Cardano’s Leios upgrade targets Solana speed with decentralisation

Cardano’s (CRYPTO:ADA) upcoming Leios protocol upgrade aims to deliver “Solana-style speed” while maintaining full decentralisation, according to founder Charles Hoskinson.

In a recent interview, Hoskinson emphasised Leios’ focus on throughput under constraint, contrasting it with Solana’s (CRYPTO:SOL) history of network outages and centralisation risks.

Leios integrates with Cardano’s Extended UTXO (EUTXO) model, enhancing transaction processing through parallel validation and execution pipelines.

The upgrade separates transaction propagation from block validation, enabling deterministic ordering and consensus security without compromising decentralisation.

“No stalls,” highlighted Hoskinson, stressing Cardano’s seven-year uptime record without downtime.

“We took the time to build it properly from the ground up,” he contrasted with Solana’s 13 major outages since 2020.

The upgrade forms part of Cardano’s modular scaling strategy, complemented by Layer 2 solutions like Hydra (CRYPTO:HYDRA) and Midgard.

Hoskinson cited Cardano’s decentralised governance framework, which includes over 1,000 DReps and a community-approved constitution.

The network also holds a $1.5 billion treasury for ecosystem development, independent of venture capital pressures.

Cardano is positioning itself as a computational layer for Bitcoin (CRYPTO:BTC) DeFi, leveraging Babel fees to enable BTC payments for smart contracts.

“We’re going to be a great layer for Bitcoin DeFi,” noted Hoskinson, highlighting the blockchain’s potential as a liquidity hub for UTXO-based assets, including Bitcoin, Litecoin (CRYPTO:LTC), and Dogecoin (CRYPTO:DOGE).

“Year by year, our DApp count is growing. TVL is doubling annually. And we’ve had zero major security incidents,” stated Hoskinson, while addressing criticism about Cardano’s slower adoption metrics and emphasising its focus on real-world use cases over speculative trends.

The Leios upgrade underscores Cardano’s commitment to balancing performance with decentralisation, aiming to set a new standard for Layer 1 blockchains.

“We’re building systems to support real-world assets, regulated finance, and public infrastructure use cases,” as Hoskinson summarised.

At the time of reporting, the Cardano (ADA) price was $0.653, and the Solana (SOL) price was $126.06.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

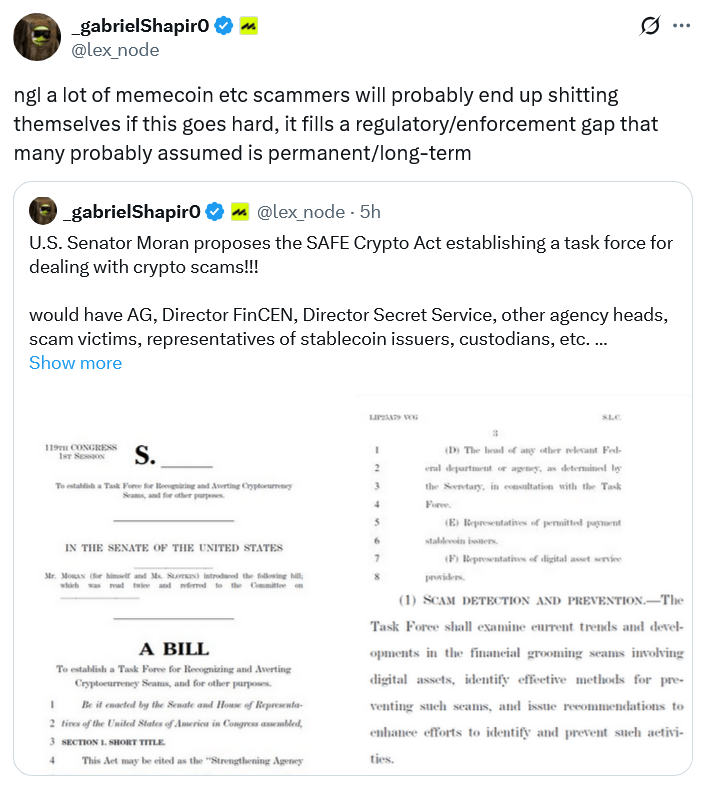

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

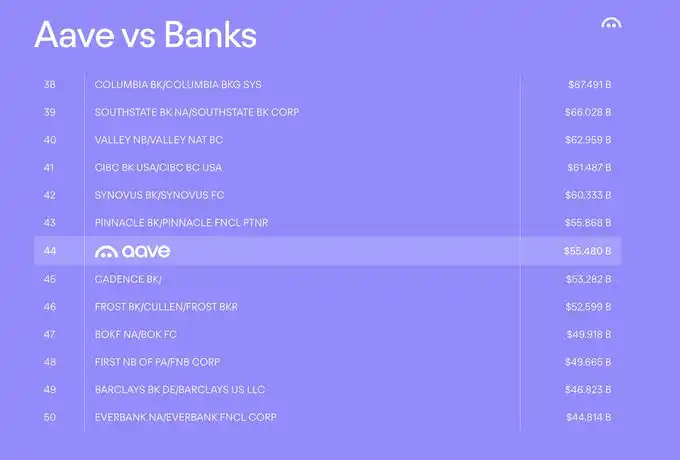

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation