What Is Crypto Decoupling and How Will It Push Bitcoin Price to New Highs?

What Is Crypto Decoupling?

Crypto decoupling refers to a shift where Bitcoin and other cryptocurrencies begin moving independently of traditional markets like stocks or fiat currencies. In the past, Bitcoin often traded in tandem with tech stocks, rising and falling based on similar investor sentiment. But now, with institutional demand rising and macroeconomic pressures mounting, Bitcoin is being increasingly viewed as digital gold or a non-correlated asset.

This transformation is crucial. It signals that crypto may be entering a new phase of maturity — one where it acts more like a safe-haven asset during economic turbulence, rather than just a speculative investment.

Why Is This Decoupling Happening Now?

Multiple factors are driving this decoupling narrative in 2025:

- US Dollar Weakness: The U.S. Dollar Index hit a 3-year low, partly triggered by President Trump’s public criticism of Federal Reserve Chair Jerome Powell . Investors are growing wary of U.S. monetary policy direction.

- Surging Institutional Interest: Major financial institutions are pouring capital into Bitcoin ETFs. BlackRock, Ark Invest, and others have seen billions in inflows. Japan’s Metaplanet recently added 5,000 BTC to its balance sheet, solidifying its pro-Bitcoin stance.

- Technical Momentum: Bitcoin has broken through key resistance levels, forming a golden cross pattern — a bullish technical indicator where the 50-day moving average crosses above the 200-day.

- Alternative Store of Value: In a world of volatile fiat currencies and uncertain equity markets, Bitcoin is becoming a hedge against inflation and macroeconomic instability.

Bitcoin Nears $87K Amid US Dollar Decline

Bitcoin (BTC) is trading close to $87,000, posting nearly a 3% gain in the last 24 hours. This spike comes as the U.S. Dollar Index plunges to multi-year lows, sparking renewed interest in Bitcoin as a hedge against traditional markets. At the same time, the S&P 500 and Nasdaq are showing weakness, reinforcing the idea that Bitcoin may finally be decoupling from the stock market.

Can Bitcoin Hit New All-Time Highs?

Analysts believe the current momentum, combined with growing belief in crypto’s independence, could propel Bitcoin past its all-time high of $73,805.27 . With ETF demand, weakening fiat currencies, and reduced correlation with stock markets, BTC could be heading toward $90,000 and beyond.

If decoupling continues to strengthen, Bitcoin could enter a price discovery phase, where the lack of correlation allows for explosive growth — especially if risk assets remain under pressure.

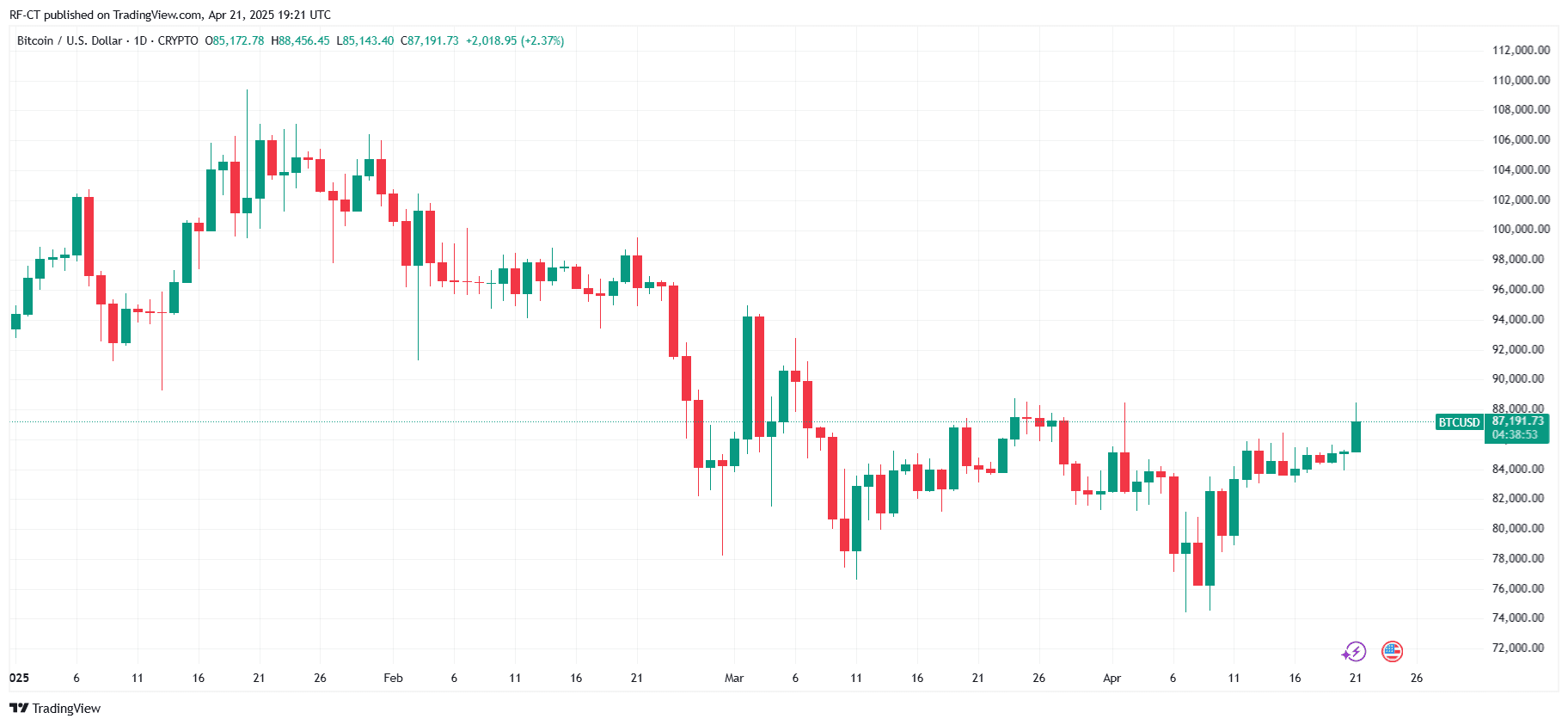

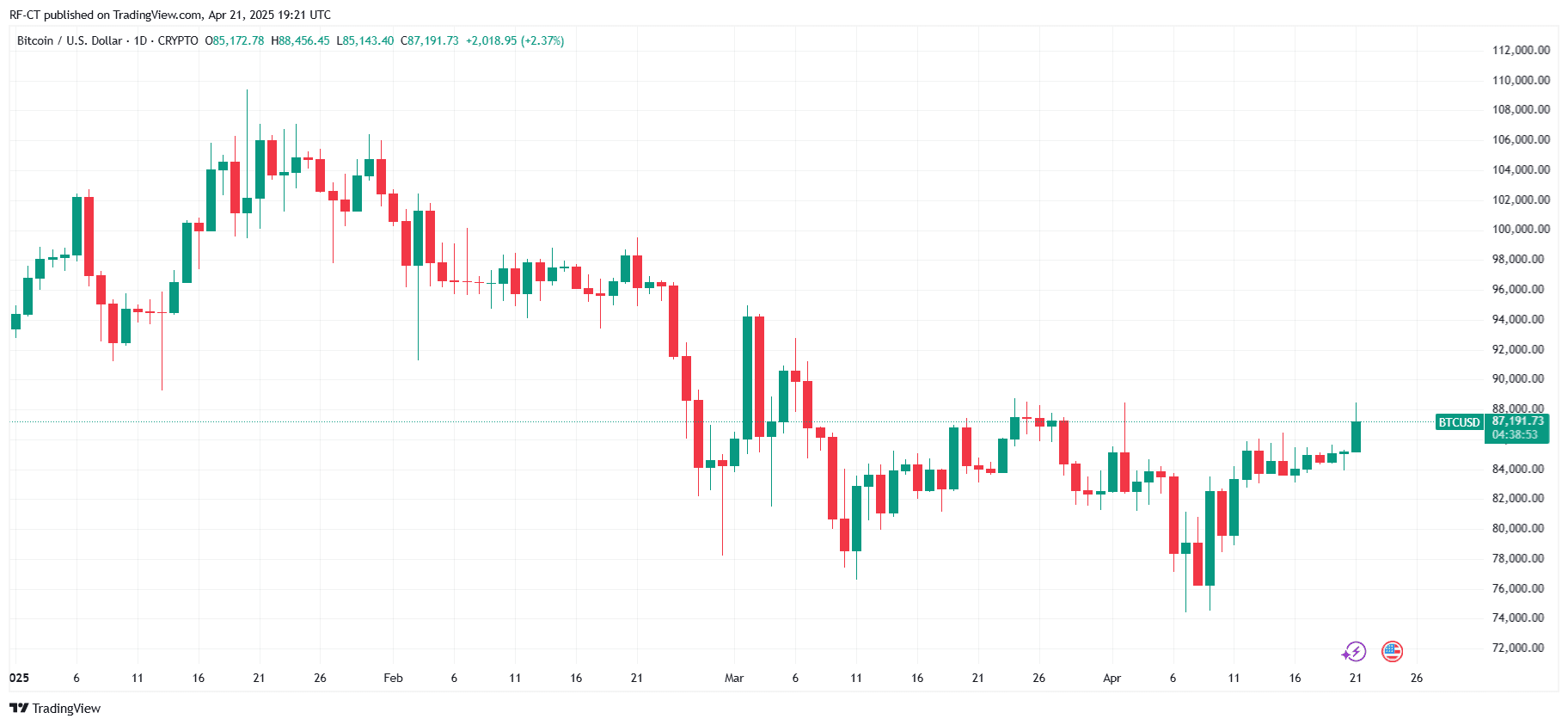

By TradingView - BTCUSD_2025-04-22 (YTD)

By TradingView - BTCUSD_2025-04-22 (YTD)

Crypto decoupling is more than a trend — it's a potential market reset. As Bitcoin begins to behave like an independent macro asset, it becomes more attractive to traditional and institutional investors seeking diversification. If the current momentum holds, this new cycle could take Bitcoin to new highs in 2025 , reshaping how global markets view crypto.

What Is Crypto Decoupling?

Crypto decoupling refers to a shift where Bitcoin and other cryptocurrencies begin moving independently of traditional markets like stocks or fiat currencies. In the past, Bitcoin often traded in tandem with tech stocks, rising and falling based on similar investor sentiment. But now, with institutional demand rising and macroeconomic pressures mounting, Bitcoin is being increasingly viewed as digital gold or a non-correlated asset.

This transformation is crucial. It signals that crypto may be entering a new phase of maturity — one where it acts more like a safe-haven asset during economic turbulence, rather than just a speculative investment.

Why Is This Decoupling Happening Now?

Multiple factors are driving this decoupling narrative in 2025:

- US Dollar Weakness: The U.S. Dollar Index hit a 3-year low, partly triggered by President Trump’s public criticism of Federal Reserve Chair Jerome Powell . Investors are growing wary of U.S. monetary policy direction.

- Surging Institutional Interest: Major financial institutions are pouring capital into Bitcoin ETFs. BlackRock, Ark Invest, and others have seen billions in inflows. Japan’s Metaplanet recently added 5,000 BTC to its balance sheet, solidifying its pro-Bitcoin stance.

- Technical Momentum: Bitcoin has broken through key resistance levels, forming a golden cross pattern — a bullish technical indicator where the 50-day moving average crosses above the 200-day.

- Alternative Store of Value: In a world of volatile fiat currencies and uncertain equity markets, Bitcoin is becoming a hedge against inflation and macroeconomic instability.

Bitcoin Nears $87K Amid US Dollar Decline

Bitcoin (BTC) is trading close to $87,000, posting nearly a 3% gain in the last 24 hours. This spike comes as the U.S. Dollar Index plunges to multi-year lows, sparking renewed interest in Bitcoin as a hedge against traditional markets. At the same time, the S&P 500 and Nasdaq are showing weakness, reinforcing the idea that Bitcoin may finally be decoupling from the stock market.

Can Bitcoin Hit New All-Time Highs?

Analysts believe the current momentum, combined with growing belief in crypto’s independence, could propel Bitcoin past its all-time high of $73,805.27 . With ETF demand, weakening fiat currencies, and reduced correlation with stock markets, BTC could be heading toward $90,000 and beyond.

If decoupling continues to strengthen, Bitcoin could enter a price discovery phase, where the lack of correlation allows for explosive growth — especially if risk assets remain under pressure.

By TradingView - BTCUSD_2025-04-22 (YTD)

By TradingView - BTCUSD_2025-04-22 (YTD)

Crypto decoupling is more than a trend — it's a potential market reset. As Bitcoin begins to behave like an independent macro asset, it becomes more attractive to traditional and institutional investors seeking diversification. If the current momentum holds, this new cycle could take Bitcoin to new highs in 2025 , reshaping how global markets view crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...