-

The recent spike in liquidity for Hyperliquid [HYPE] positions the altcoin as a potential candidate for a resurgence, echoing movements in Bitcoin (BTC).

-

Despite a recent dip of 2.77% to $33, HYPE’s underlying trading dynamics indicate that this pullback could be a temporary setback, aided by rising trading fees and volume.

-

“A single whale opened a $250 million BTC long recently, showcasing the close relationship between HYPE and Bitcoin’s market activities,” stated COINOTAG.

Hyperliquid [HYPE] demonstrates potential for growth amidst rising liquidity and a strong correlation with Bitcoin, hinting at a possible rally ahead.

The Significance of Liquidity Inflow for HYPE’s Prospects

As liquidity continues to surge on Hyperliquid, analysts are optimistic about HYPE’s prospects in the coming weeks. High liquidity often leads to improved price stability and enhanced trading opportunities, fostering a robust environment for traders. This increased inflow signifies an escalating interest in the altcoin, which could trigger a rally.

The Correlation Between HYPE and Bitcoin

Understanding the relationship between HYPE and Bitcoin is crucial for investors. The close correlation has been evident, with both assets mirroring each other’s price movements. This synergy is indicative of how Bitcoin’s market influence can steer HYPE’s trajectory. Increased trading volumes on HYPE are often a response to Bitcoin’s market shifts, making it essential to monitor BTC for anyone looking to invest in HYPE.

Source: TradingView

With major transactions and a growing number of Bitcoin traders utilizing Hyperliquid for long positions, HYPE stands to benefit significantly as market conditions shift in Bitcoin’s favor.

Analyzing On-Chain Sentiment for HYPE

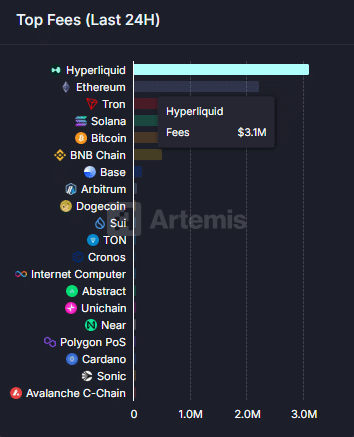

The ongoing on-chain activity surrounding HYPE provides additional insights into its bullish sentiment. Over the past day, HYPE surpassed notable competitors in trading fees, generating $3.1 million—evidence of its rising popularity in the decentralized exchange space.

Source: Artemis

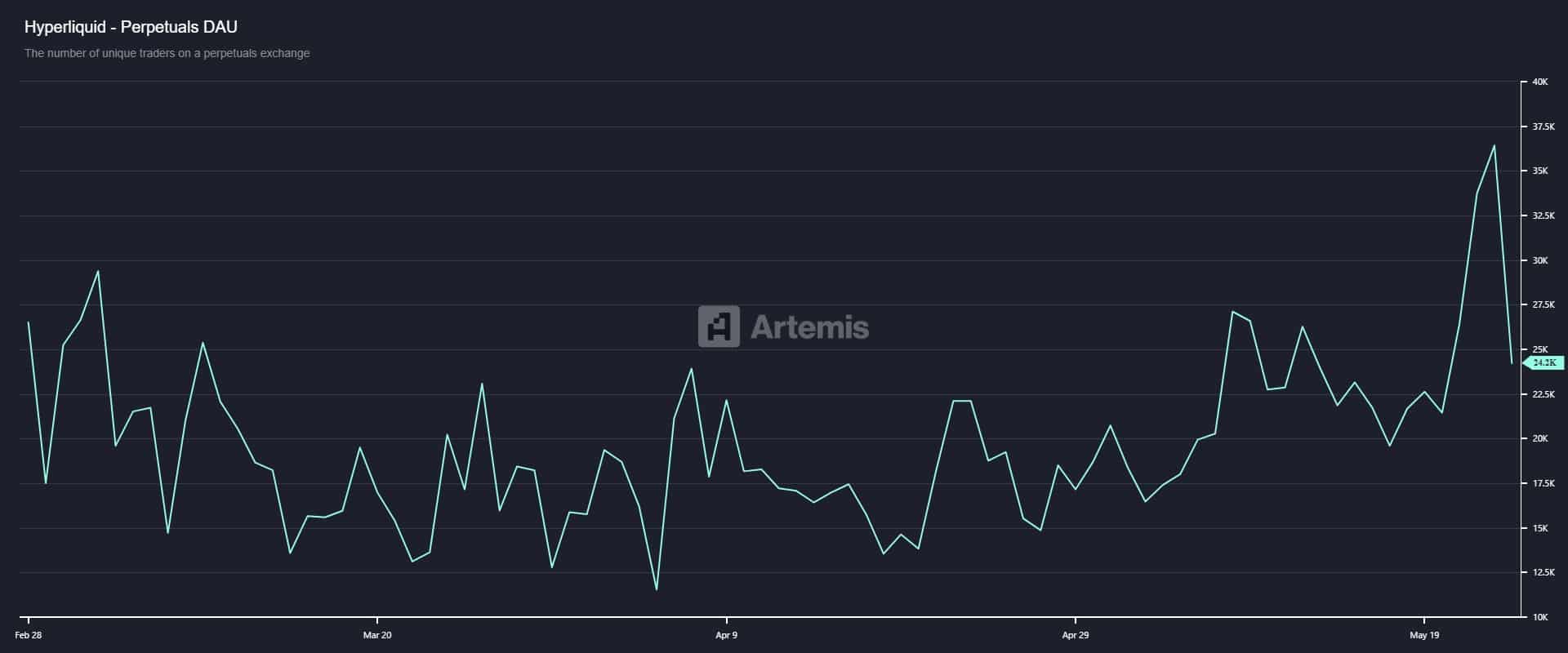

Moreover, the annualized trading fees have surged to $777 million, showcasing a 52% increase over the last month—a sign that user engagement is on the rise. This heightened trading activity could fuel a bullish momentum for HYPE as more users engage with the platform.

Source: DeFiLlama

However, despite this positive trend in trading fees, the decline in daily transactions to 518 million indicates a slight decrease in user activity, which could temper immediate bullish expectations.

Source: Artemis

As HYPE looks to rebound from recent volatility, the decline in DEX volume alongside steady holding patterns among investors reignites optimism for a potential price recovery.

Conclusion

In summary, Hyperliquid [HYPE] is facing a pivotal moment influenced by rising liquidity and its significant correlation with Bitcoin. The increased trading fees and robust engagement on the platform underscore bullish sentiments among traders. Moving forward, investors should closely monitor Bitcoin’s performance and on-chain metrics for HYPE, as they may offer valuable insights into its recovery trajectory.