Calamos unveils ‘Protected Bitcoin’ strategy for institutional investors

Investment firm Calamos has unveiled a new investment strategy aimed at limiting Bitcoin’s downside potential.

Bitcoin (BTC) is becoming increasingly attractive to institutions, but many still view it as too risky. In response, on June 7, global investment firm Calamos introduced its “protected Bitcoin” strategy , designed to limit both the downside and the upside of Bitcoin exposure.

The firm noted that although Bitcoin has reached a $2 trillion valuation, institutional investors remain concerned about its volatility. As a result, most allocate just 1–2% of their portfolios to BTC to avoid outsized risk exposure.

Calamos has structured its strategy to offer some upside participation while managing risk by combining Bitcoin futures with U.S. Treasuries. Specifically, the firm purchases zero-coupon U.S. Treasury bonds maturing at the end of the year.

Calamos pairs treasuries with Bitcoin

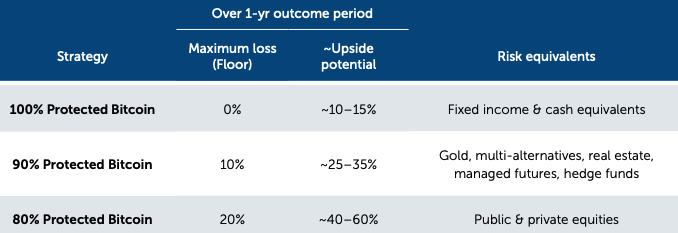

These Treasuries act as a protective floor in predefined worst-case scenarios, limiting losses to 0%, 10%, or 20%, depending on the risk tier. Simultaneously, Calamos buys call options on the Bitcoin Index to capture potential gains. To fund these, the firm also sells out-of-the-money call options, effectively capping the upside between 25% and 60%.

Calamos risk-reward tiers | Source: Calamos

Calamos risk-reward tiers | Source: Calamos

Each risk-return tier is benchmarked to familiar asset classes. The 100% protected Bitcoin tier mirrors the risk profile of Treasuries, offering capital preservation with virtually no downside risk. The second tier is comparable to gold or alternative assets, while the third tier aligns with equities in terms of expected returns and volatility.

Calamos believes this structured approach could enhance Bitcoin’s appeal relative to traditional assets. However, timing remains critical. Traders must hold positions to maturity to benefit from the downside protection; early exits could result in loss of principal. While rare, another risk includes potential sovereign debt default, which the firm notes is highly unlikely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Terra Luna Classic Shakes the Crypto Market with Surprising Developments

In Brief LUNC experienced a significant price decline following Do Kwon's sentencing. The court cited over $40 billion losses as a reason for Do Kwon's penalty. Analysts suggest short-term pressure on LUNC may persist, despite long-term community support.

NYDIG: Tokenized Assets Offer Modest Crypto Gains as Growth Depends on Access and Regulation

Cardano Investors Split As Market Fatigue Sets In

Bitcoin : Strategy escapes the chopping block during the first Nasdaq 100 sorting