Gold’s Historic Peak Sparks Analyst Speculation on Bitcoin’s Future: New Highs Incoming?

As gold hits record highs, Bitcoin’s future remains uncertain. Could BTC follow gold’s parabolic rise, or will it struggle to keep up?

Gold prices skyrocketed to an all-time high of $3,004 per ounce, fueled by escalating geopolitical tensions, mounting inflation concerns, and a surge in demand for safe-haven assets.

The milestone has reignited speculation over whether Bitcoin (BTC)—often referred to as “digital gold”—could experience a similar rally in the face of global uncertainty.

Gold vs Bitcoin: Can BTC Follow Gold’s Historic Rally?

On Friday, gold surged past the key $3,000 mark for the first time, setting a new all-time high for the 13th time this year. The rally pushed the precious metal’s total market capitalization beyond $20 trillion, according to data from CompaniesMarketCap.

Meanwhile, Bitcoin has taken a different trajectory. Its value has plummeted significantly as macroeconomic conditions continue to weigh on it.

Bitcoin Price Performance. Source:

BeInCrypto

Bitcoin Price Performance. Source:

BeInCrypto

The leading cryptocurrency is currently trading 23.3% below its all-time high, having dropped 14.5% over the past month. At press time, BTC was valued at $83,643, reflecting a 0.8% decline in the past 24 hours.

Despite Bitcoin’s short-term struggles, analysts suggest it could follow a path similar to gold’s historic rise.

In the latest X (formerly Twitter) post, an analyst compared the launch of the Gold exchange-traded funds (ETFs) in November 2004 to the launch of the Bitcoin ETF in January 2024. He suggested that Bitcoin may follow a similar price trajectory to gold after its ETF introduction.

The introduction of the Gold ETF provided institutional and retail investors easier access to gold exposure. Over time, gold saw a massive price increase, with cyclical tops and corrections but a long-term bullish trend.

As per the analysis, Bitcoin appears to be following a similar pattern. If the trend holds, BTC could see a similar multi-year growth trajectory, with its ETF launch acting as a catalyst for institutional adoption and sustained price appreciation.

Gold vs Bitcoin Price Performance. Source:

X/Bitcoindata21

Gold vs Bitcoin Price Performance. Source:

X/Bitcoindata21

Another market analyst echoed this sentiment, noting that gold and Bitcoin are following a five-step parabolic model. He predicted that Bitcoin could soon experience a significant breakout, akin to gold’s past performance.

“Bitcoin’s future is written in gold! Gold followed this pattern before its breakout. Now, Bitcoin is mirroring the move,” Merlijn wrote.

According to his projections, Bitcoin has completed its “fakeout” phase, with an all-time high on the horizon. His bold forecast? A surge to $150,000 is “loading.”

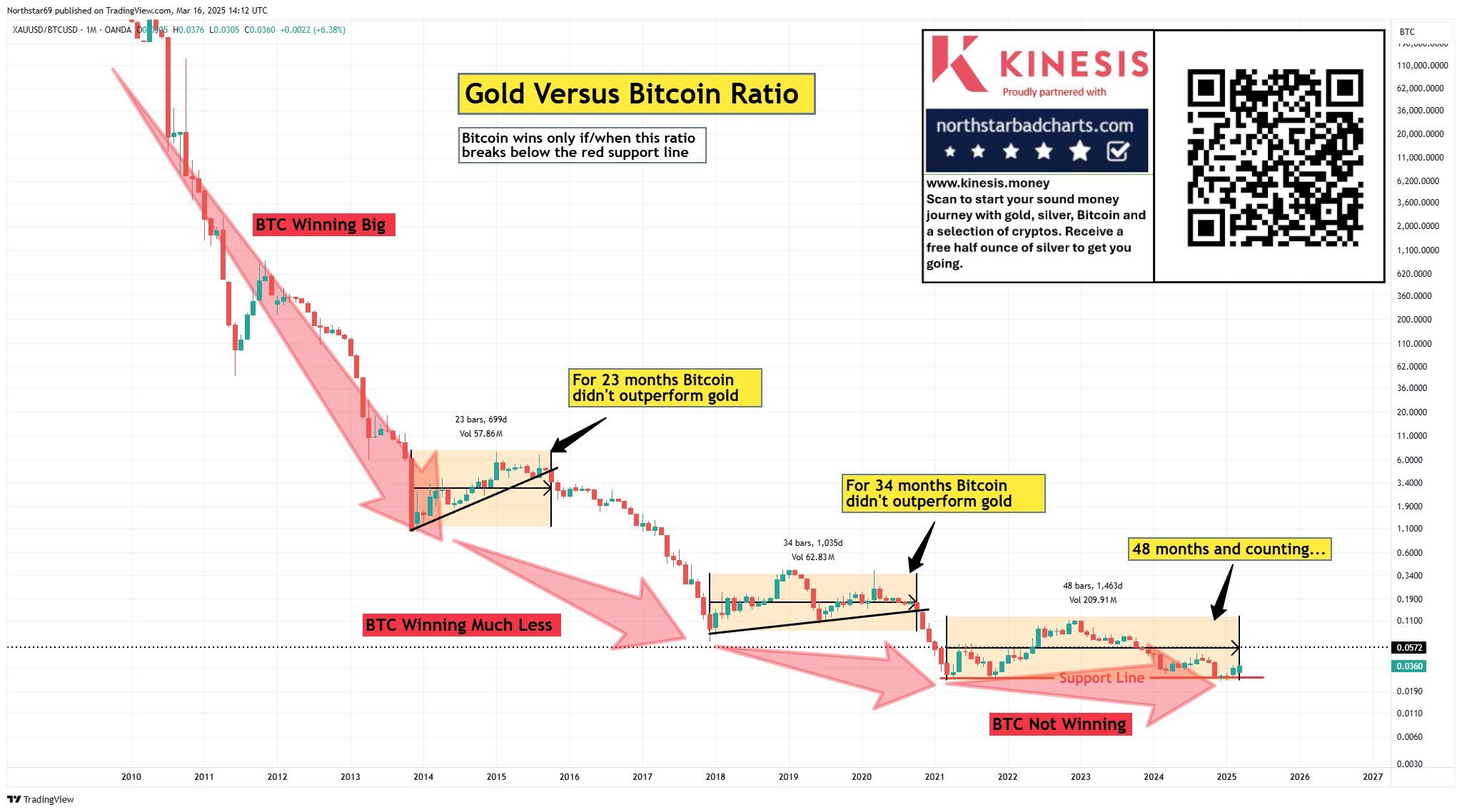

However, not all experts are convinced. Northstar, a market analyst, pointed out a concerning trend in the gold/bitcoin ratio. It has been in a prolonged downtrend. In fact, Bitcoin has failed to outperform gold for four years, marking the longest period on record.

Gold/Bitcoin Ratio. Source:

Northstar/X

Gold/Bitcoin Ratio. Source:

Northstar/X

He warned that gold’s breakout isn’t just about its price increase but what it signals.

“Historically, when gold breaks out versus stock markets, it initiates a capital rotation event, sending NASDAQ down 80% or so. Unfortunately, Bitcoin tracks NASDAQ,” the analyst remarked.

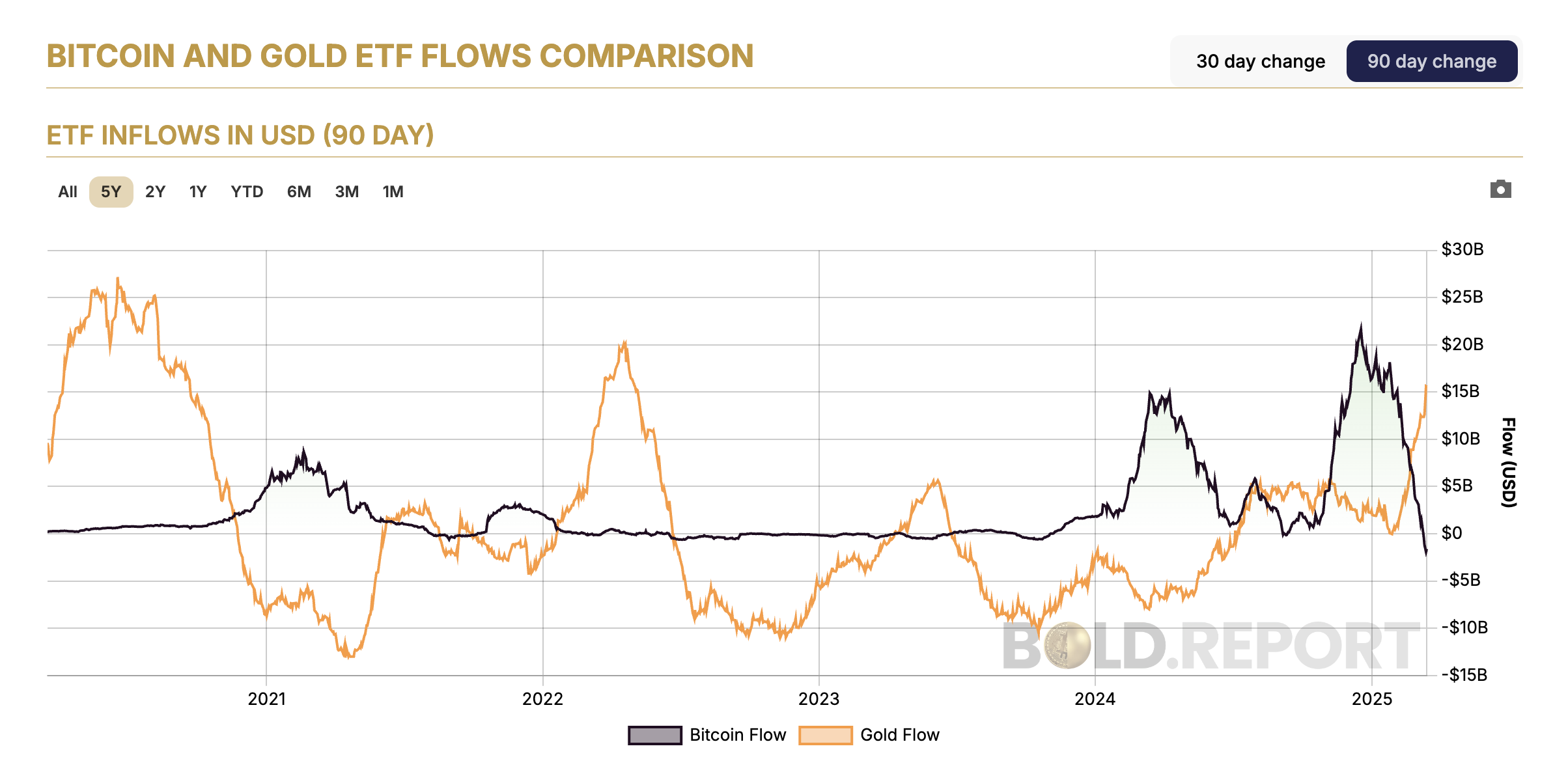

Adding to the skepticism, financial analyst Charlie Morris identified a divergence in ETF flows. While gold-backed funds have seen inflows amid the recent price surge, Bitcoin ETFs are experiencing a substantial downturn.

Gold vs Bitcoin ETF Inflows. Source:

The Bold Report

Gold vs Bitcoin ETF Inflows. Source:

The Bold Report

With Bitcoin trading at around $80,000, the coming months will be crucial in determining whether it can follow gold’s trajectory or continue to underperform. For now, the ongoing debate persists—will Bitcoin establish itself as a long-term store of value, or will gold’s enduring appeal continue to outshine the digital asset’s potential?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.