TRUMP meme coin pumps, then dumps after fake utility news

Key Takeaways

- The TRUMP meme coin price surged 19% before falling due to fake utility news spreading on X.

- DB's compromised account spread false reports, leading to confusion and price volatility.

Share this article

The TRUMP meme coin saw a sudden 19% surge before plummeting after false reports circulated that it would have real-world utility.

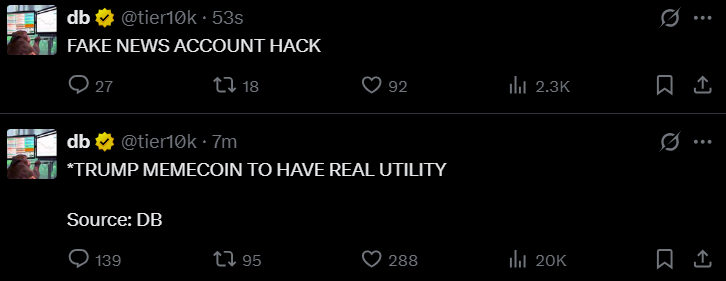

The digital asset jumped from $10.4 to $12.4 after DB, a prominent crypto news outlet, posted on X that the TRUMP token would “have real utility” on Thursday.

The surge was short-lived as a follow-up post appeared approximately seven minutes later claiming the account had been compromised. The TRUMP token price fell to $10.8 following the statement.

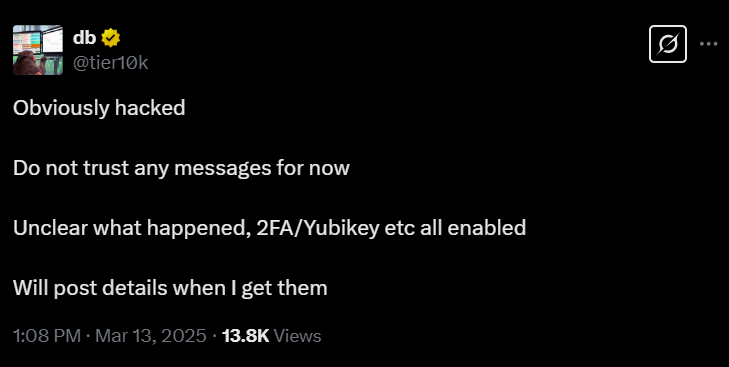

Initially, it was uncertain whether hackers or DB posted the second tweet. Ansem and others in the crypto community observed a grammatical error in the tweet, suggesting the security breach had yet to be resolved.

Some X users reported that DB’s account also shared fake news that BlackRock had filed for a spot HYPE ETF.

DB has since removed the unauthorized posts and issued a statement asking users to disregard messages posted during the security breach.

The news outlet confirmed an investigation is in progress and will provide updates when available.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.

Deep Reflection: I Wasted Eight Years in the Crypto Industry

In recent days, an article titled "I Wasted Eight Years in the Crypto Industry" has garnered over a million views and widespread resonance on Twitter, directly addressing the gambling nature and nihilistic tendencies of cryptocurrencies. ChainCatcher now translates this article for further discussion and exchange.