6 Days of ETF Outflows Can’t Shake Bullish BTC Derivatives Traders | ETF News

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

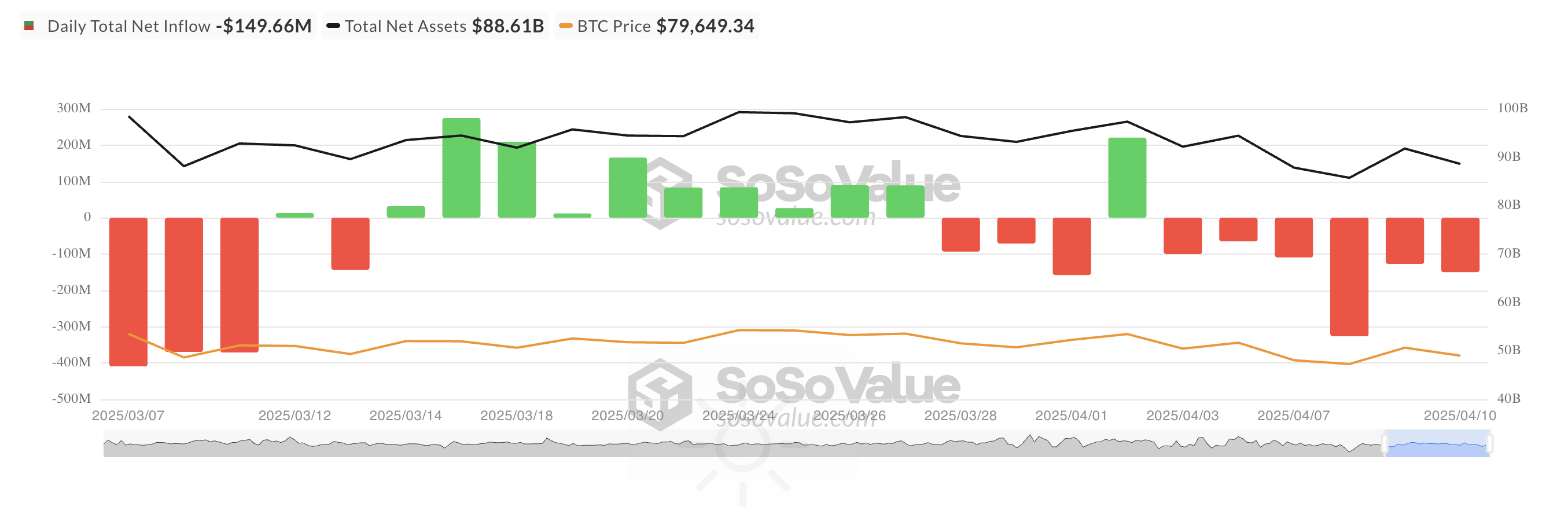

Even as crypto markets try to put on a brave face this week, institutional investors clearly are not buying it. Yesterday, Bitcoin spot ETFs recorded another round of outflows, marking the sixth straight day of capital flight from these funds.

Despite the broader market’s attempt at a short-term rebound, the continued withdrawals suggest that institutional sentiment remains cautious. The consistent outflows paint a picture of investors seeking safety or perhaps just sitting on the sidelines while volatility does its thing.

Bitcoin ETFs Continue Losing Streak

On Thursday, net outflows from BTC ETFs totaled $149.66 million, reflecting a 17% increase from the $127.12 million in outflows seen on Wednesday.

This marked the sixth consecutive day of withdrawals from spot Bitcoin ETF funds, highlighting the growing caution and weakening sentiment among institutional BTC investors.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

According to SosoValue, Grayscale Bitcoin Mini Trust ETF $BTC recorded the highest net inflow on that day, totaling $9.87 million, bringing the fund’s historical net inflow to $1.15 billion.

On the other hand, Fidelity’s ETF FBTC witnessed the highest net outflow on Wednesday, totaling $74.67 million. As of this writing, its total historical net inflow is $11.40 billion.

Derivatives Market Remain Optimistic

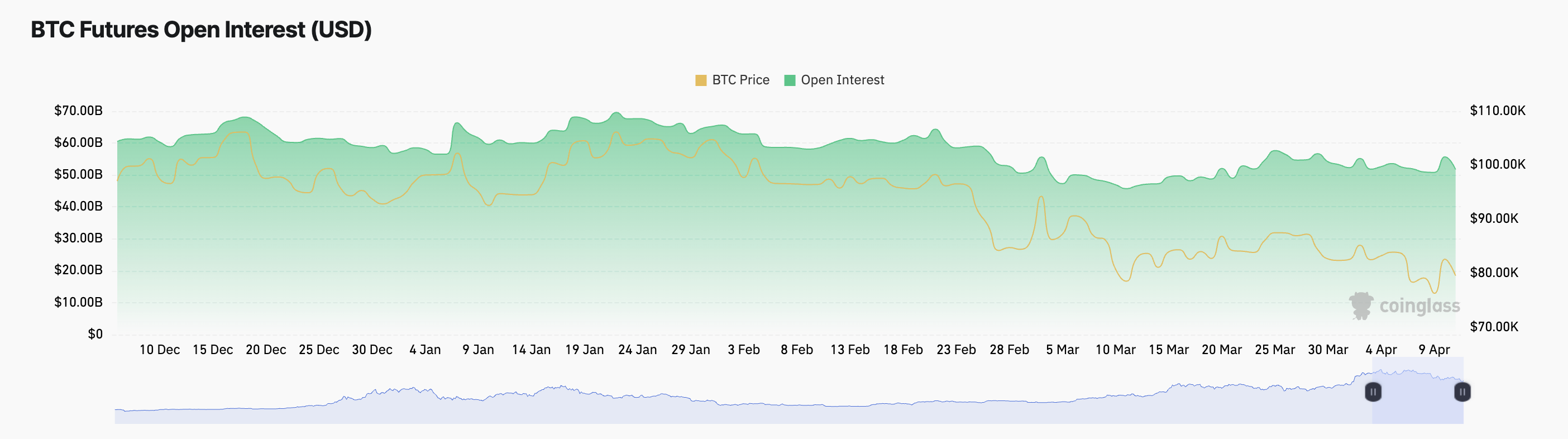

Meanwhile, BTC futures open interest has taken a modest hit, in line with the broader market dip. At press time, it stands at $51.73 billion, falling by 7% over the past day. This comes amid the decline in broader cryptocurrency market activity over the past 24 hours, during which BTC’s value has dipped by 2%.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

A drop in open interest during a price decline suggests that traders are closing out positions rather than opening new ones. This indicates a possible bottoming phase or reduced volatility ahead.

But the story doesn’t end there.

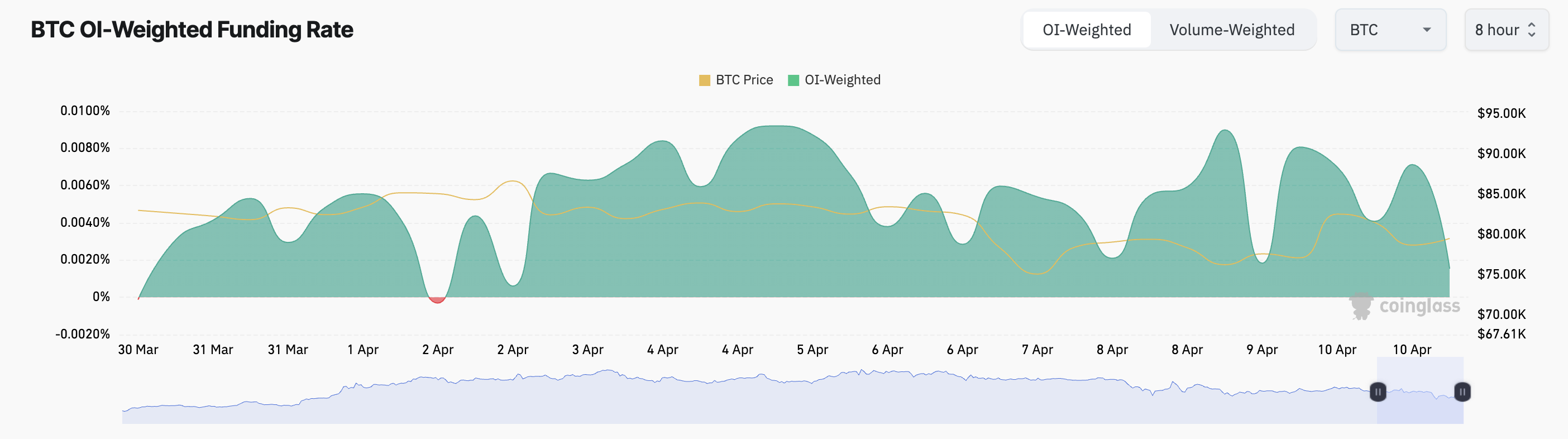

Funding rates remain positive, and call options are in high demand, both considered bullish signals.

At press time, BTC’s funding rate stands at 0.0015%. The funding rate is a recurring payment exchanged between long and short traders in perpetual futures markets to keep contract prices aligned with the spot market. A positive funding rate like this indicates that long traders pay short traders, signaling that bullish sentiment is dominant.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

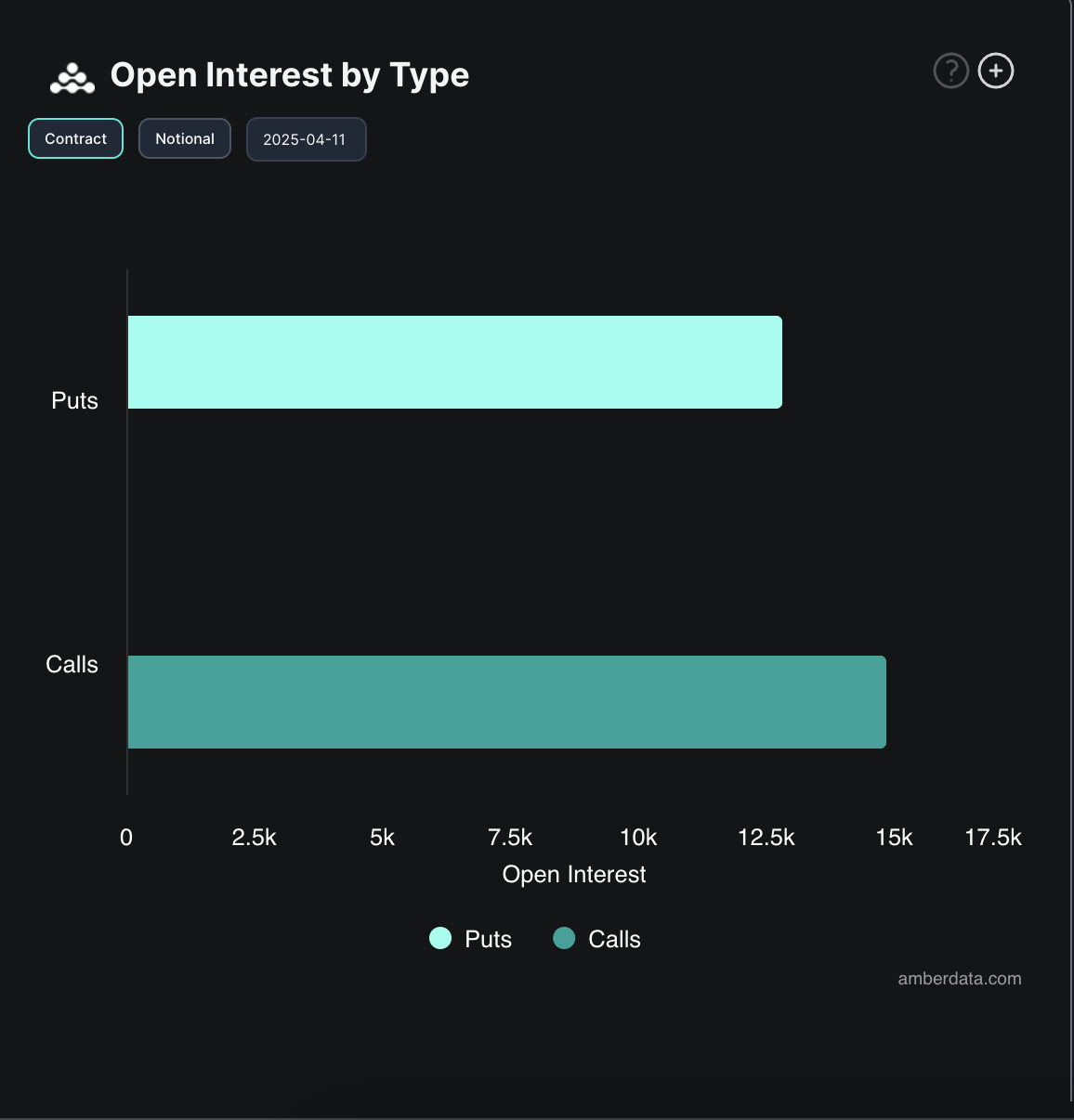

In the options market, there is a high demand for calls over puts, further reflecting a bullish bias toward BTC.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

The divergence between ETF flows and derivatives activity recorded this week suggests that while traditional institutions may be scaling back exposure, retail and leveraged traders continue to bet on rebounds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

P2P Payments Dominate Stablecoin Use on Ethereum

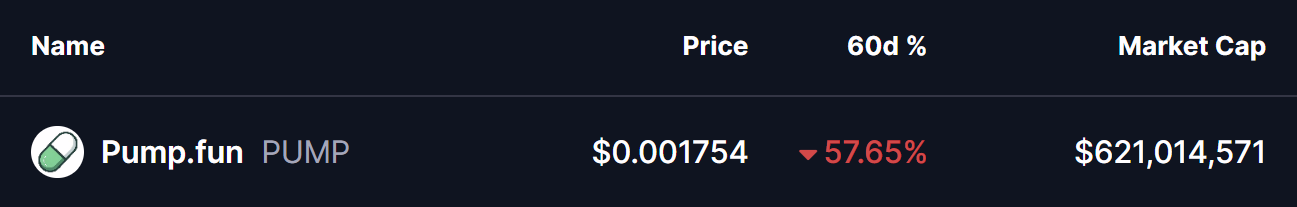

Is Pump.fun (PUMP) Poised for Further Downside? This Bearish Breakdown Suggests So!

New CFTC chair Selig inherits Pham’s crypto pilots as Congress eyes DA rules

Midnight (NIGHT) Price is Plummeting — But Big Holders Are Still Buying