-

Bitcoin’s surge towards $200,000 by the end of the year reflects the potential impact of Federal Reserve rate cuts and shifting global economic dynamics.

-

Market analysts are closely monitoring bullish patterns as Bitcoin currently sits at pivotal resistance points.

-

“If Bitcoin surpasses $100K, we may witness an unprecedented rally,” noted Matt Mena from 21Shares.

Bitcoin aims for a $200K target influenced by Fed policies and global trends, igniting hope among investors and analysts alike.

Bitcoin’s Momentum and Market Sentiment

Bitcoin’s ascent to $99,000 signifies a resilient comeback, with a recovery of approximately 32% from its April lows. Markets reacted positively following the Federal Reserve’s decision to maintain interest rates, indicating strong labor market conditions coupled with persistent inflation challenges. This environment has created fertile ground for Bitcoin’s bullish trajectory, raising expectations for a significant price breakthrough.

The Role of Federal Reserve Policies

As the possibility of more Fed rate cuts looms on the horizon in Q3 2025, investors are increasingly favoring risk assets such as Bitcoin. Matt Mena asserts that a decisive breakout beyond $100,000 could create momentum towards the all-time high of $108,500. Such movements would likely be fueled by increased adoption and positive regulatory developments impacting Bitcoin’s market landscape.

Source: Bloomberg

The influence of traditional markets on Bitcoin’s price trajectory is evident, with investor interest shifting towards BTC as a hedge against inflation. Recent flows into BlackRock’s Bitcoin ETF suggest a growing preference for digital assets over gold, marking a critical shift in investor sentiment.

Current Market Dynamics and Liquidity Zones

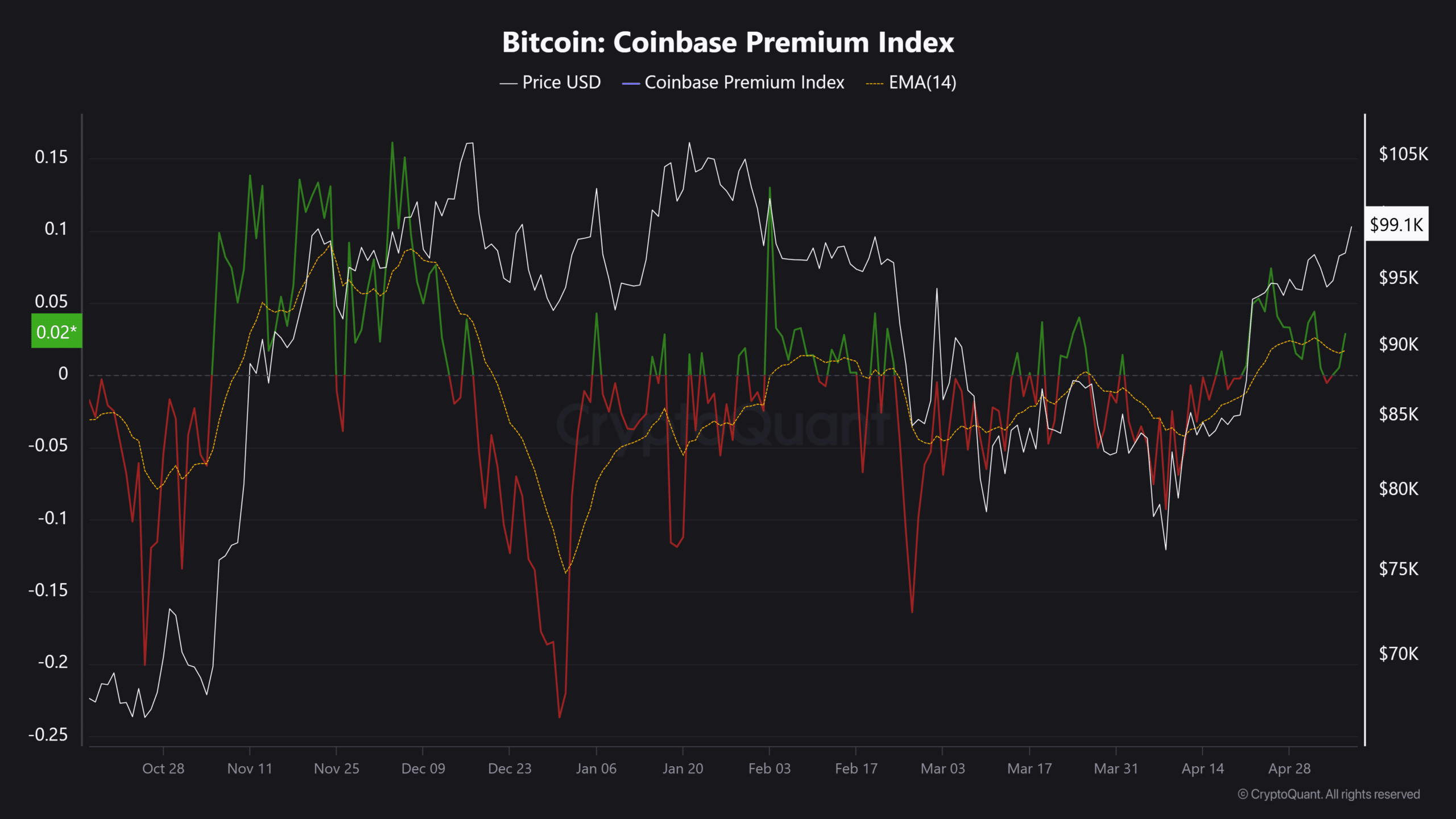

Bitcoin’s current trading activity reveals significant liquidity zones, with key levels identified at $98K, $100K, and a potential price magnet at $106K. The Coinbase Premium Index indicates increasing investor confidence, reinforcing the positive trajectory of BTC. As U.S. spot BTC ETFs attracted $2 billion in inflows over the past week, total year-to-date inflows have surpassed $5 billion.

Source: CryptoQuant

Looking ahead, macroeconomic factors, particularly developments in the U.S.-China trade talks, could further positively affect BTC. While short-term trends appear robust, long-term prospects hinge on the Federal Reserve’s monetary strategy and the broader market’s adoption of cryptocurrencies.

Conclusion

In summary, Bitcoin stands at a critical juncture, poised for potential historic gains as favorable economic conditions align. The market’s focus on the upcoming Fed rate decisions and expanding global acceptance of Bitcoin will be pivotal in determining its trajectory over the coming months. Investors should remain vigilant and consider the prevalent macroeconomic trends driving market sentiment.