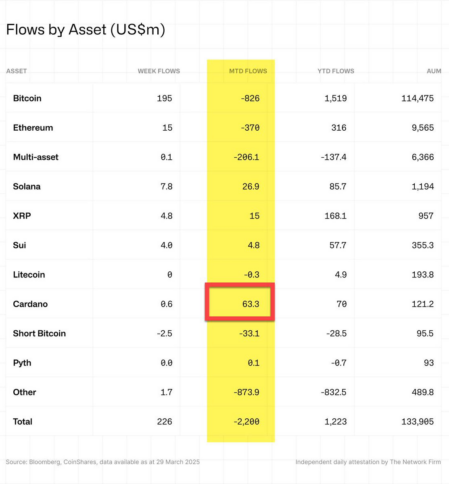

Cardano (ADA) has surpassed Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) in institutional inflows over the past month

As of March 29, 2025, Cardano recorded $63.3 million in month-to-date (MTD) inflows, making it the top-performing digital asset in institutional investments.

Bitcoin may have pulled in $195 million in weekly inflows, but it was hit with $826 million in outflows for the month, dragging down its overall standing. Ethereum didn’t fare much better, losing $370 million in MTD outflows.

Cardano surpasses BTC, ETH, and SOL in inflow | Source: TapTools

Cardano surpasses BTC, ETH, and SOL in inflow | Source: TapTools

Solana gained $26.9 million, a positive number, but still well behind Cardano’s impressive figures. Across the board, total outflows reached $2.2 billion, showing that the overall market has been in decline. Yet somehow, ADA managed to go against that trend.

ADA started gaining more interest after President Trump announced creating a U.S. Strategic Crypto Reserve , which included ADA along with XRP and SOL on March 2nd. ADA rallied 50% within 90 minutes after the news on the day.

Although the administration revised its stance, deciding to split the reserve into two separate funds: a Bitcoin-only reserve and an altcoin stockpile. The hype that ADA was even considered is still fueling the adoption, as more investors start to trade the token.

Meanwhile, ADA’s futures open interest surged to $702 million, marking a 10% increase year-to-date, according to the Coinglass report.

ADA Open Interest | Source: Coinglass

ADA Open Interest | Source: Coinglass

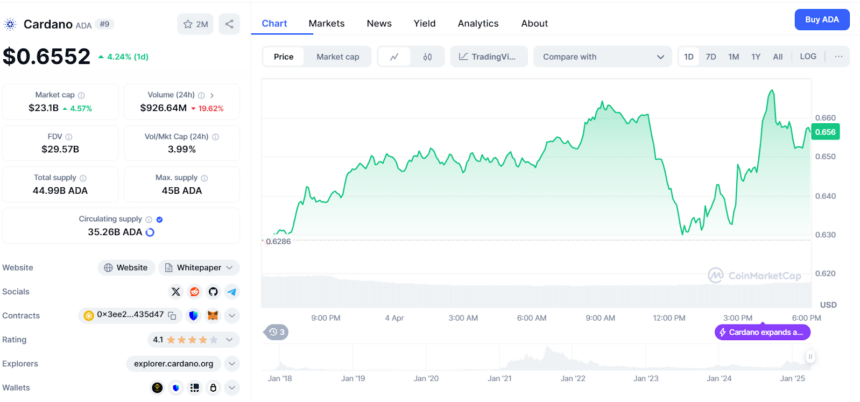

Moreover, ADA has been showing a lot of volatility for the past 24 hours as it consolidated between $0.67 and $0.62. It is currently trading at $0.6550.

ADAUSD Price Chart | Source: CoinMarketCap

ADAUSD Price Chart | Source: CoinMarketCap

The token gained 4% in value today and currently trades at $0.65 after gaining 4% today. However, the trading volume is not doing great as it recorded a 20% drop in the last 24 hours to $923 million.