector suffered a 6.8% loss in the past 24 hours alone, bringing its total market capitalization down to $4.4 billion. Additionally, all of the top 10 AI tokens have recorded double-digit losses over the past week, signaling a widespread correction.

Further insights from Cookie Fun reveal that the downturn is spread across multiple blockchains. Solana’s (SOL) AI Agents sector has seen a 4.3% decline over the past day. Its market capitalization stood at $1.1 billion.

Similarly, Base’s AI sector has dropped to $736.6 million, marking a 5.8% loss over the same period.

Other blockchain networks hosting AI-related tokens have been hit even harder, with their collective market cap shrinking to $722.2 million, down a staggering 15.2% in the last 24 hours.

The Future of AI Agents: Still a Game-Changer?

While the sector’s sharp decline has raised concerns about its long-term viability, Guy Turner, founder of Coin Bureau, argues that it is still too early to dismiss the potential of AI Agents.

“With the right catalyst, not only could it recover, but it could even surge to new heights,” Turner said.

He believes AI Agents could see renewed interest as AI technology advances, drawing fresh adoption. Turner pointed to retail engagement, regulatory clarity, and institutional investment as key growth drivers.

According to him, support from governments, tech firms, and financial institutions could legitimize the sector, shifting it from speculation to a major market force.

That’s not all. Turner also acknowledged the possibility of a meme coin resurgence acting as a short-term catalyst. While AI Agent tokens are sometimes dismissed as “meme coins with a chatbot attached,” he believes this perception oversimplifies their true potential.

“AI agents are clearly a disruptive force, and we don’t yet know exactly how much value they can provide but you can bet your bottom dollar that tech companies everywhere are going to do whatever it takes to find out,” he added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off

$110M XRP Moved from Australia’s Top Exchange. Here’s the Destination