XRP is about to cross $3 for the first time in 7 years — analyst eyes $6 once $3 mark is breached

XRP is trading at $2.94 at the time of writing, up 6% in the past 24 hours and 29% over the last week.

Following the latest rally, XRP ( XRP ) may cross the crucial $3 psychological mark, a level last reached in 2018. Its seven-day range is between $2.25 and $2.95, and traders are keeping a close eye on it to see if it can hold above this long-standing resistance.

Whale interest has clearly increased, as reported by crypto.news on July 10. More than 2,742 wallets currently hold at least 1 million XRP. These wallets now hold over 47 billion XRP in total, pointing to strong confidence from large holders.

The recent push also comes as Bitcoin ( BTC ) reached a new record high above $120,000 on July 14, helping lift market sentiment across the board. XRP’s 24-hour trading volume stands at $7.15 billion, up 5.9% from the day before.

On the derivatives side, data from Coinglass shows that futures volume has risen by 10.48% to $17.31 billion, while open interest has climbed 10.64% to $8.12 billion. This indicates increasing interest and momentum as more traders are taking on new positions.

Some analysts have set even higher price targets as a result of this momentum. According to analyst Ali Martinez’s July 12 post on X, a confirmed weekly close above $3 might pave the way for a longer rally toward $6 or higher.

Looking at the technical picture, XRP is attempting to break past the psychological $3 resistance with strong upward momentum. Prices are riding the upper Bollinger Band and holding well above the 20-day simple moving average, which currently sits around $2.85.

Although the asset is overbought, as indicated by the relative strength index at 83, the momentum and MACD indicators still point to further upside. The price is trading well above all of the major moving averages, including the 200-day EMA ($2.14) and the 10-day EMA ($2.60), indicating a strong upward trend that has steepened in recent sessions.

XRP price analysis. Credit: crypto.news

XRP price analysis. Credit: crypto.news

In the short term, XRP may unlock more upside toward the $3.50–$4.20 range if it breaks above $3 with volume confirmation and posts a weekly close above that level. Catalysts from ETFs and regulations may help maintain momentum. A longer-term path toward $6 as projected by Martinez could be possible in the long term.

Profit-taking may occur if the price fails to hold above $3 or if it is rejected close to that level, particularly if there is a decline in volume. Stronger demand may reappear close to the $2.35–$2.45 region, where several moving averages are clustered. Initial support is located around $2.60, aligning with the 10-day EMA.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says

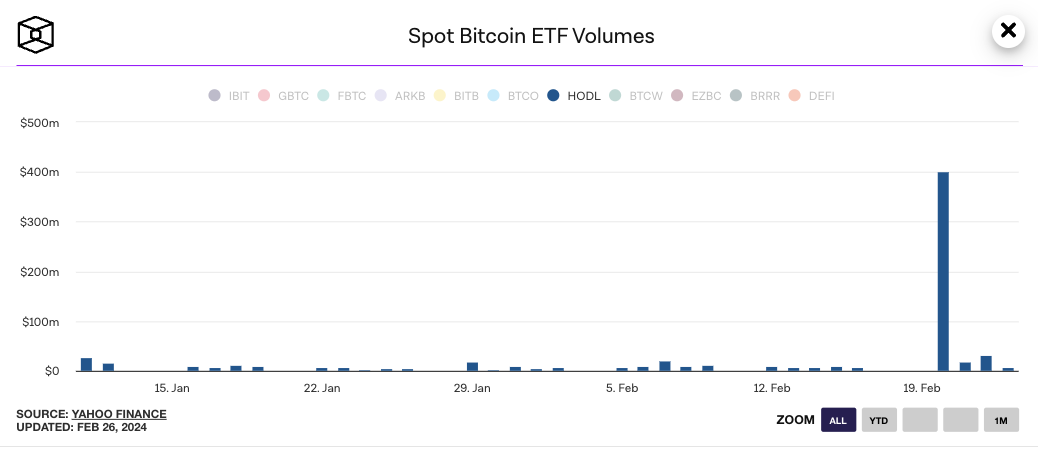

Spot bitcoin ETF volume spike may be due to high-frequency trading, CoinShares says

'Sloppy' US crypto mining survey put on pause by Texas judge