- Stellar has completed a fourth wave near $0.40 and may now rise to $0.50 if buying strength remains strong

- The support zone around $0.395 has held steady and buyers continue to push the price toward higher levels

- Volume and wave signals show the price has room to climb and traders are watching $0.50 as the next test

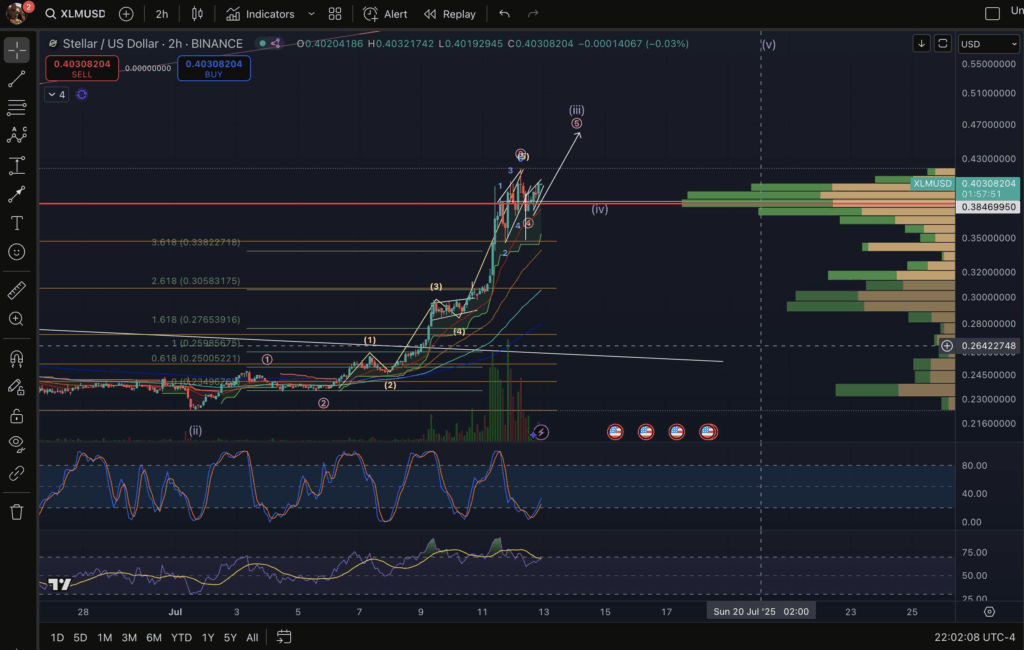

Stellar Lumens (XLM) remains bullish above $0.40 as analysts track an active wave structure signaling a possible breakout. A key chart posted on July 13, 2025, shows XLM nearing the end of a fourth wave, hinting that a strong move may follow. Fibonacci levels and volume clusters support this view, with upward targets between $0.50 and $0.55.

Source:

X

Source:

X

According to chart data from Binance’s 2-hour timeframe, the price of XLM currently trades at $0.4038. The Elliott Wave pattern suggests the asset may be finishing wave (iv), with a potential move into wave (v) targeting higher resistance. The previous wave (iii) showed strong upward momentum that pushed price above key Fibonacci zones, including 1.618 and 2.618 levels.

User on X stated, “If XLM is done with 4th here… God damn it’s about to send,” highlighting bullish expectations among market watchers. The trading chart confirms this view, showing rising moving averages, elevated volume nodes, and support levels above $0.39. The price has also reclaimed $0.40 after a brief dip, which may now act as an immediate support level.

Chart Indicators Suggest More Upside Ahead

The chart includes critical Fibonacci extensions, with 1.618 at $0.2765, 2.618 at $0.3056, and 3.618 at $0.3382. These levels served as key turning points during the previous rally and now form part of the upward roadmap. The price has respected these extensions, forming wave structures that remain within a bullish trend.

An ascending pattern supported by trendlines and moving averages strengthens the setup. Indicators such as the Stochastic RSI and RSI show price cooling off briefly before another potential leg upward. The volume profile also shows high activity at $0.384, confirming demand in that zone.

Support appears strongest near $0.395, a level also mentioned by market分析人士. That zone may determine whether XLM builds toward $0.45 or retests lower consolidation zones. Traders have pointed out that as long as price remains above this level, the bullish outlook stays valid.

Market participants are now watching for the next wave breakout . If wave (v) unfolds as forecasted, price could rise above $0.45 and challenge $0.50 resistance. A sustained break beyond $0.50 would then open the path toward $0.55 or higher, matching volume target zones.

Can XLM Surpass $0.50 in This Bullish Impulse?

The key question now is whether Stellar Lumens can maintain momentum and close above $0.50 during this wave cycle.

Based on the current setup, the price structure has followed typical impulse behavior. Wave (i) began near $0.25, and wave (iii) peaked above $0.40, reflecting aggressive buyer activity. If wave (v) continues this pattern, the $0.50 to $0.55 range becomes a logical upside target.

Analyst commentary and wave positioning both align with the possibility of further gains. 市场分析人士 confirmed he views $0.395 as critical support, and recent price action confirms that level has held firm. If XLM remains above that line, then a continuation toward the upper Fibonacci extensions may follow.

Volume indicators confirm strong interest between $0.384 and $0.403. These zones now form a solid base. With price still riding moving averages and completing a wave pattern, the market will focus on the next move above resistance lines.