Date: Fri, March 28, 2025 | 04:55 AM GMT

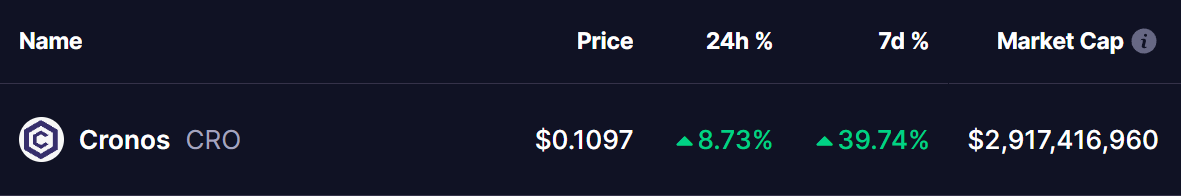

While the broader cryptocurrency market remains under pressure, Cronos (CRO) is defying the trend with an impressive 8% daily gain and a remarkable 39% weekly surge. The rally follows two major developments—an exclusive partnership with Truth Social, the social media platform backed by U.S. President Donald Trump, and a breakthrough announcement from the SEC.

Source: Coinmarketcap

Source: Coinmarketcap

SEC Closes Investigation into Crypto.com

In a significant win for the crypto industry, the U.S. Securities and Exchange Commission (SEC) has officially closed its investigation into Crypto.com without taking any action against the exchange. This was confirmed by Crypto.com CEO Kris Marszalek , who took to X (formerly Twitter) to express his thoughts.

“They used every tool available to attempt to stifle us, restricting access to banking, auditors, investors, and beyond. It was a calculated attempt to put an end to the industry.” — Marszalek stated on March 28.

The SEC had initially issued a Wells notice to Crypto.com in August 2024, signaling potential legal action. However, today’s news eliminates a major regulatory hurdle, boosting confidence in CRO and the broader crypto market.

Historical Pattern Points to a Bullish Rally

A look at CRO’s weekly price chart suggests a bullish setup is unfolding. The chart reveals a recurring accumulation pattern, characterized by a series of higher lows and resistance retests. Every previous bounce from this accumulation zone has triggered a triple-digit percentage rally, with gains ranging from 125% to 185%.

Currently, CRO is testing its 50-day moving average (50 MA) resistance, a critical level that has historically signaled strong upward moves. If this breakout materializes, CRO could target the long-term ascending resistance trendline, potentially reaching the $0.25–$0.30 range.

Final Thoughts

With the SEC investigation officially closed and strong historical price action backing a potential rally, Cronos (CRO) is in a prime position for further upside. If the breakout above the 50 MA is confirmed, traders could witness another triple-digit rally, similar to previous cycles. However, as always, investors should stay cautious and conduct their own research before making investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.