Date: Sun, March 30, 2025 | 12:35 PM GMT

The cryptocurrency market today is showing mixed signs of upside momentum as major altcoins attempt to recover after a sharp drop over the last two days. Ethereum (ETH) fell over 8% in that period, slipping below $1,850 from its previous high of $2,000.

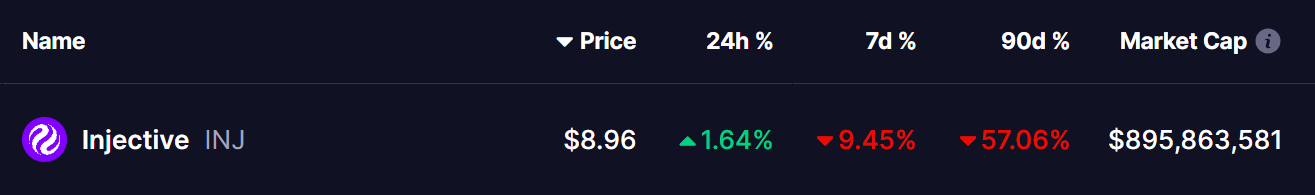

However, as some altcoins attempt to get back on track, Injective (INJ) is also making modest gains. However, the recent drop erased its weekly gains, plunging over 9% and extending its 90-day correction cycle to nearly three months of continuous losses.

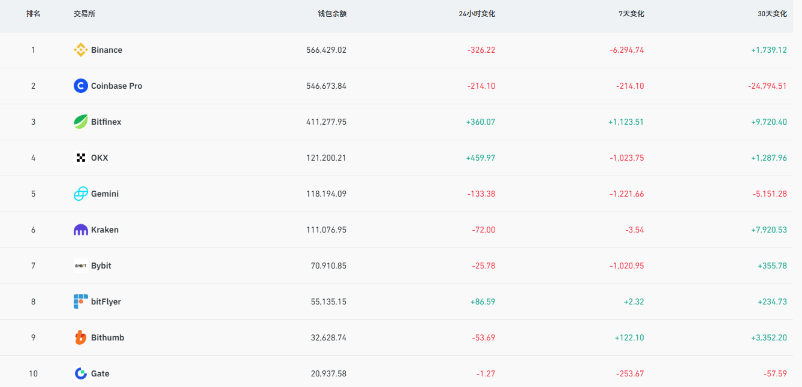

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Its Falling Wedge Breakout

On the daily chart, Injective (INJ) experienced an impressive 120% rally in November 2024. However, after reaching its peak, the price entered a correction phase, forming a falling wedge pattern. This led to a prolonged downtrend, with the price dropping 77% to a low of $8.214, where it finally found wedge support.

Injective (INJ) Daily Chart/Coinsprobe (Source: Tradingview)

Injective (INJ) Daily Chart/Coinsprobe (Source: Tradingview)

With this bounce, INJ recently broke out from the wedge’s descending trendline at $9.72, reaching a short-term high of $11.12 before pulling back. Now, amid broader market weakness, INJ is retesting its breakout trendline, currently trading around $8.96

If buyers step in at this level and successfully push the price higher, it could confirm a rebound and propel INJ toward the next key resistance zone at the 50-day moving average. A successful breach of this level could see the price targeting the $16.85 price zone, representing a potential 83% rally from current levels.

Further, a decisive move above $16.19 could open the doors for INJ to test the 200-day moving average and the $21.20 price zone.

What’s Next for INJ?

With INJ currently retesting its breakout trendline, a successful bounce and a move above the 50-day MA could confirm a recovery phase and trigger a bullish continuation toward higher price targets. The broader market stabilization would also be a key factor in determining whether INJ can regain momentum, as renewed buying interest could mark the end of its prolonged downtrend.

The MACD indicator is also signaling a potential shift in momentum, with the blue line attempting to cross above the signal line.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.