Bitcoin Market Fatigue Grows: Could BTC Price Drop Below $100,000?

2025/06/27 02:20

2025/06/27 02:20Bitcoin’s price has recently rebounded, bringing it close to the critical $108,000 level. While this recovery offers hope, the key resistance remains unclaimed as support.

Adding to concerns is a noticeable shift in investor behavior, signaling market fatigue, which could be setting the stage for a price decline below $100,000.

Bitcoin Profit Taking Slows Down

In the previous market cycle (2020–2022), Bitcoin investors realized a total of approximately $550 billion in profit during multiple rallies, including two major waves. Fast forward to the current cycle, and realized profits have already exceeded $650 billion, surpassing the previous cycle’s total. This indicates that, while large gains have been made, the market may be entering a cooling phase.

The latest data suggests that profit-taking has peaked, with the market now in a cool-down period after the third major wave of profit realization. Although gains have been secured, the momentum driving Bitcoin’s upward movement appears to be waning. As realized profitability tapers off, investor sentiment shifts, leading to reduced buying pressure.

Bitcoin Bull Market Profit Realization Trend.

Bitcoin Bull Market Profit Realization Trend.

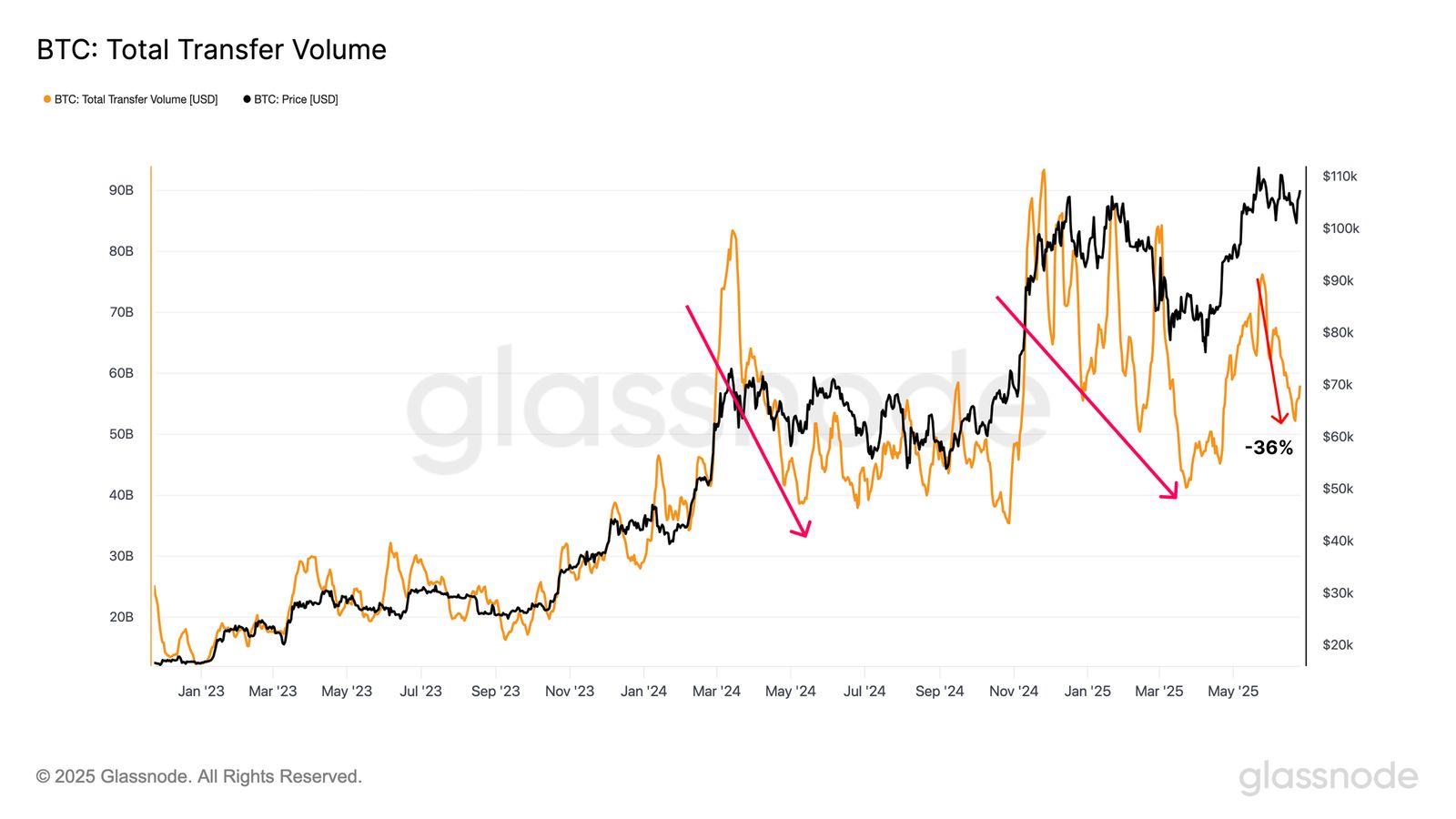

Bitcoin’s total transfer volume has also shown signs of cooling. The 7-day moving average of on-chain transfer volume has dropped by approximately 32%, falling from a peak of $76 billion in late May to $52 billion over the past weekend. This decline is consistent with the broader pattern of market cooling, signaling that Bitcoin’s bullish momentum may be losing steam.

The slowdown in transfer volume reflects a general loss of activity across key Bitcoin metrics, reinforcing the notion that market participants are taking a cautious approach. As the market eases, Bitcoin’s price could face downward pressure.

Bitcoin Total Transfer Volume.

Bitcoin Total Transfer Volume.

BTC Price Needs To Secure Support

Bitcoin’s price is currently at $106,907, just below the $108,000 resistance. For BTC to continue its upward trend, it must flip $108,000 into support. This would set the stage for further gains, pushing Bitcoin towards the $110,000 mark and potentially beyond. However, the current market sentiment remains fragile.

Given the rising signs of market fatigue and the cooling of key activity metrics, a decline is more likely in the near term. If demand does not revive, Bitcoin’s price could fall below $105,000 and test the critical $100,000 support level. Any further loss in momentum may trigger a deeper decline.

Bitcoin Price Analysis.

Bitcoin Price Analysis.

Alternatively, if Bitcoin’s price manages to hold above key support levels, the bullish trend remains intact. Successfully reclaiming $108,000 as support would clear the path for Bitcoin to rise to $110,000. A break above this level could lead to a move towards the all-time high of $111,980, maintaining the upward momentum and investor optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know