Shiba Inu Price Prediction: Can SHIB Crash to $0 in This Bearish Market?

Shiba Inu Price Prediction: Can SHIB Crash to $0.000001 in This Bearish Market?

The crypto market is once again gripped by bearish momentum, and Shiba Inu (SHIB) is feeling the heat. With prices stuck below key resistance and volume thinning out, many investors are asking a critical question: Can SHIB crash all the way down to $0.000001?

Let’s break it down.

SHIB Price Today: Stuck in a Tight Range

As of March 29, 2025, SHIB is trading around $0.00001282 , down slightly on the day but still holding above a major support zone at $0.000012. Despite minor bounces, momentum indicators like RSI and MACD suggest continued bearish pressure, reflecting the overall market mood.

Can Shiba Inu Drop to $0.000001?

The short answer: technically yes, but highly unlikely in the near term. For SHIB to drop that low, extreme bearish triggers would need to come into play.

What Could Cause SHIB to Crash to $0.000001?

🟥 Total Market Collapse: If Bitcoin crashes and takes the entire crypto sector down, SHIB could follow.

🟥 Loss of Community Trust: SHIB relies on a strong fanbase. A mass exodus would tank demand.

🟥 Shibarium or Ecosystem Failure: If promised utilities don’t deliver or are abandoned, SHIB’s perceived value could disappear.

🟥 Whale Dumping: Large holders exiting positions could send the price spiraling down.

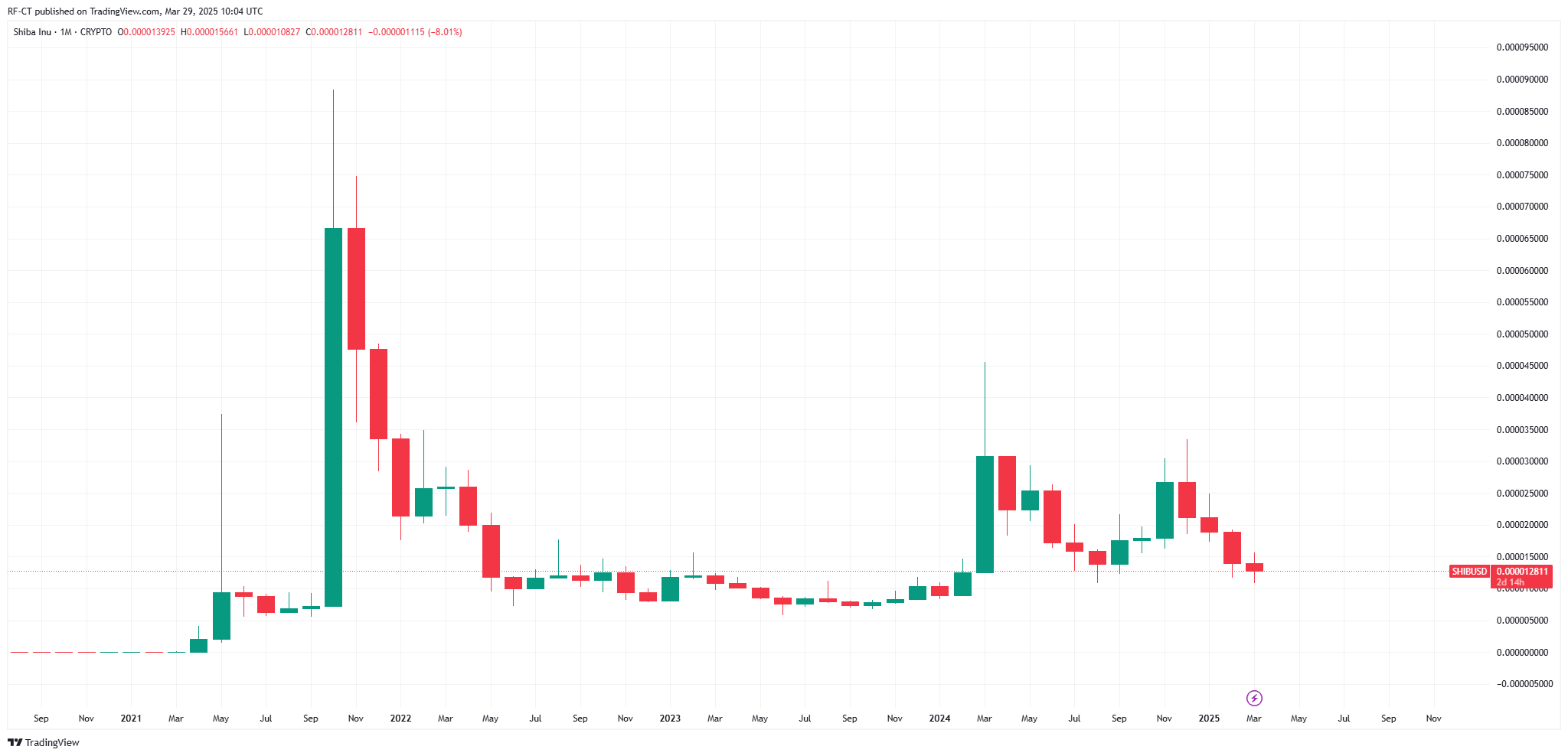

By TradingView - SHIBUSD_2025-03-29 (All)

By TradingView - SHIBUSD_2025-03-29 (All)

Why It’s Unlikely to See $0 Anytime Soon

✅ Strong Historical Support: SHIB has consistently held above $0.000010, even during past downturns.

✅ Burn Mechanism: Token burns continue to reduce supply, slowly boosting price over time.

✅ Shibarium Launch: The Layer 2 blockchain adds real use cases and value to the SHIB ecosystem.

✅ Loyal Community: SHIB’s army of holders continues to support the token, making a total collapse unlikely.

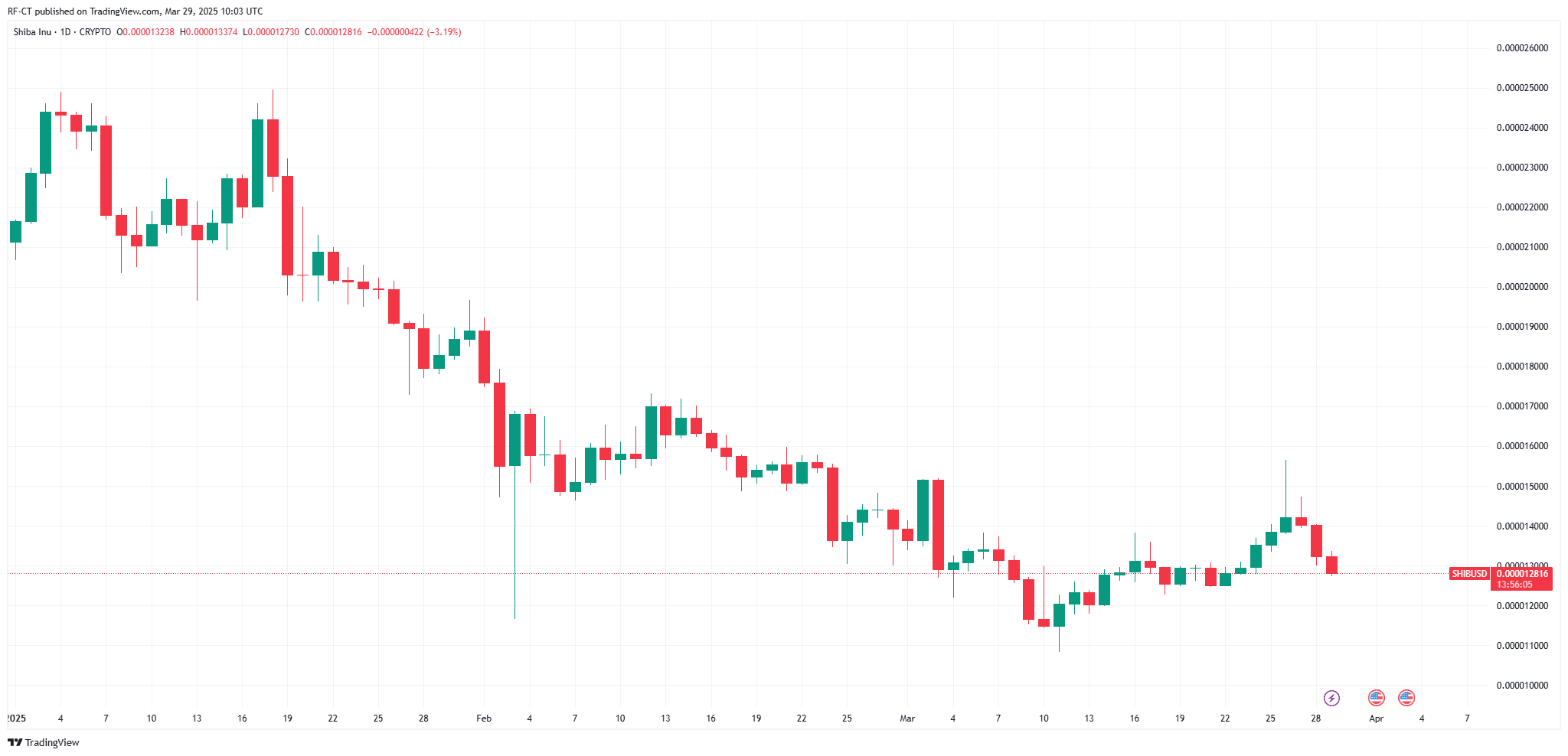

By TradingView - SHIBUSD_2025-03-29 (1M)

By TradingView - SHIBUSD_2025-03-29 (1M)

Shiba Inu Price Prediction: What to Expect in the Coming Months

While SHIB is under pressure, analysts still expect a bounce if broader market sentiment recovers. Price forecasts for 2025 range from $0.000020 to $0.000028, assuming Shibarium adoption picks up and altcoin sentiment turns bullish.

However, if bears remain in control, SHIB may retest $0.000010 or even $0.000007, but a full drop to $0.000001 would require unprecedented negative events.

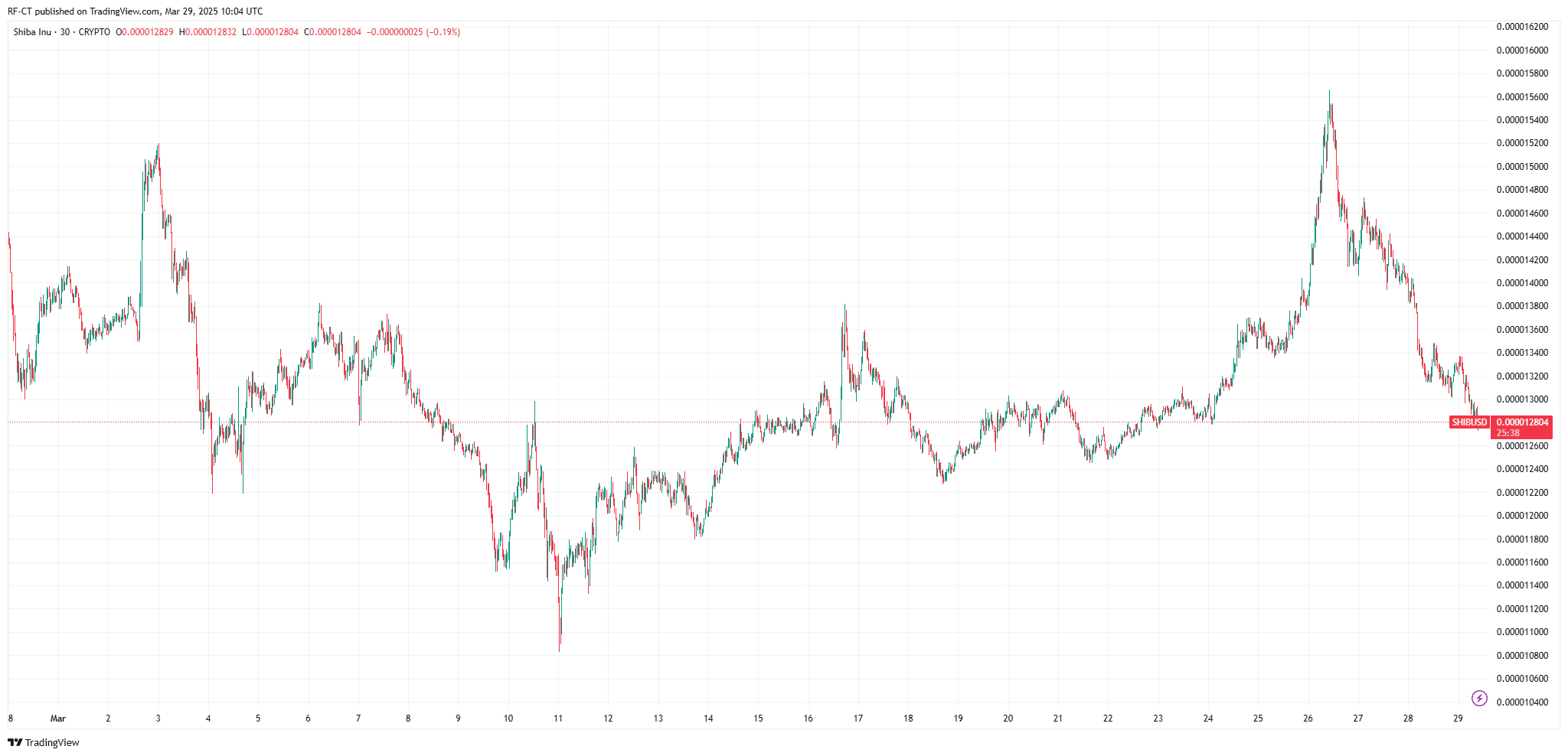

By TradingView - SHIBUSD_2025-03-29 (YTD)

By TradingView - SHIBUSD_2025-03-29 (YTD)

The road ahead for Shiba Inu is uncertain but not hopeless . While fears of a drop to $0.000001 exist, the fundamentals—active development, community backing, and deflationary mechanics—suggest SHIB still has fuel in the tank. Keep your eyes on market trends, and watch the $0.000010 level closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: The Cornerstone of the New Digital Civilization

Is the Halving Myth Over? Bitcoin Faces Major Changes in the "Super Cycle"

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.