SPX Hits 31 % Daily Gain, PEPE Eyes 10.8 % Upside | Meme Coins To Watch Today

SPX6900’s strong 30% rise sets a bullish tone for meme coins like PEPE and BITCOIN, with key resistance tests shaping their next moves.

Meme coins lost their groove over the last few days but some tokens continue to find bullish momentum. One of the leading the meme coins in the last 24 hours has been SPX6900, which has risen by 30%.

BeInCrypto has analyzed two other meme coins for investors to watch as they follow SPX’s footsteps.

Pepe (PEPE)

- Launch Date – April 2023

- Total Circulating Supply – 420.69 Trillion PEPE

- Maximum Supply – 420.69 Trillion PEPE

- Fully Diluted Valuation (FDV) – $6.08 Billion

- Contract Address – 0x6982508145454ce325ddbe47a25d4ec3d2311933

PEPE has maintained an uptrend for the past three weeks, aiming to extend its price gains. Currently trading at $0.00001443, the meme coin faces resistance at $0.00001489, which it must overcome to continue its upward trajectory.

If bullish momentum continues, PEPE could break past $0.00001489. This breakthrough might trigger a 10.79% rise, pushing the price to $0.00001600 and confirming the strength of the ongoing uptrend.

PEPE Price Analysis. Source:

TradingView

PEPE Price Analysis. Source:

TradingView

However, failure to breach $0.00001489 could lead to a decline. PEPE may fall below the support level of $0.00001384, potentially dropping toward $0.00001216 and invalidating the current bullish trend.

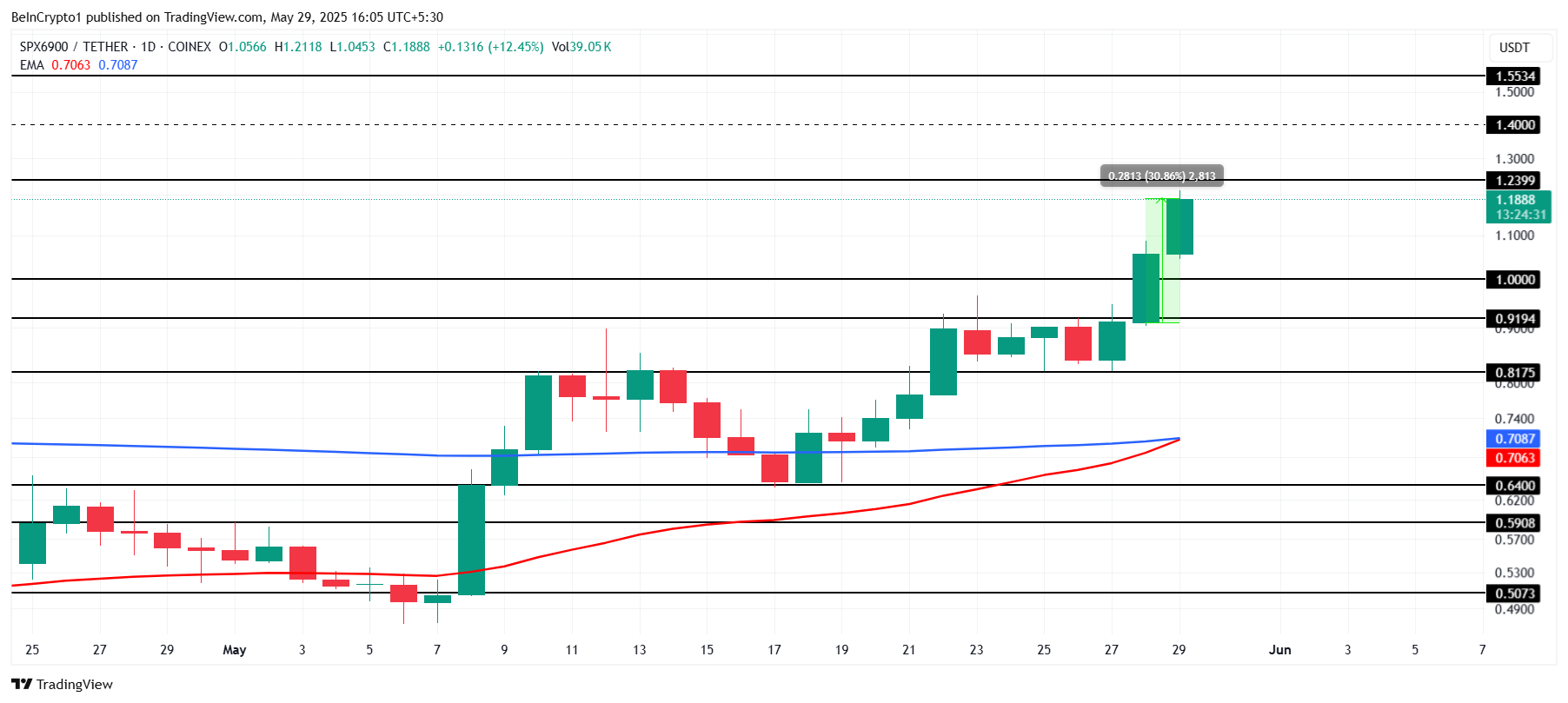

SPX6900 (SPX)

- Launch Date – March 2024

- Total Circulating Supply – 930.99 Million SPX

- Maximum Supply – 1 Billion SPX

- Fully Diluted Valuation (FDV) – $1.11 Billion

- Contract Address – 0xe0f63a424a4439cbe457d80e4f4b51ad25b2c56c

SPX surged nearly 31% in the last 24 hours, currently trading at $1.18, just below the $1.23 resistance. This momentum suggests the meme coin is set to continue rising, fueled by growing investor interest and positive market sentiment.

The potential Golden Cross, with the 50-day EMA crossing above the 200-day EMA, signals a strong bullish shift. If confirmed, SPX could advance toward $1.40, attracting more buyers.

SPX Price Analysis. Source:

TradingView

SPX Price Analysis. Source:

TradingView

However, failure to break $1.23 or increased selling pressure could push SPX back to $1.00. This decline would negate the recent gains and challenge the current bullish outlook.

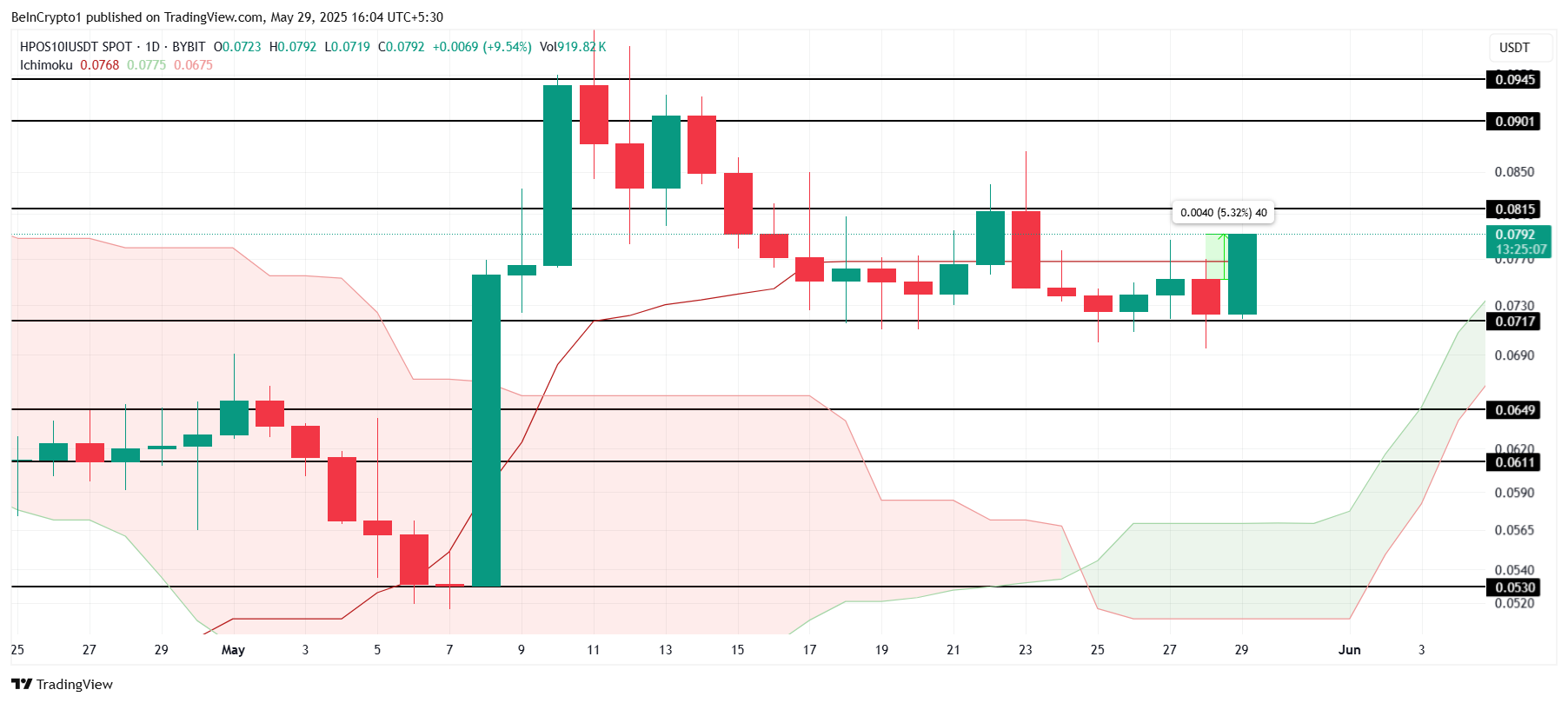

Small Cap Corner – HarryPotterObamaSonic10Inu (ETH) (BITCOIN)

- Launch Date – July 2023

- Total Circulating Supply – 999.79 Million BITCOIN

- Maximum Supply – 1 Billion BITCOIN

- Fully Diluted Valuation (FDV) – $79.75 Million

- Contract Address – 0x72e4f9f808c49a2a61de9c5896298920dc4eeea9

The meme coin BITCOIN has risen 5.3% recently, with the Ichimoku Cloud below the candlesticks, indicating continued bullish momentum. This suggests the price could sustain its upward trajectory in the near term.

Currently trading at $0.079, BITCOIN remains confined between $0.081 and $0.071. A breakout above $0.081 could drive the meme coin’s price to $0.090.

BITCOIN Price Analysis. Source:

TradingView

BITCOIN Price Analysis. Source:

TradingView

However, increased selling pressure may lead to consolidation. If BITCOIN falls below the $0.071 support, it could drop to $0.064, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know