Katana, the DeFi-focused chain incubated by Polygon Labs and GSR, launches private mainnet

Quick Take Polygon Labs and GSR have incubated a DeFi-focused blockchain called Katana, which is launching in private mainnet on Wednesday. The network is designed to concentrate liquidity across its applications, including launch partners like Sushi and Morpho, helping users to generate yield. Users can start locking up ETH, USDC, USDT, or WBTC during the Katana private mainnet period will receive KAT tokens.

Polygon Labs and market maker GSR have incubated a new DeFi-optimized blockchain called Katana, which will launch in private mainnet on Wednesday, according to an announcement. The new chain is accompanied by the launch of the Katana Foundation, a nonprofit organization that will help foster relationships with projects including rollup platform Conduit and crypto oracle Chainlink.

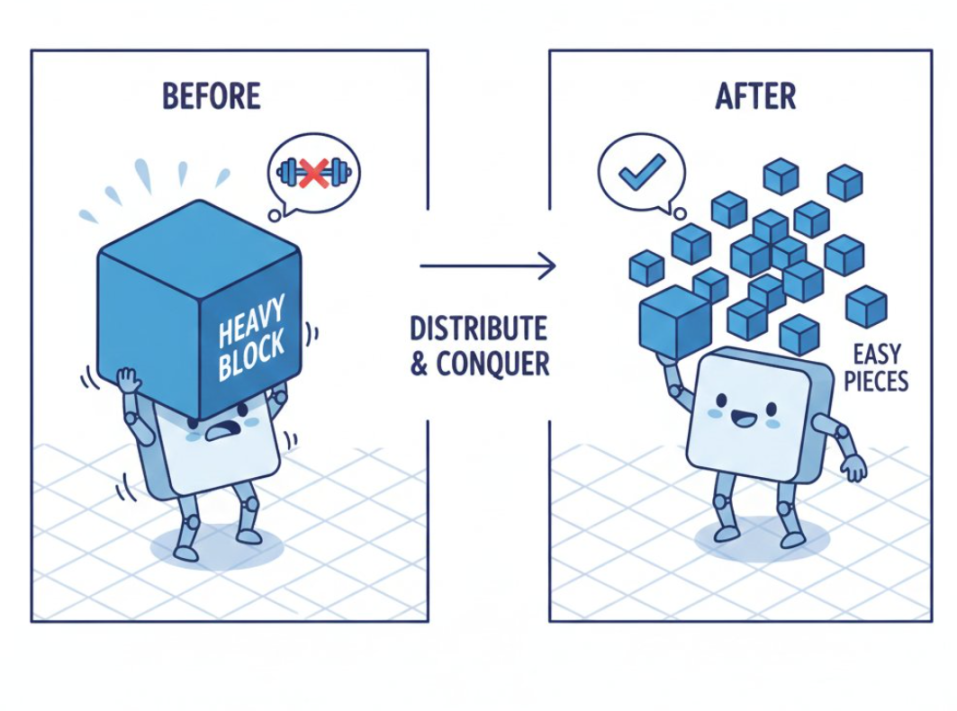

"Unlike the fragmented traditional DeFi experience, Katana concentrates all liquidity in a set of protocols and collects yield from all potential sources to power a self-sustaining DeFi engine for long-term growth," the team wrote in a statement. "Katana is tailor-made to ensure liquidity is concentrated and deep for slippage to be low and borrowing and lending rates to be stable."

According to the announcement, users will now be able to "pre-deposit" funds to earn Katana's native KAT token. A public mainnet launch is expected in June.

Katana is built using a custom version of OP Stack, called cdk-opgeth. The network is also connected to Polygon’s zero-knowledge-powered Agglayer. The team notes these ZK proofs — essentially a form of cryptography that can prove something is true without revealing the reason why — are generated by the SP1 prover built by Succinct Labs.

The blockchain was incubated in part through Polygon’s Agglayer Breakout Program .

Additionally, GSR will provide liquidity management and cross-chain transaction support as well as business development through its venture arm.

"We're not just deploying capital but helping to architect sustainable, accessible DeFi ecosystems," said GSR President Jakob Palmstierna. "With Katana, we're applying our deep markets expertise to unlock real yield and concentrated liquidity."

Katana’s claim to be “DeFi-optimized” stems from its liquidity management system, which consolidates “liquidity across a select group of leading DeFi protocols.” This helps to ensure lower price slippage and more competitive rates.

At launch, Katana will integrate versions of lending protocol Morpho, decentralized trading platform Sushi, and perps exchange Vertex. It will also support Agora’s AUSD stablecoin, Lombard’s liquid-staked wrapped LBTC, and Ether.Fi’s yield-bearing weETH, among other DeFi integrations.

Cross-chain platform Universal will also provide access to “blue-chip assets that are not natively available on Katana,” like XRP, SOL, and SUI.

According to the release, users who pre-deposit ETH, USDC, USDT, or WBTC during the Katana private mainnet period will receive KAT tokens, which will automatically unlock after “no more” than nine months. KAT tokens can also be locked up for the veKAT governance token, which will use a “vote-escrow model.”

"DeFi users deserve ecosystems that prioritize sustainable liquidity and consistent ‘real’ yields,” Polygon Labs CEO Marc Boiron said in a statement. “Katana’s user-centric model turns inefficiencies into advantages, establishing a truly positive-sum environment for builders and participants alike."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

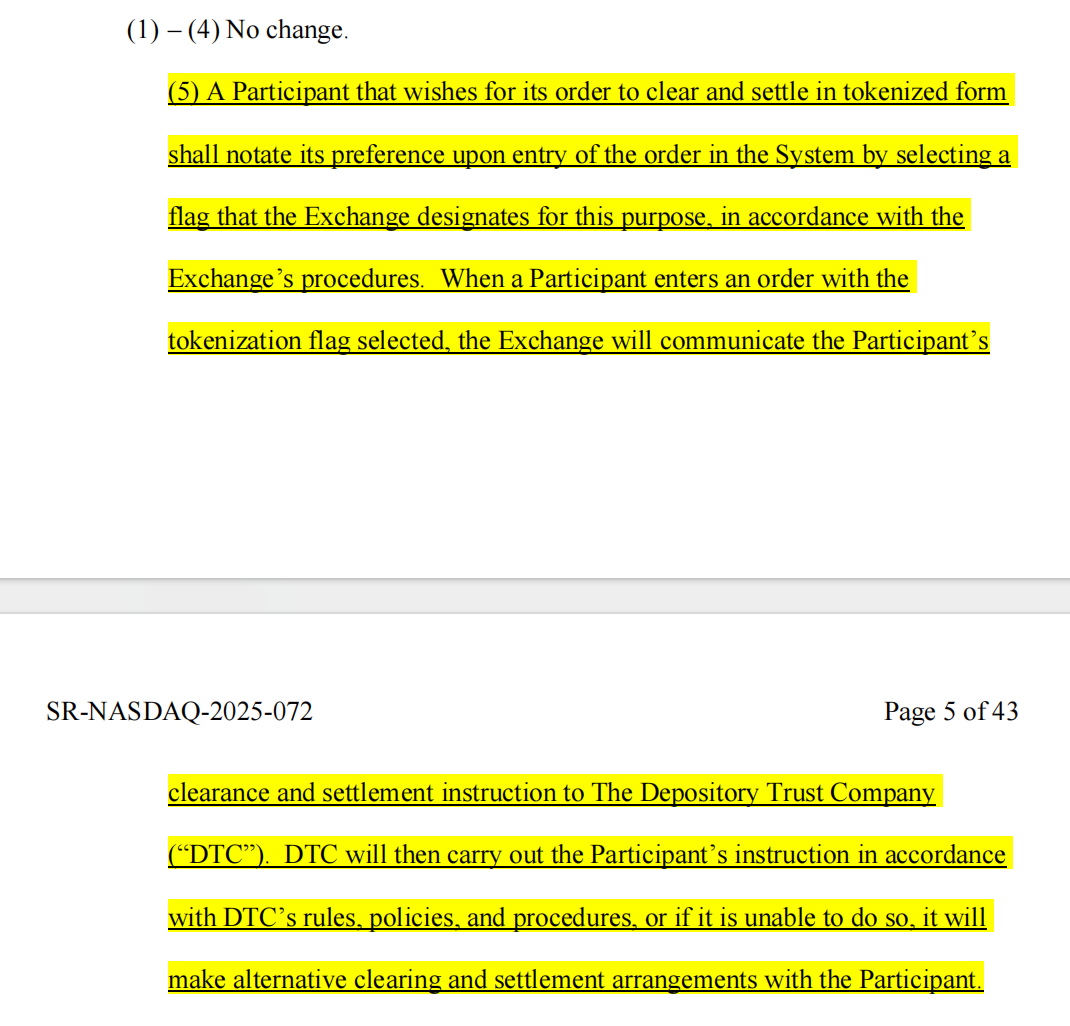

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

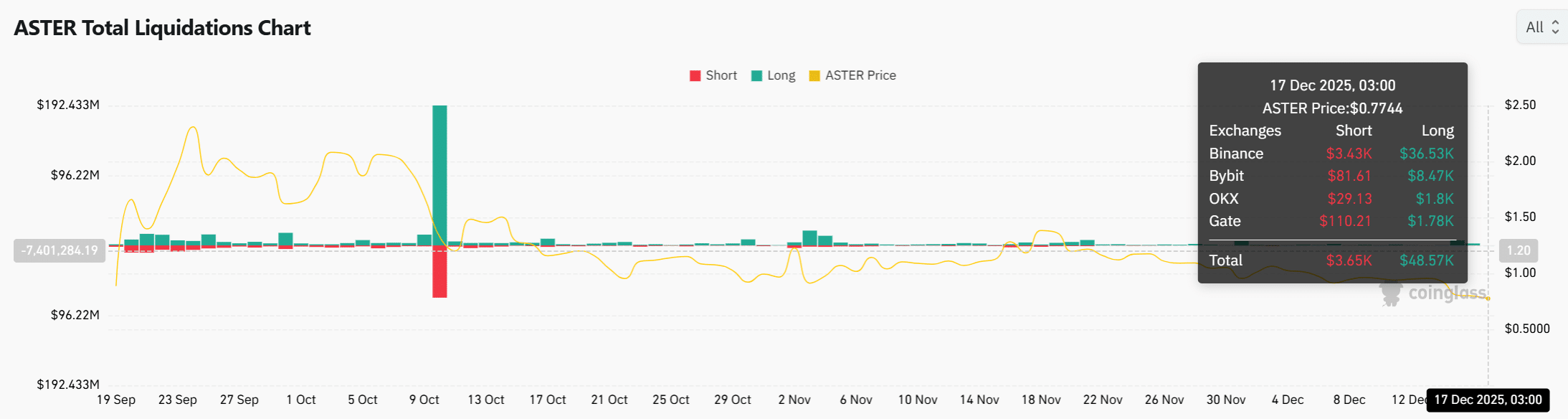

ASTER price sinks as whale losses deepen – Is $0.6 next?