Date: Sat, April 19, 2025 | 09:16 AM GMT

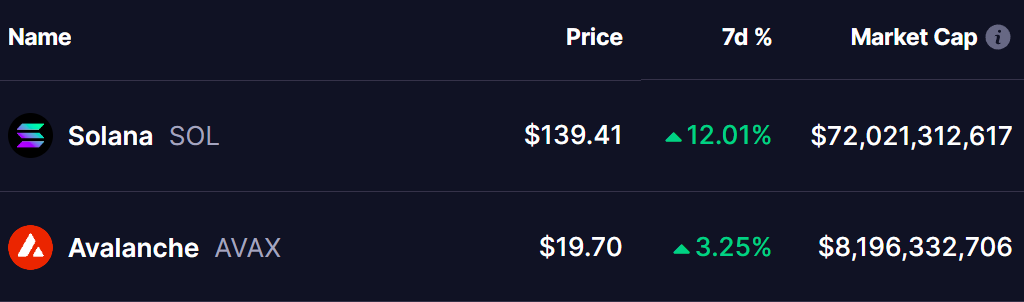

In the cryptocurrency market, Solana (SOL) is stealing the spotlight with a strong 12% weekly surge, powered by a textbook technical setup on the 4-hour chart. But here’s where it gets interesting — Avalanche (AVAX) seems to be setting up for a very similar move.

Source: Coinmarketcap

Source: Coinmarketcap

SOL and AVAX Fractal Comparison

On the left side of the chart, Solana (SOL) broke through a key resistance level at $136 and is now trading around $139. This rally fits perfectly into a classic accumulation → manipulation → expansion pattern. After a long period of sideways chop (accumulation), SOL saw a quick liquidity sweep (manipulation phase) before launching higher. Bulls are now setting their sights on the next key zone near $149, targeting another potential 10% upside from the breakout point.

Meanwhile, on the right side of the chart, Avalanche (AVAX) is quietly mirroring the same structure. After spending time in accumulation and shaking out weak hands (manipulation phase), AVAX looks primed for its own expansion move.

From here, AVAX is expected to first challenge the accumulation high resistance around $21. If bulls can crack through that level, the next target sits at $23.48 — implying an 11.78% rally from the breakout zone.

Final Thoughts

Solana (SOL) has already confirmed its breakout, showing strong technical structure and early bullish momentum. If Avalanche (AVAX) can clear the $21 barrier, it could quickly follow SOL’s playbook and stage its own breakout rally.

Both charts are flashing similar accumulation-to-expansion setups, and smart traders are keeping a close eye. Short-term opportunities look promising — but remember, risk management always comes first in volatile markets.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.

![[Bitpush Daily News Highlights] Ripple, Circle, and three other crypto companies receive conditional bank license approval in the US; Tether submits an all-cash acquisition offer, aiming for full control of Serie A giant Juventus and pledges to inject 1 billion euros; Moody’s plans to launch a stablecoin rating framework, with reserve asset quality as the core indicator; Fogo cancels its $20 million token presale, mainnet launch will switch to airdrop distribution.](https://img.bgstatic.com/multiLang/image/social/96c285805bf77c355ca73a8b952ce0b91765614780984.png)