- Market cap stands at $130 billion as of 30 April.

- XRP Ledger now handles 3,400+ transactions/sec.

- Despite positive momentum, economic risks could cap near-term gains.

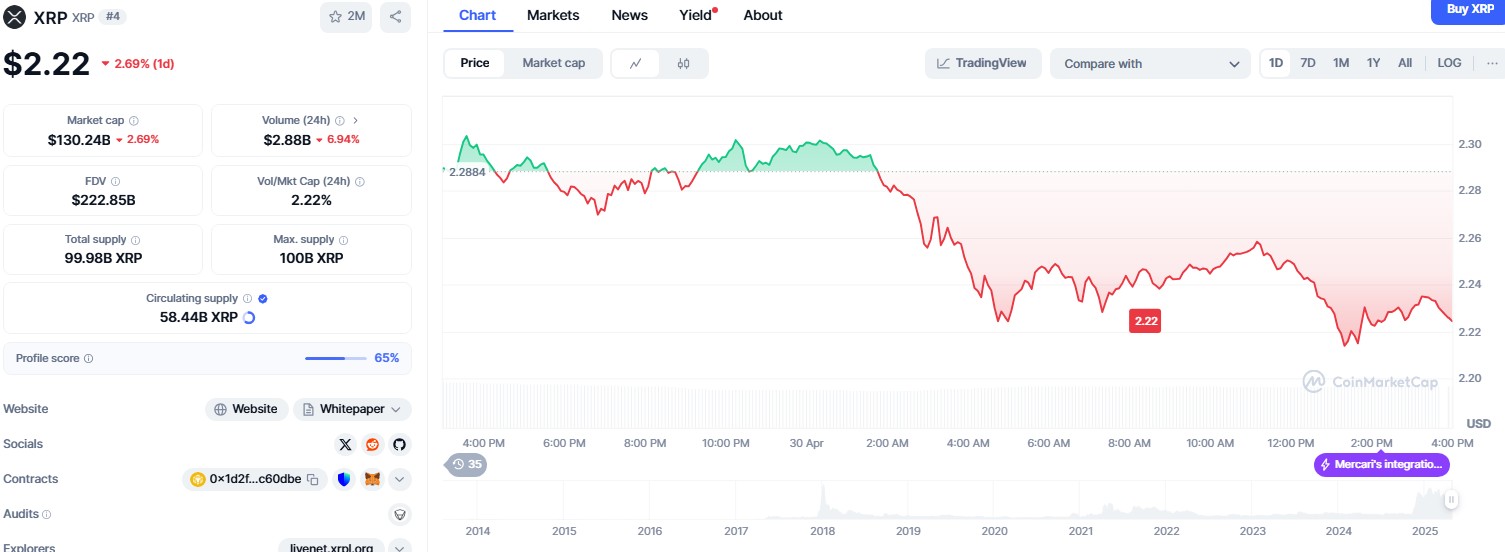

XRP has rallied 8.63% over the past week, trading at $2.22 as of 30 April 2025, according to CoinMarketCap .

The token’s latest market capitalisation stands at $130.09 billion, with 58.44 billion XRP in circulation and $2.89 billion in 24-hour trading volume.

While XRP is down 3.04% in the past 24 hours, it remains up sharply from its April lows.

The recent momentum is largely attributed to optimism surrounding the launch of XRP futures exchange-traded funds (ETFs), despite the delay of ProShares Trust’s product to 2025.

Analysts say XRP’s recent breakout above its 21-day and 50-day moving averages—combined with the end of a multi-week downtrend—suggests continued strength in the short term.

The current focus is whether XRP can retest 2025 highs and potentially reach $3.40, although macroeconomic uncertainties remain a limiting factor.

Legal win and SEC approval drive sentiment

Ripple’s March 2025 legal victory against the US Securities and Exchange Commission (SEC) has revived investor confidence.

The ruling cleared the path for XRP-based futures ETFs, providing institutional investors with new avenues for exposure.

The surge in XRP follows a similar pattern seen with Bitcoin’s reaction to its spot ETF approvals in early 2024.

Market observers believe XRP could mirror Bitcoin’s post-ETF rally, especially as investor sentiment continues to improve.

XRP’s price strength, even amid broader volatility, reinforces its position as a leading altcoin heading into the second half of 2025.

Trump policies and Fed caution weigh on upside

Despite positive momentum, economic risks could cap near-term gains. President Trump’s expanded tariff programme and renewed trade disputes have fuelled concerns of stubborn inflation.

This, in turn, may keep the US Federal Reserve in a hawkish stance longer than markets would prefer.

These factors increase the likelihood of risk-off behaviour among investors, which could impact high-volatility assets like XRP.

As a result, while some traders have speculated about XRP surging toward $10, this scenario appears unlikely unless broader market conditions shift significantly.

Ripple network and adoption expand

Beyond price action, Ripple’s ecosystem continues to grow. The December 2024 launch of the RLUSD stablecoin has enhanced on-chain liquidity and transaction flexibility.

Upgrades to the XRP Ledger have also boosted transaction speeds, now capable of handling more than 3,400 transactions per second, improving its appeal for institutional use.

The Trump administration’s pro-crypto stance—including the appointment of Paul Atkins as SEC Chair—suggests that regulatory clarity may continue to improve.

In March, Trump identified XRP as a key digital asset that could be included in the US government’s digital stockpile initiative.