PENGU and PNUT Remain Bearish Despite Robinhood Listing

PENGU and PNUT show signs of recovery, but meme coin sentiment remains weak. Clearing key resistance levels could trigger stronger breakouts.

Meme coins have struggled to regain momentum despite the recent listing of PENGU and PNUT on Robinhood. While these tokens were expected to surge, their price action has remained subdued, reflecting broader skepticism in the market, especially around meme coins.

However, their RSI levels indicate room for further growth if buying pressure increases and meme coin sentiment improves. If momentum recovers, both PENGU and PNUT could test key resistance levels, potentially reversing their recent downtrends.

PENGU Has Been Trading In All-Time Lows

PENGU, an NFT token on Solana, has lost nearly 80% of its value in the past two months, with its market cap now at $400 million.

Today’s Robinhood listing saw the token surge by 6%, but technical indicators show it still lacks momentum for a strong recovery.

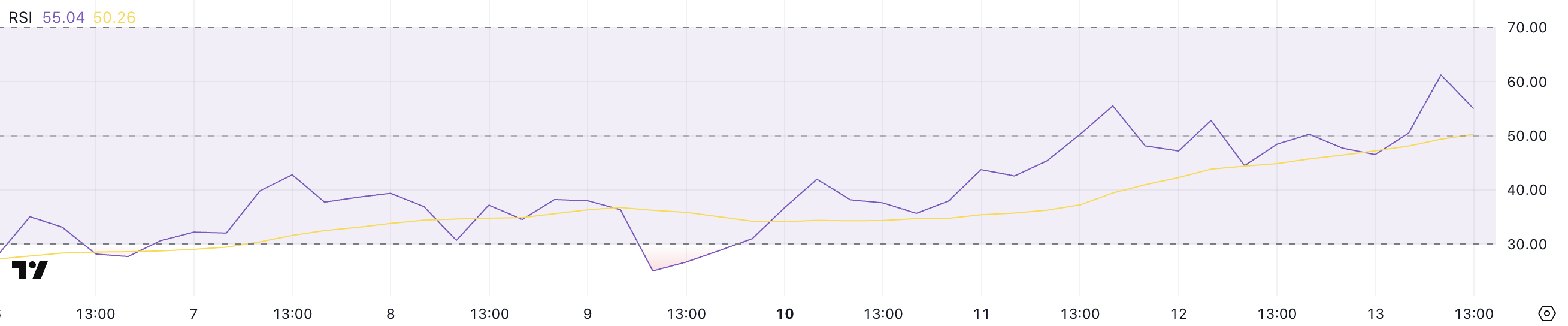

PENGU RSI. Source:

TradingView.

PENGU RSI. Source:

TradingView.

Its RSI has climbed to 55 from 25 in just four days, indicating increased buying interest.

However, even with the listing, PENGU has yet to see a major rally, as meme coins and NFT tokens face skepticism in the current market.

PENGU’s EMA lines still indicate a bearish trend, but the upward movement in short-term EMAs suggests a possible shift.

PENGU Price Analysis. Source:

TradingView.

PENGU Price Analysis. Source:

TradingView.

If momentum builds, the token could test resistance at $0.0069, with a breakout opening the door for a move toward $0.0075 and $0.0093, breaking above $0.0090 for the first time since March 2.

However, if the downtrend resumes and PENGU loses support at $0.0059, selling pressure could push it as low as $0.0050, marking new lows.

PNUT Is Currently Attempting A Recovery In The Last Few Days

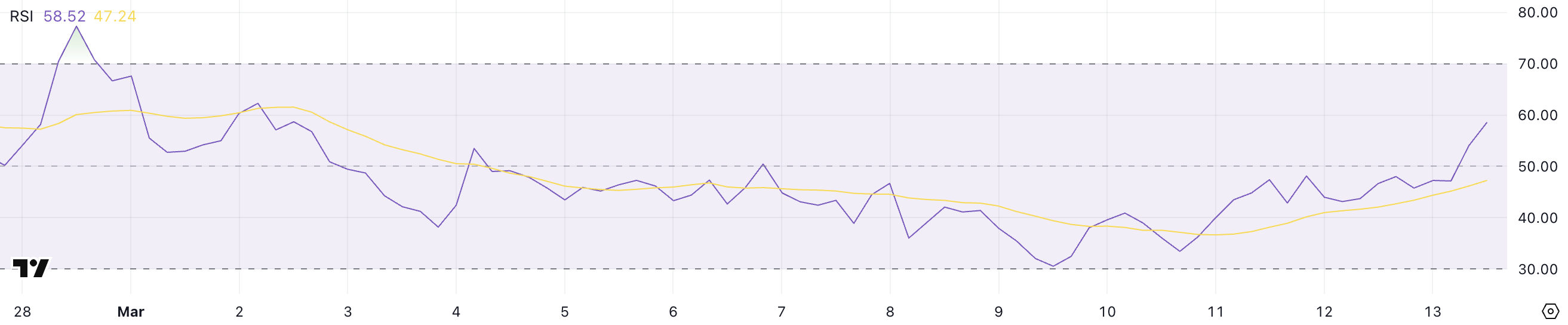

PNUT has been one of the struggling meme coins in recent months, with its price dropping 35% in the last 15 days. However, its RSI has been steadily rising, jumping from 33.4 on March 10 to 58.5 now.

This shift suggests that buying pressure has increased, potentially signaling a short-term recovery. If RSI continues to rise and crosses 60, it could strengthen bullish sentiment, pushing PNUT toward key resistance levels.

PNUT RSI. Source:

TradingView.

PNUT RSI. Source:

TradingView.

Despite this momentum, PNUT’s EMA lines still suggest a bearish trend, as short-term EMAs remain below long-term ones. However, the short-term lines are moving upward, hinting at a possible trend reversal.

If these EMAs form a golden cross, PNUT could gain enough strength to test resistance at $0.211. A breakout above this level could lead to further gains, with the next targets at $0.25 and potentially $0.309.

PNUT Price Analysis. Source:

TradingView.

PNUT Price Analysis. Source:

TradingView.

On the downside, if the current uptrend fails to hold, PNUT could face renewed selling pressure. The key support level to watch is $0.144, which has previously held price declines.

If this level is lost, PNUT could drop further to $0.133, marking new lows and reinforcing the bearish structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When AI Makes Candlestick Charts Speak

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

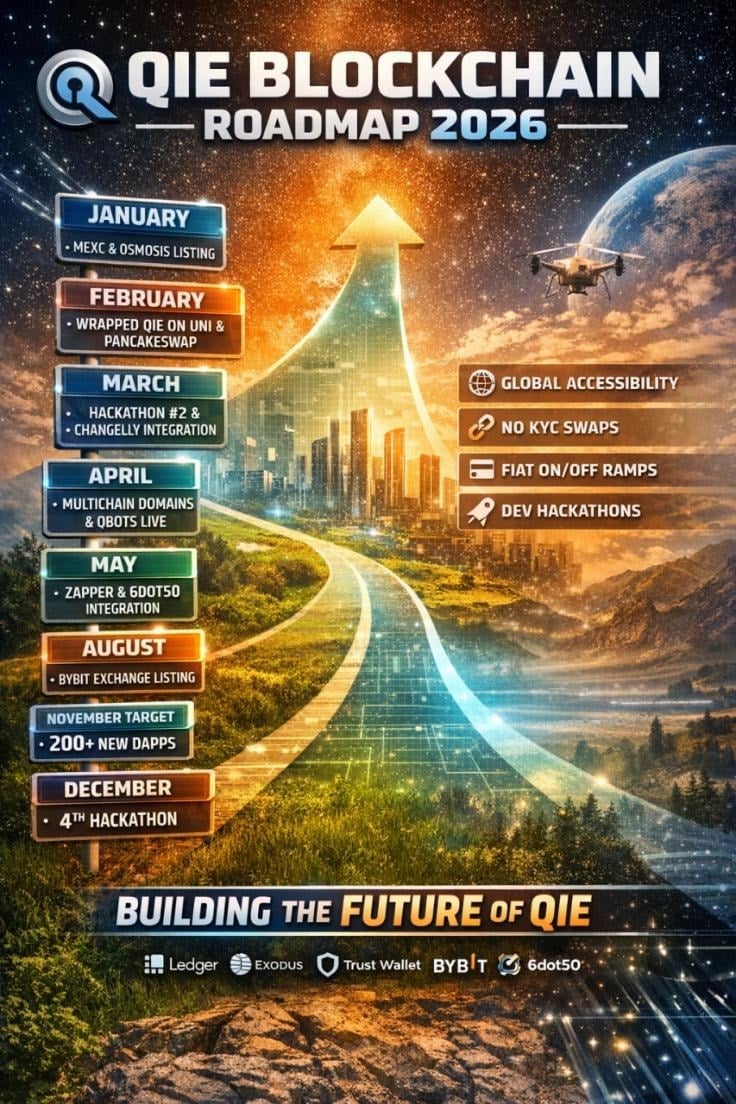

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Ripple advances protocol safety with new XRP Ledger payment engine specification