Bitcoin Gears Up for a Supply Squeeze as Miners and HODLers Clamp Down

Bitcoin's low supply environment, rising miner reserves, and a concentration of liquidity near $110K point to a potential breakout, though risks remain.

After several failed attempts to breach the $110,000 price mark over the past week, leading coin Bitcoin may be set for a decisive breakout.

On-chain data shows coin accumulation is quietly intensifying, and the bullish signals are beginning to align.

Bitcoin Supply Tightens as Miners Hold and Velocity Hits 3-Year Low

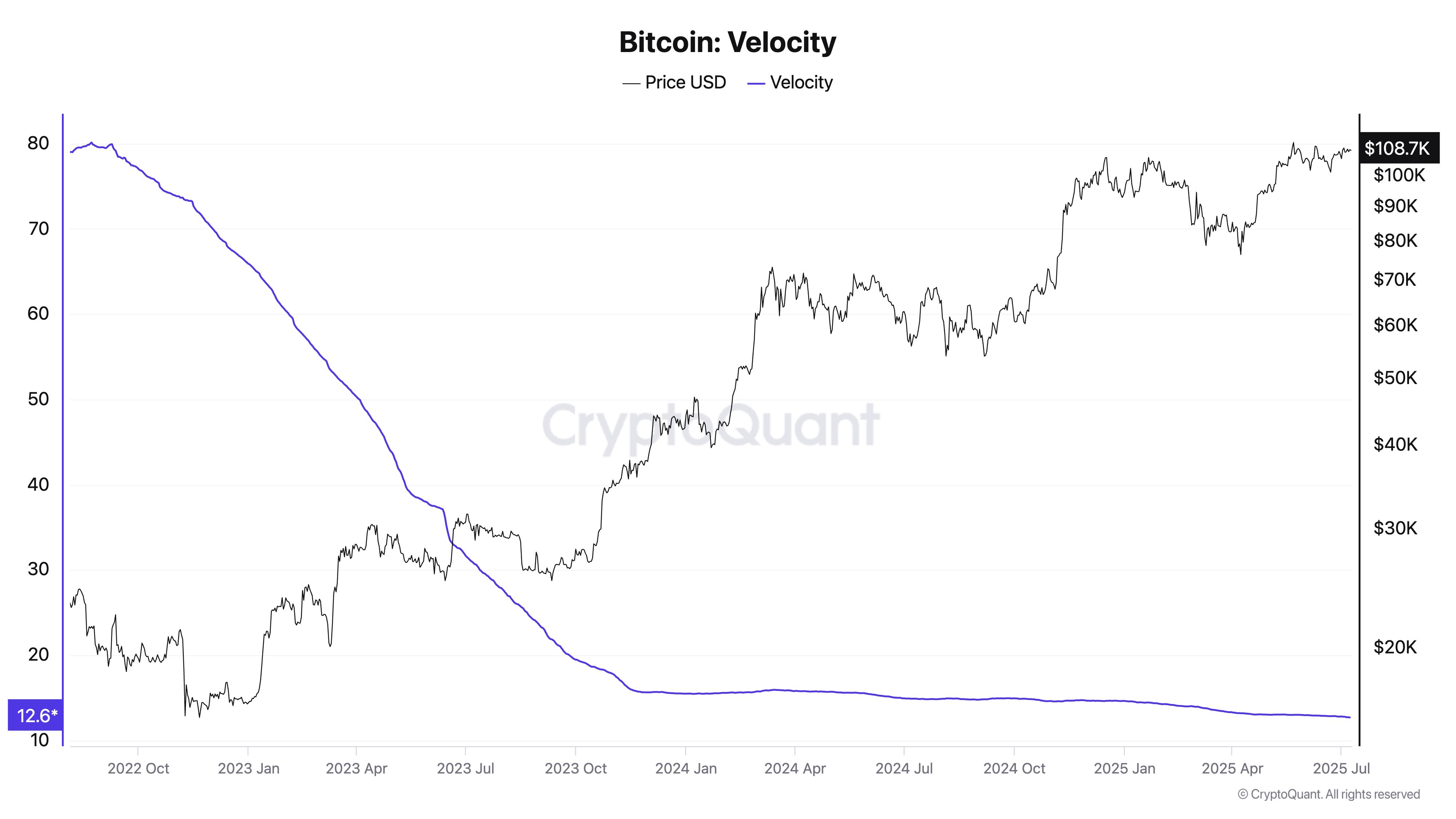

BTC’s Velocity has slowly declined since July started, indicating that the coin is entering a low-supply environment. On July 8, the on-chain metric, which measures how frequently BTC changes hands over a given period, closed at a three-year low of 12.68.

Bitcoin Velocity. Source:

CryptoQuant

Bitcoin Velocity. Source:

CryptoQuant

When an asset’s velocity falls, fewer coins are moving through the network, indicating that holders are choosing to sit tight rather than trade or sell.

This is a bullish signal, as it reflects growing conviction among investors and a gradual tightening of liquid supply, which can drive prices higher if demand increases.

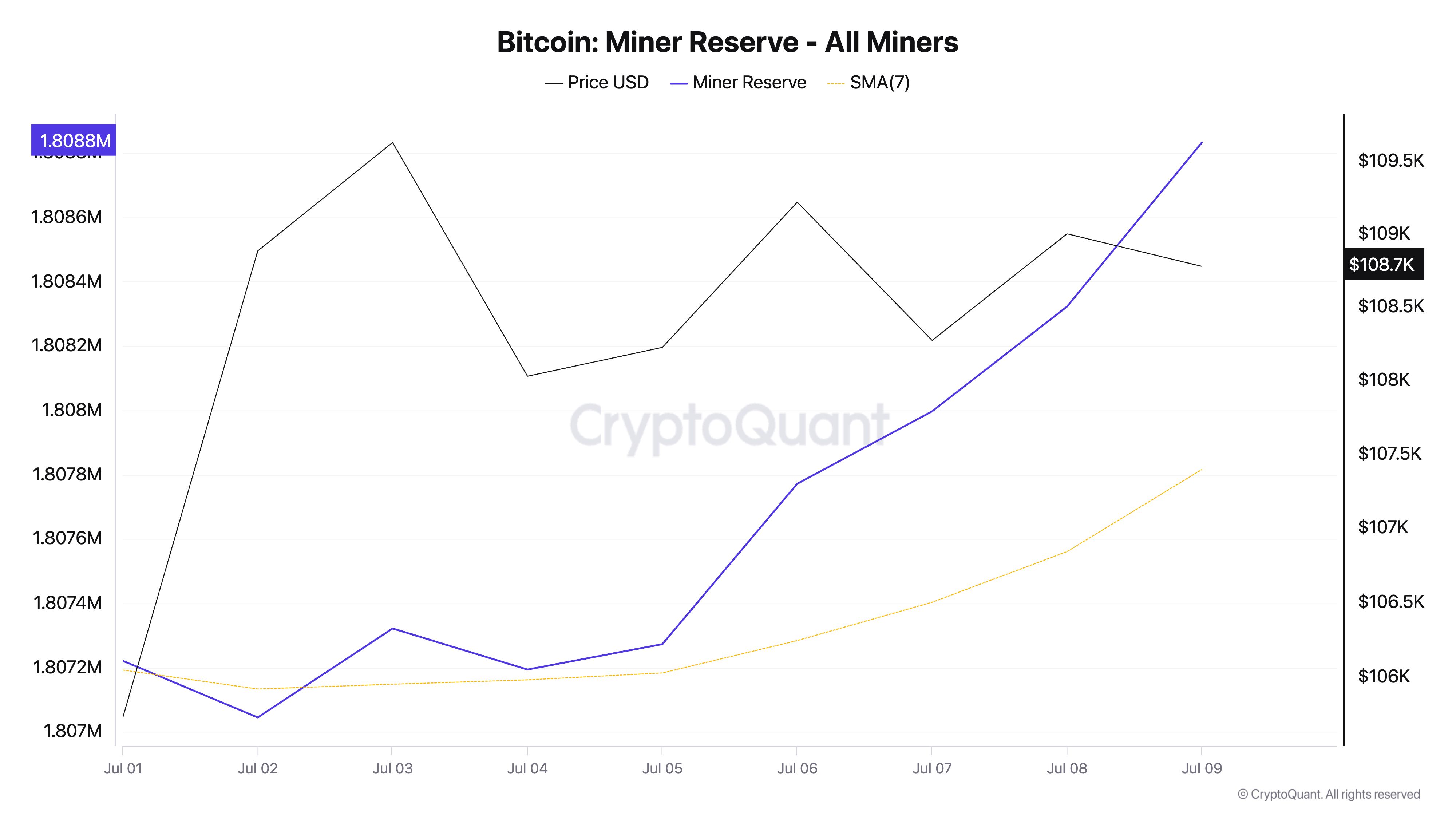

In addition, Bitcoin’s Miner Reserve has climbed steadily over the past week. Data from CryptoQuant shows that miners have added 1,782 BTC to their holdings in the last seven days, pushing the total Miner Reserve to 1.81 million coins at press time.

Bitcoin Miner Reserve. Source:

CryptoQuant

Bitcoin Miner Reserve. Source:

CryptoQuant

The rise in BTC’s Miner Reserve since the beginning of July suggests a shift in miner behavior toward holding rather than selling as the market presses harder for a climb rally above $110,000.

Bitcoin Could Surge as Traders Zero In on $110,000 Liquidity Zone

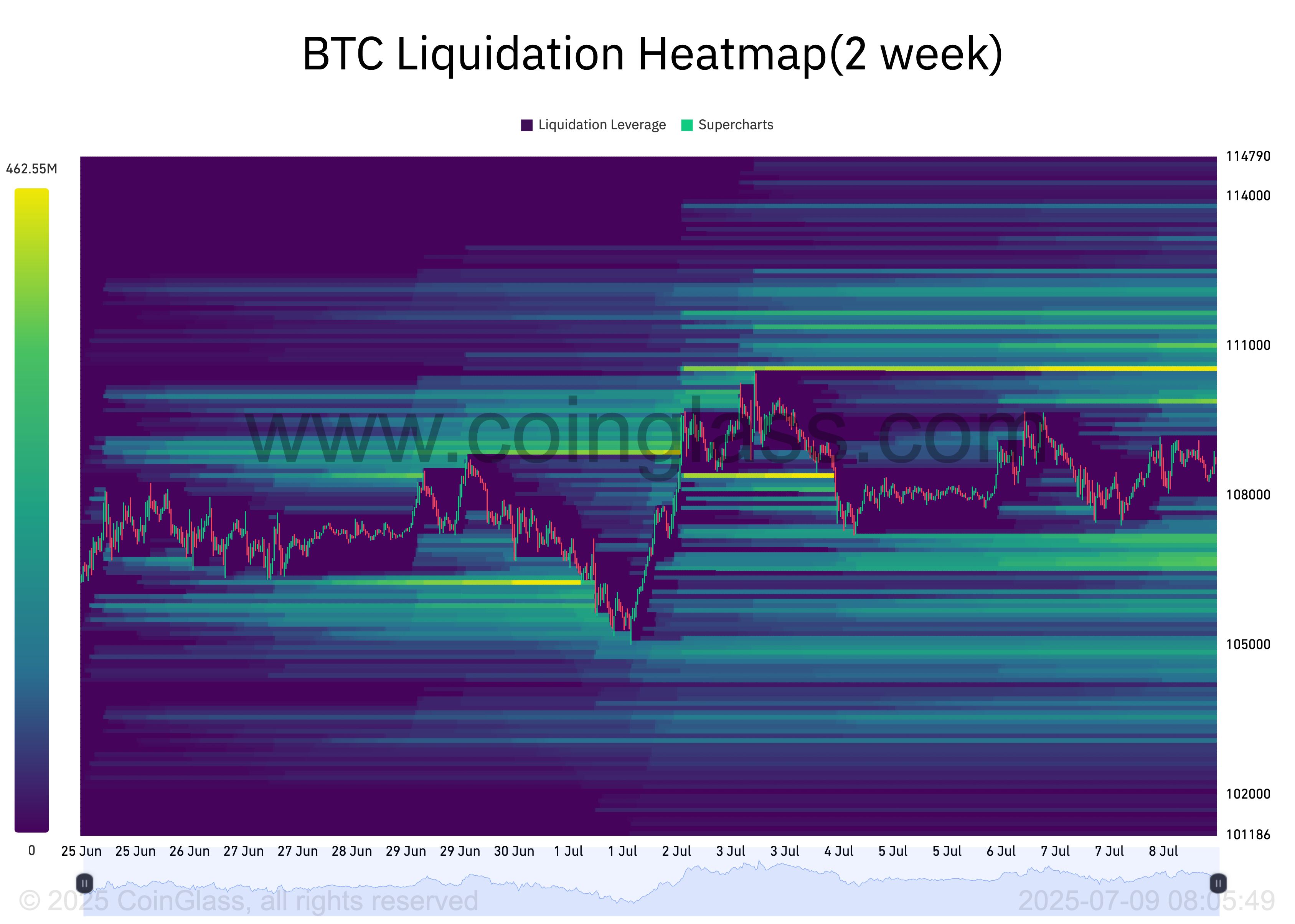

An assessment of BTC’s liquidation heatmap shows a notable concentration of liquidity around the $110,473 price zone.

BTC Liquidation Heatmap. Source:

Coinglass

BTC Liquidation Heatmap. Source:

Coinglass

Liquidation heatmaps identify price levels where clusters of leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones (yellow) representing larger liquidation potential.

Usually, these cluster zones act as magnets for price action, as the market tends to move toward these areas to trigger liquidations and open fresh positions.

Therefore, for BTC, the cluster of a high volume of liquidity at the $110,473 price level indicates a strong trader interest in buying or closing short positions at that price. It creates room for a potential surge past $110,000 in the near term.

However, this will not happen if selling pressure gains momentum and new demand fails to enter the BTC market. In this case, the coin’s price could fall toward $107,745.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

BTC’s price could breach support and slide toward $104,709 if buying pressure remains weak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.