First XRP ETF Launched, Can XRP Beat Ethereum After All?

XRP’s Big Break: First Ever Spot XRP ETF Lands in Brazil

XRP just made crypto history! On April 25, 2025, Brazil launched the world’s first ever spot XRP ETF, called the Hashdex Nasdaq XRP Fundo de Índice (XRPH11) . Managed by Hashdex and listed on Brazil’s B3 exchange, this ETF gives investors direct exposure to XRP — no futures, no leverage games, just pure spot action.

That’s a huge deal because a real spot ETF usually means more adoption, more buying pressure, and ultimately… higher prices.

The timing couldn't be better either — XRP has been bubbling under the surface while Bitcoin and Ethereum stole most of the spotlight. But now? XRP’s making noise again.

XRP ETF XRPH11 by Hashdex

XRP ETF XRPH11 by Hashdex

How Did XRP Price React?

Right after the Brazil ETF launch, XRP price bounced over 8% in a single day, pushing closer to the $0.60 mark. Not a crazy moonshot yet, but enough to wake up the bulls.

Even more interesting? Trading volume on major exchanges spiked 22% after the news dropped — showing that the market cares about this ETF way more than most expected.

And remember, we recently talked about XRP potentially overtaking Ethereum (ETH) in market cap one day if the right catalysts lined up. Well, a spot ETF is exactly the kind of catalyst that could tilt the scales.

By TradingView - XRPUSD_2025-04-26 (YTD)

By TradingView - XRPUSD_2025-04-26 (YTD)

Why This ETF Matters for XRP's Future

Let's keep it real: XRP has always been a bit of a black sheep. Lawsuits, SEC drama, market doubt — it's been through it all.

But an official spot ETF like the one launched in Brazil sends a clear message:

Institutions are starting to trust XRP again.

And that’s key because once bigger investors start pouring money in, XRP’s liquidity, credibility, and market cap could explode.

Plus, if Brazil's XRP ETF is successful (early signs say it will be), it sets a blueprint for spot ETFs in bigger markets like the U.S., Europe, and Asia.

And guess what? Big players like Grayscale, Bitwise, and 21Shares have already filed for U.S. spot XRP ETFs . If — or when — the SEC gives the green light, XRP could skyrocket the same way Bitcoin did after its spot ETFs launched.

So... Can XRP Really Surpass Ethereum?

It’s not just hopium anymore.

Ethereum's facing its own challenges (scaling issues, regulation fears).

XRP has a real use case (fast, cheap cross-border payments).

Institutional interest is warming up.

The ETF era is just getting started.

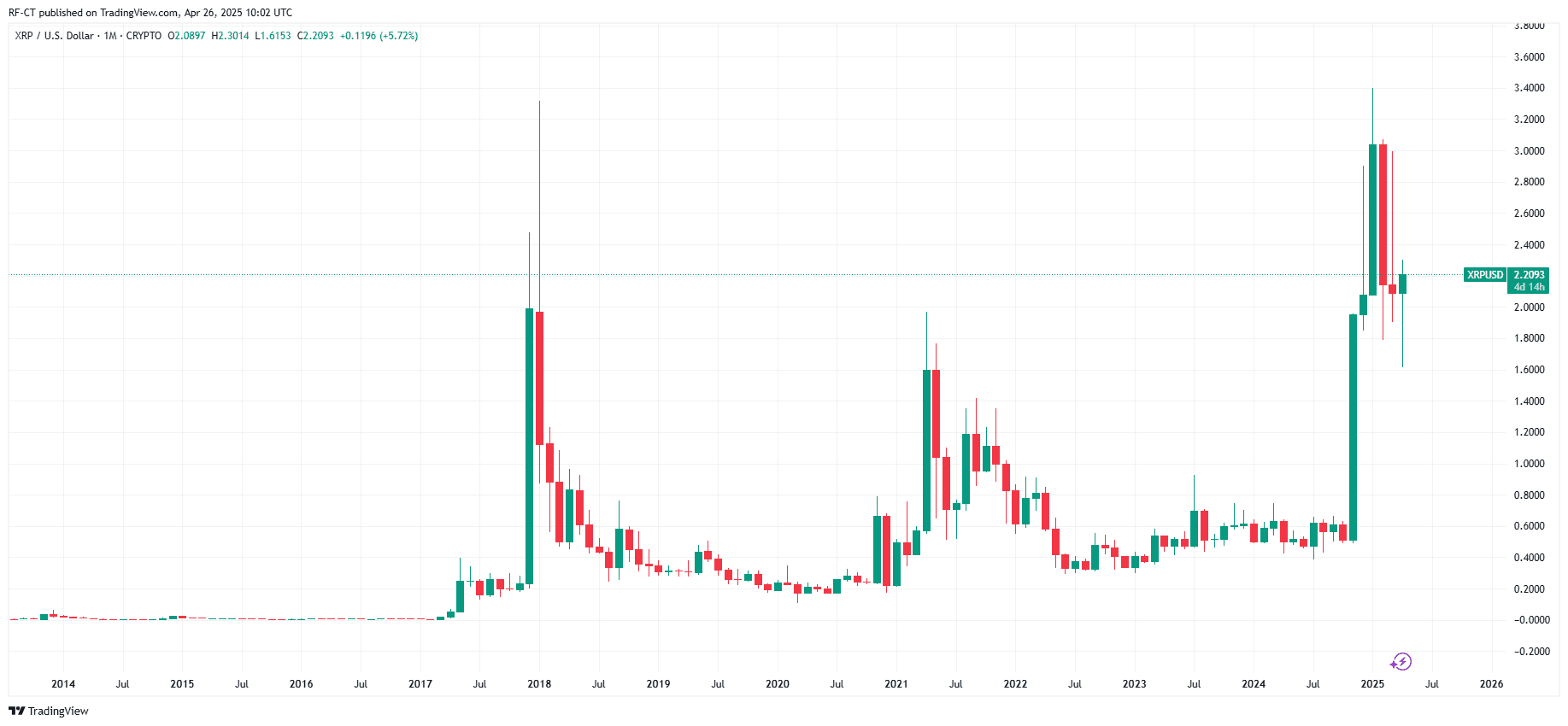

By TradingView - XRPUSD_2025-04-26 (All)

By TradingView - XRPUSD_2025-04-26 (All)

If XRP continues getting serious investment attention — and if U.S. ETFs come next — yes, XRP has a real shot at flipping ETH someday. It won’t happen overnight, but the seeds are definitely being planted.

Final Thoughts

The launch of the world's first spot XRP ETF in Brazil is more than just another headline. It’s a signal that XRP’s future is looking stronger — and maybe a little more golden — than it has in years.

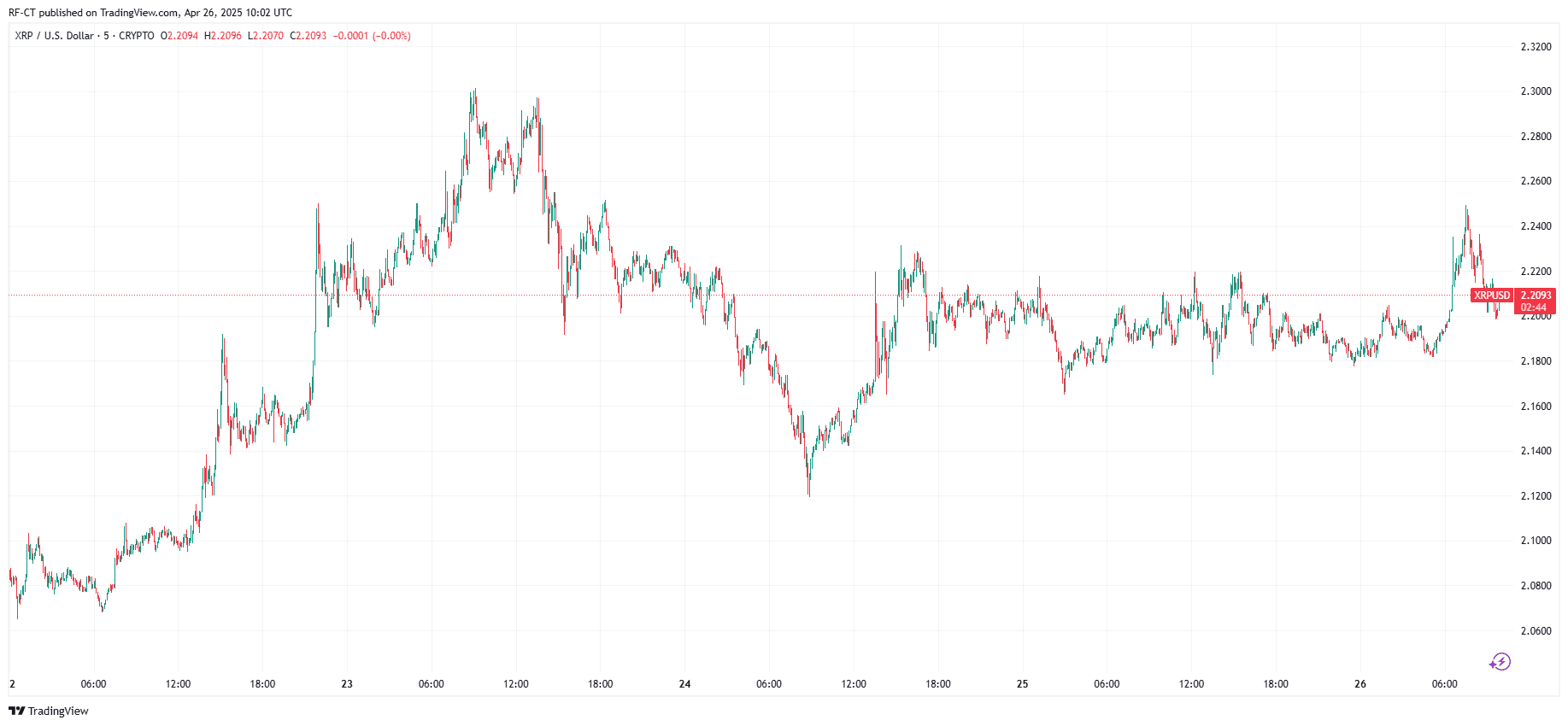

By TradingView - XRPUSD_2025-04-26 (5D)

By TradingView - XRPUSD_2025-04-26 (5D)

If the momentum holds, if institutional doors keep opening, and if XRP stays clear of any new legal messes...

we might just be looking at the biggest XRP comeback story ever.

Stay tuned — things are about to get real!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.