Date: Thu, March 27, 2025 | 06:40 PM GMT

The cryptocurrency market is showing upside strength, with Ethereum (ETH) surging 13% from its March 11 low of $1,754 to reclaim the $2,000 level. This resurgence has provided a much-needed boost to altcoins , many of which have struggled through a sharp downtrend over the past 90 days.

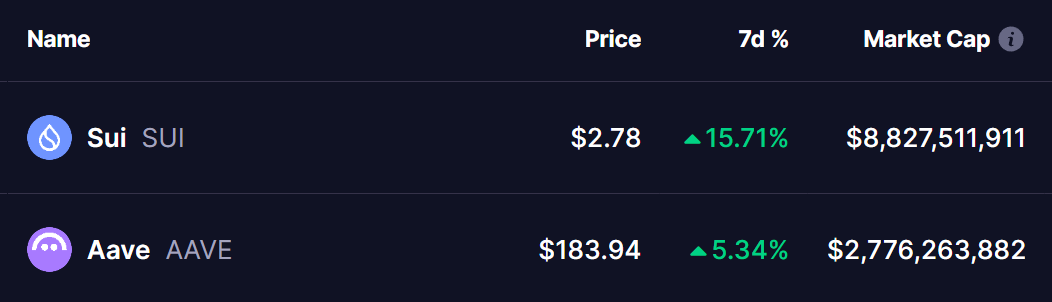

Among the standout performers, Sui (SUI) has gained significant attention after breaking out of a falling wedge and climbing 15% over the past week. Meanwhile, Aave (AAVE) is showing early signs of a potential breakout that could replicate SUI’s bullish move.

Source: Coinmarketcap

Source: Coinmarketcap

Aave (AAVE) Gearing Up for a SUI-Style Breakout?

SUI’s price action (left chart) has confirmed a bullish breakout after weeks of downward movement, with the wedge resistance finally giving way at $2.38. This breakout pushed SUI to a local high of $2.78, indicating renewed buying pressure and the possibility of further gains.

Examining AAVE’s price structure (right chart), a nearly identical pattern emerges. Since reaching a high of $399 on December 16, AAVE has been in a sustained downtrend, recently bottoming out at $160 at the wedge’s support level. However, the price has since rebounded to $183 and is now approaching the wedge’s upper boundary.

If AAVE follows a similar trajectory to SUI, a breakout could propel it toward its 50-day moving average (MA). A successful breach above this level would set the stage for a move toward the key resistance zone at $278 and its 100-day MA—representing a potential 52% gain from current levels.

What’s Ahead?

AAVE is displaying remarkable similarities to SUI’s breakout pattern, indicating that a similar bullish move could be in the making. To confirm the breakout, AAVE needs to close above the wedge resistance and sustain volume-driven momentum.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.