Key Notes

- XRP has been consolidating between $2.03 and $2.27.

- A breakout above resistance or below support will determine the next major move.

- Large XRP holders have sold over 1.12 billion XRP worth $2.34 billion.

- If this trend continues, further bearish pressure could weigh on XRP's price.

Amid the broader crypto market recovery, the XRP XRP $2.15 24h volatility: 2.8% Market cap: $124.90 B Vol. 24h: $4.19 B price is up by 7% today, shooting to $2.17 levels with its daily trading volumes jumping 18% to more than $4.22 billion. The Ripple cryptocurrency has reversed its trajectory after falling to the crucial support levels of $2.03 on Monday.

The XRP futures open interest is also up 1.23%, moving to $3.58 billion. This shows that the overall trader sentiment remains bullish for the Ripple cryptocurrency from here onwards.

However, on the weekly chart, the Ripple crypto still remains down by 12% due to the heavy whale dumping over the last week. The overall sentiment around XRP seems to be waning despite some positive developments in the Ripple lawsuit.

XRP Price Action Going Ahead

Although today’s XRP price pump has gotten investors’ attention back, the bulls need to pull off more effort to continue with this rally ahead. For a long time, Ripple has been trading within the $2.03 to $2.27 range. It needs to break either below $2.03 support or above $2.27 resistance to determine the next big move.

Source: TradingView

XRP has been facing strong volatility recently amid broader crypto market turbulence and the Trump tariff war. The overall market remains jittery as the Tariff “Liberation Day” on April 2nd comes closer. Investors should remain cautious, considering the volatility that can come along with it.

Ripple Whales Show Uncertainty

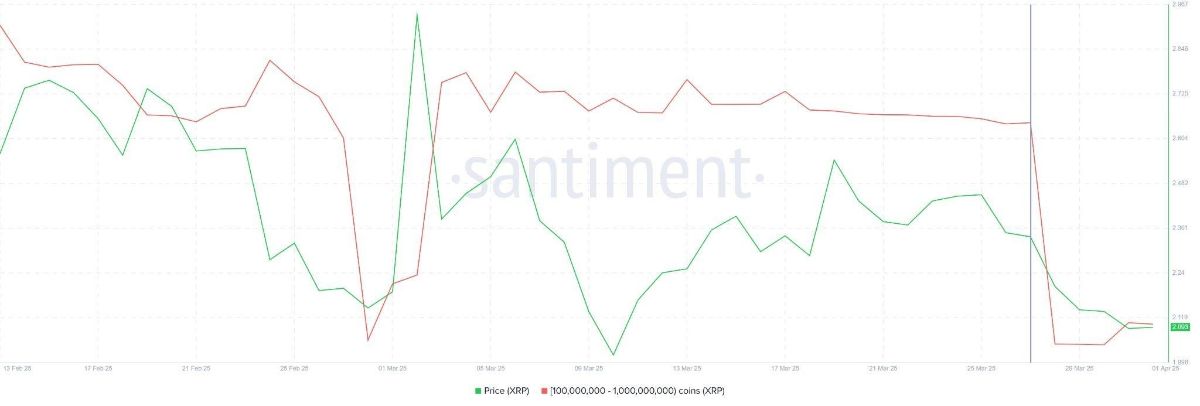

The whale activity has played a key role in XRP price decline, with a large number of holders offloading a majority of their holdings. Addresses holding between 100 million and 1 billion XRP have sold over 1.12 billion XRP, worth approximately $2.34 billion, in the past week, reducing their total holdings to 8.98 billion XRP.

Source: Santiment

This large-scale selling suggests a cautious stance among major investors. While whale sell-offs often signal market uncertainty, they can also trigger short-term price volatility. If this selling trend continues, XRP could face further bearish pressure in the near term.

If Ripple decides not to proceed with the cross-appeal in the XRP lawsuit, all eyes will be on the settlement in this case. Any positive development in April can trigger further price action ahead for XRP.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.