Crypto Market Follows S&P 500 and Nasdaq As Recession Fears Loom

As traditional markets show clear signs of an impending recession, the crypto space is not immune from damage. Liquidations are surging as the overall crypto market cap mirrors declines in the stock market. Even though the source of these problems is localized to the US, the damage will have global implications. Traders are advised to …

As traditional markets show clear signs of an impending recession, the crypto space is not immune from damage. Liquidations are surging as the overall crypto market cap mirrors declines in the stock market.

Even though the source of these problems is localized to the US, the damage will have global implications. Traders are advised to prepare for a sustained period of trouble.

How Will A Recession Impact Crypto?

Several economic experts have warned that the US market is poised for an impending recession. For all we know, it’s already here.

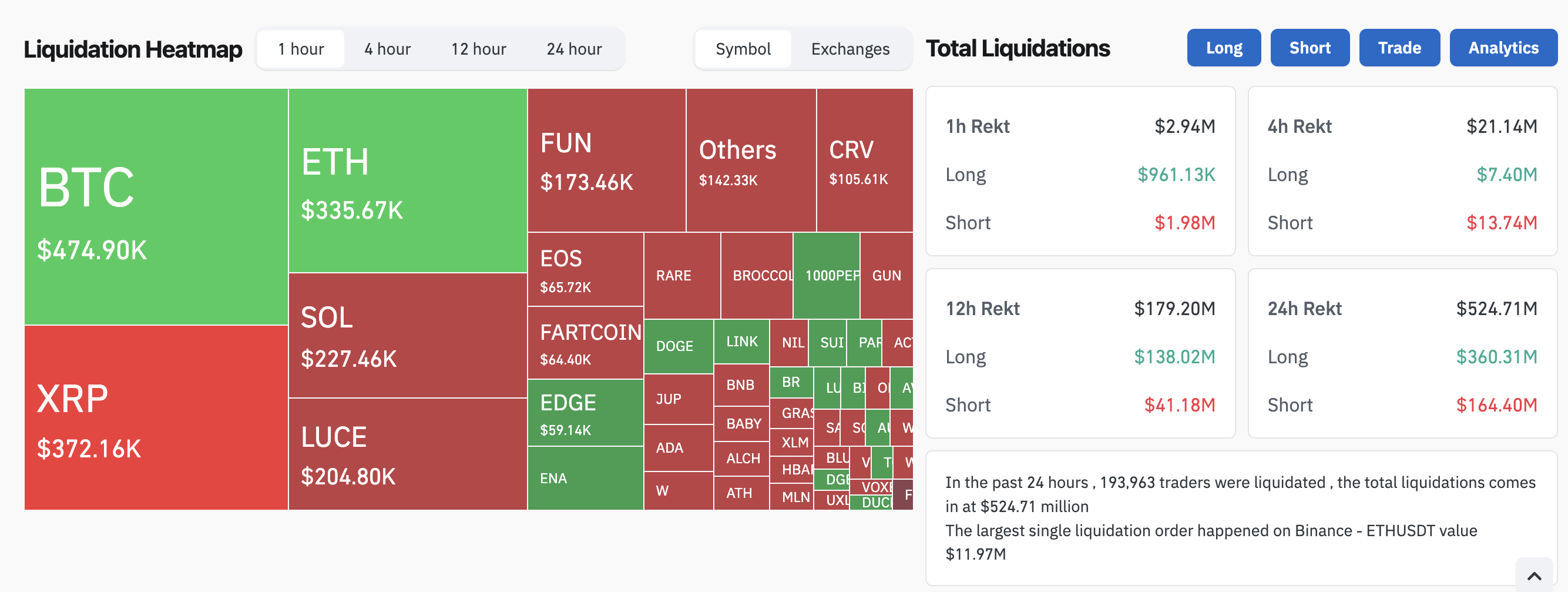

Since Donald Trump announced his Liberation Day tariffs, all financial markets have taken a real hit. The overall crypto market cap is down nearly 8%, and liquidations in the last 24 hours exceeded $500 million.

Crypto Liquidation Data. Source:

CoinGlass

Crypto Liquidation Data. Source:

CoinGlass

A few other key indicators show a similar trend. In late February, the Crypto Fear and Greed Index was at “Extreme Fear.” It recovered in March but fell back down to this category today.

Similarly, checkers adjacent to crypto, such as Polymarket, began predicting that a recession is more likely than not.

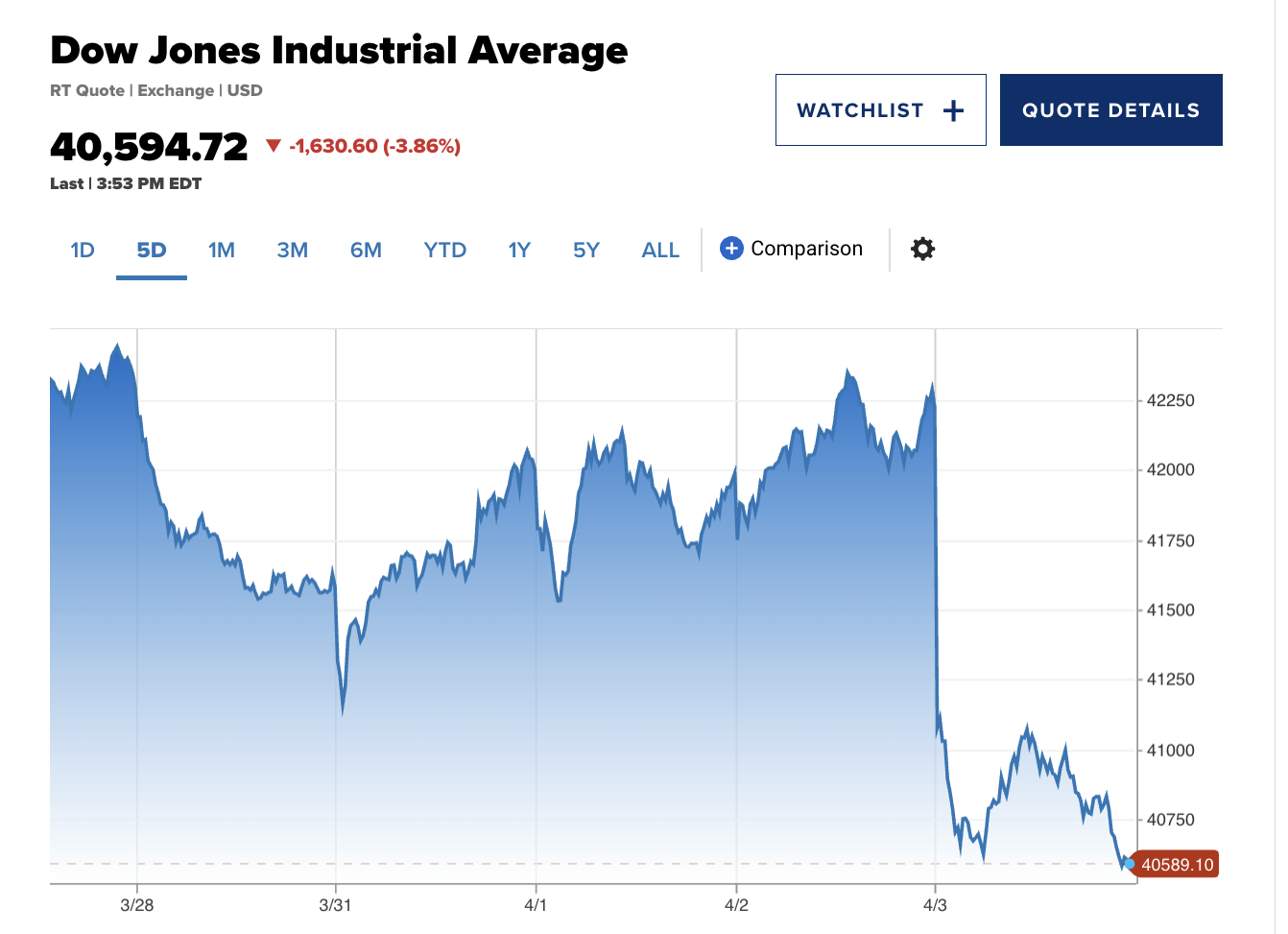

Although the crypto industry is closely tied to President Trump’s administration, it is not the driving force behind these recession fears. Indeed, crypto actually seems to be tailing TradFi markets at the moment.

The Dow dropped 1600 points today, and the NASDAQ and S&P 500 both had their worst single-day drops since at least 2020.

Recession Fears Sweep Traditional Markets. Source:

CNBC

Recession Fears Sweep Traditional Markets. Source:

CNBC

Amidst all these recession fears, it’s been hard to identify an upside for crypto. Bitcoin briefly looked steady, but it fell more than 5% in the last 24 hours.

This doesn’t necessarily reflect its status as a secure store of value, as gold also looked steady before crumbling. To be fair, though, gold has only fallen 1.2% today.

In this environment, crypto enthusiasts worldwide should consider preparing for a recession. Trump’s proposed tariffs dramatically exceeded the worst expectations, and the resultant crisis is centered around the US.

Overall, current projections show that the crypto market will mirror the stock market to some extent. If the Nasdaq and S&P 500 fall further, the implications for risk assets could worsen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary Capital Files for Staked Injective ETF, Will INJ Price Recover From 30% Monthly Drop?

Trump Media is merging with fusion power company TAE Technologies in $6B+ deal

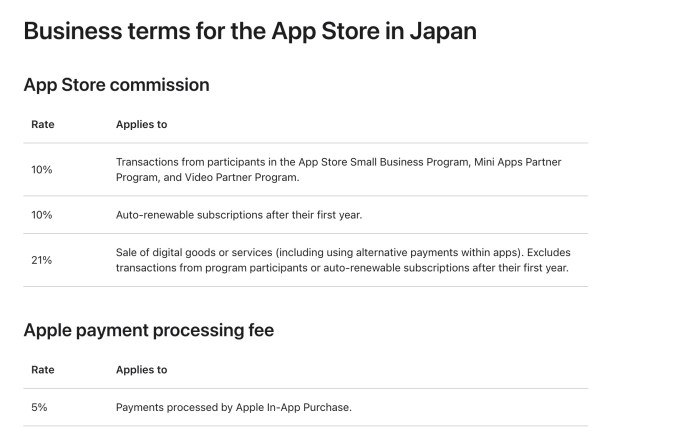

Apple opens up its App Store to competition in Japan

Top 5 Presale Tokens Investors Are Accumulating in 2025: IPO Genie ($IPO) Ranks High