SEC vs. Ripple Case Nears Conclusion: Impact on XRP and Crypto Regulation

The prolonged legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs regarding the classification of XRP as a security is reportedly nearing its end. This development holds significant implications for Ripple, XRP , and the broader cryptocurrency market. Here is an XRP price prediction following such news.

Background of the SEC vs. Ripple Case

In December 2020, the SEC filed a lawsuit against Ripple Labs and its executives , alleging that the company raised over $1.3 billion through an unregistered securities offering by selling XRP tokens. Ripple contested the allegations, asserting that XRP should be classified as a digital currency, not a security.

Recent Developments in the Ripple SEC Lawsuit

In August 2024, U.S. District Judge Analisa Torres issued a mixed ruling. She determined that Ripple's institutional sales of XRP violated securities laws, while its programmatic sales to retail investors did not. Consequently, Ripple was fined $125 million and prohibited from selling XRP to institutional investors.

Both parties filed appeals, but recent shifts in the SEC's approach , including the dropping of cases against major crypto firms like Coinbase and Kraken, indicate the agency may be preparing to conclude its case against Rippl e. The departure of former SEC Chair Gary Gensler has also contributed to this changing landscape.

XRP Price Prediction: New ATH?

The potential resolution of the case has significantly influenced XRP's price dynamics . Following reports suggesting the SEC may soon wrap up the case, XRP witnessed increased market activity, reflecting optimism among investors. Historically, legal updates in this case have directly impacted XRP's valuation, and a favorable resolution could drive further price appreciation. Conversely, continued regulatory pressure may suppress bullish momentum.

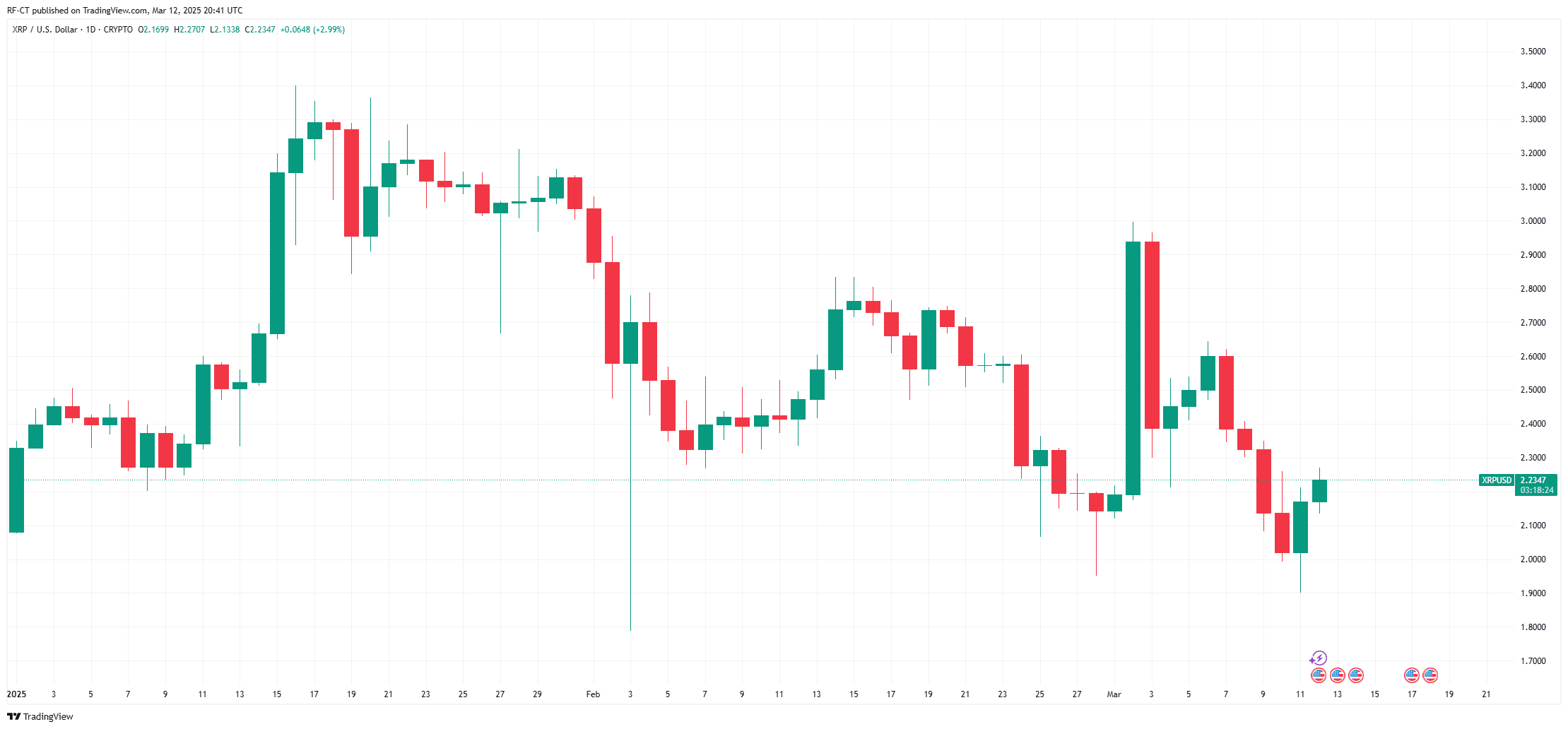

By TradingView - XRPUSD_2025-03-12 (YTD)

By TradingView - XRPUSD_2025-03-12 (YTD)

Implications for Ripple and the Cryptocurrency Industry

The anticipated conclusion of this case could have far-reaching effects:

- Regulatory Clarity: A decisive outcome may provide clearer guidelines for the classification and regulation of digital assets in the U.S., influencing future regulatory strategies.

- Market Confidence: Resolving the case could strengthen investor confidence in XRP and other cryptocurrencies, potentially attracting more participants to the market.

- Ripple's Business Prospects: With diminished legal uncertainties, Ripple can focus on expanding its services and forming new partnerships without the overhang of litigation.

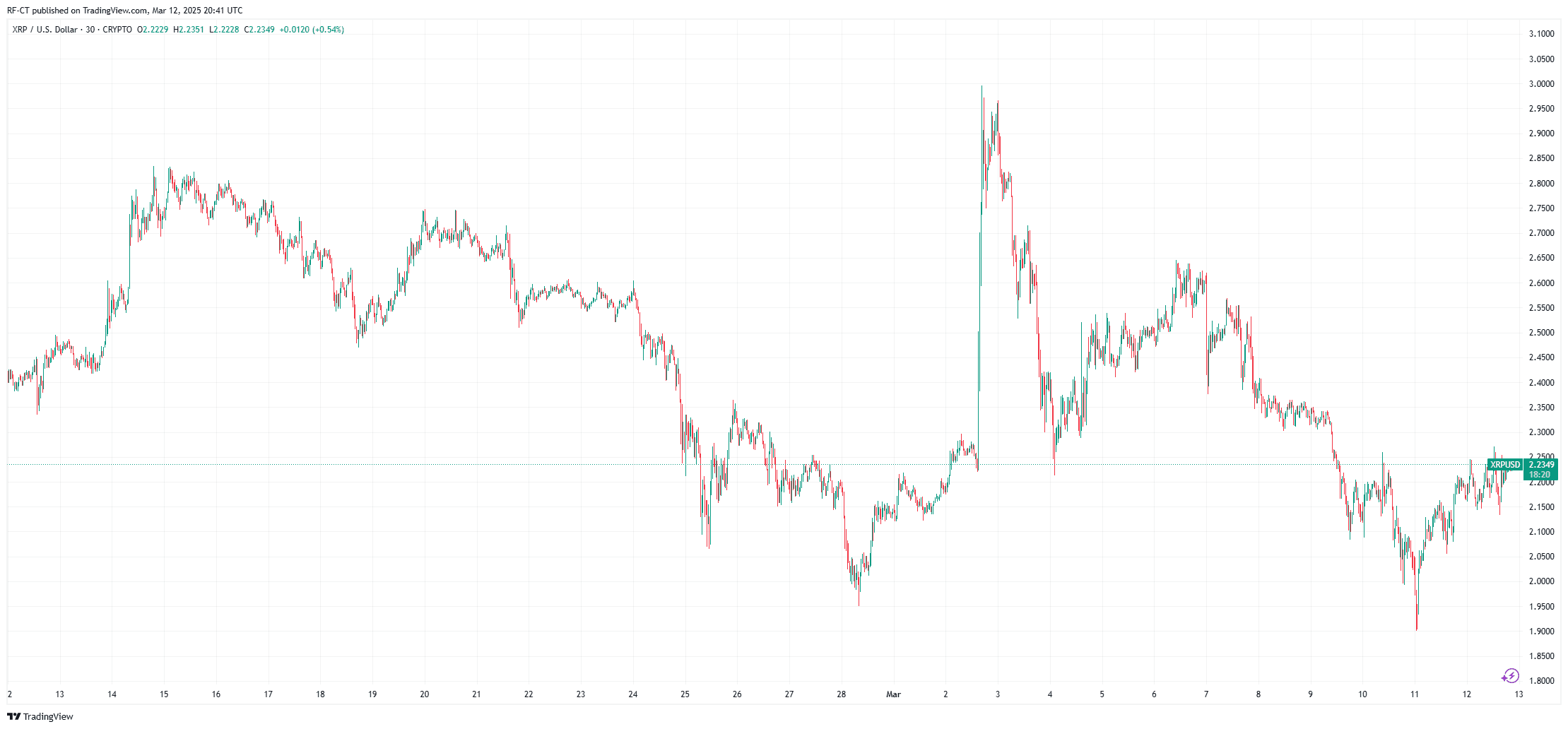

By TradingView - XRPUSD_2025-03-12 (1M)

By TradingView - XRPUSD_2025-03-12 (1M)

The nearing conclusion of the SEC’s enforcement action against Ripple marks a pivotal moment for the cryptocurrency sector. It highlights the evolving relationship between regulatory bodies and digital asset companies, emphasizing the need for consistent and transparent regulatory frameworks. For XRP, the case’s outcome could be a decisive factor in shaping its price trajectory and market presence.

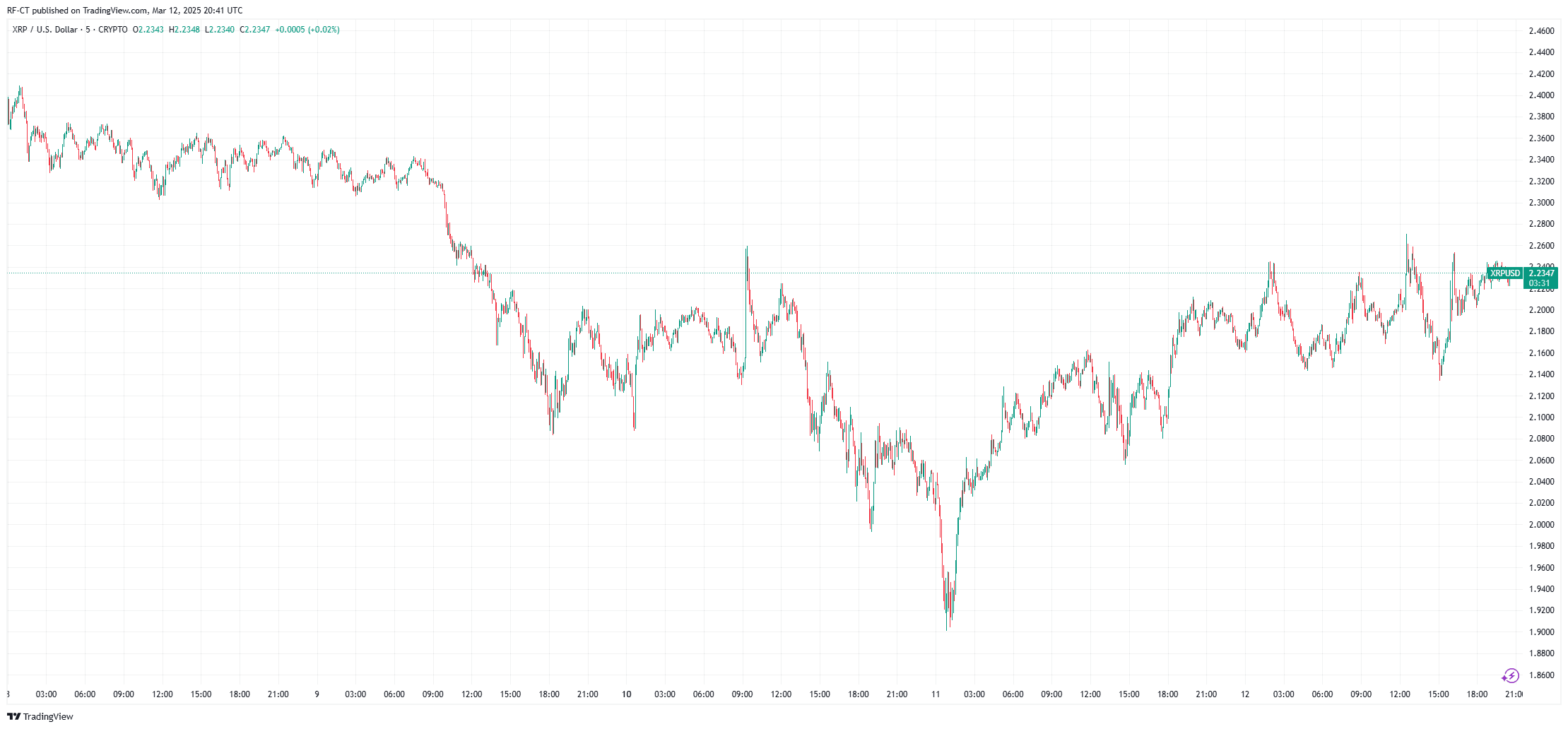

By TradingView - XRPUSD_2025-03-12 (5D)

By TradingView - XRPUSD_2025-03-12 (5D)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

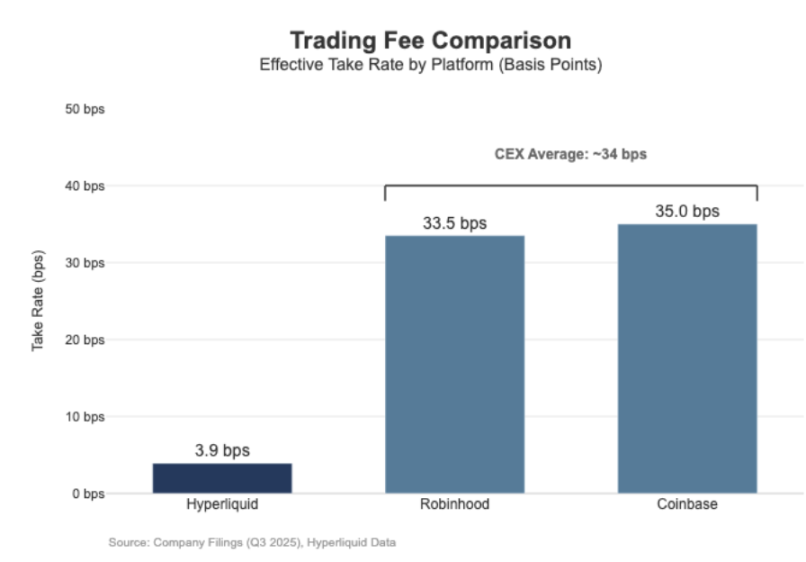

Hyperliquid at a Crossroads: Follow Robinhood or Continue the Nasdaq Economic Paradigm?

Superform Closes Token Sale with $4.7M in Commitments, as SuperVaults v2 Launches

Uniswap vote may soon tie the value of UNI tokens to its multi-billion dollar trading engine

Digital Asset Treasuries Draw In $2.6B Amid Crypto Market Uncertainty