Ethereum Price Rises as Institutional Interest Grows

- ETH price surpassed $3,000 with a 6.6% daily gain.

- Institutional inflows support potential staked ETH ETF.

- Market optimism despite recent Ethereum Foundation treasury transfers.

The Ethereum surge signifies increased institutional interest driven by the potential approval of a staked ETH ETF , positioning the cryptocurrency for further growth.

Over the past two weeks, Ethereum prices have surged beyond $3,000, marking a 22% jump. This rally resembles past bull cycles driven by ETF expectations . The Ethereum Foundation’s treasury moves, involving 21,000 ETH, have sparked speculation around asset management.

Institutional players are driving the price hike, hoping for the first staked ETH ETF approval. With over 35 million ETH already staked, the anticipated product is seen as a catalyst for further growth.

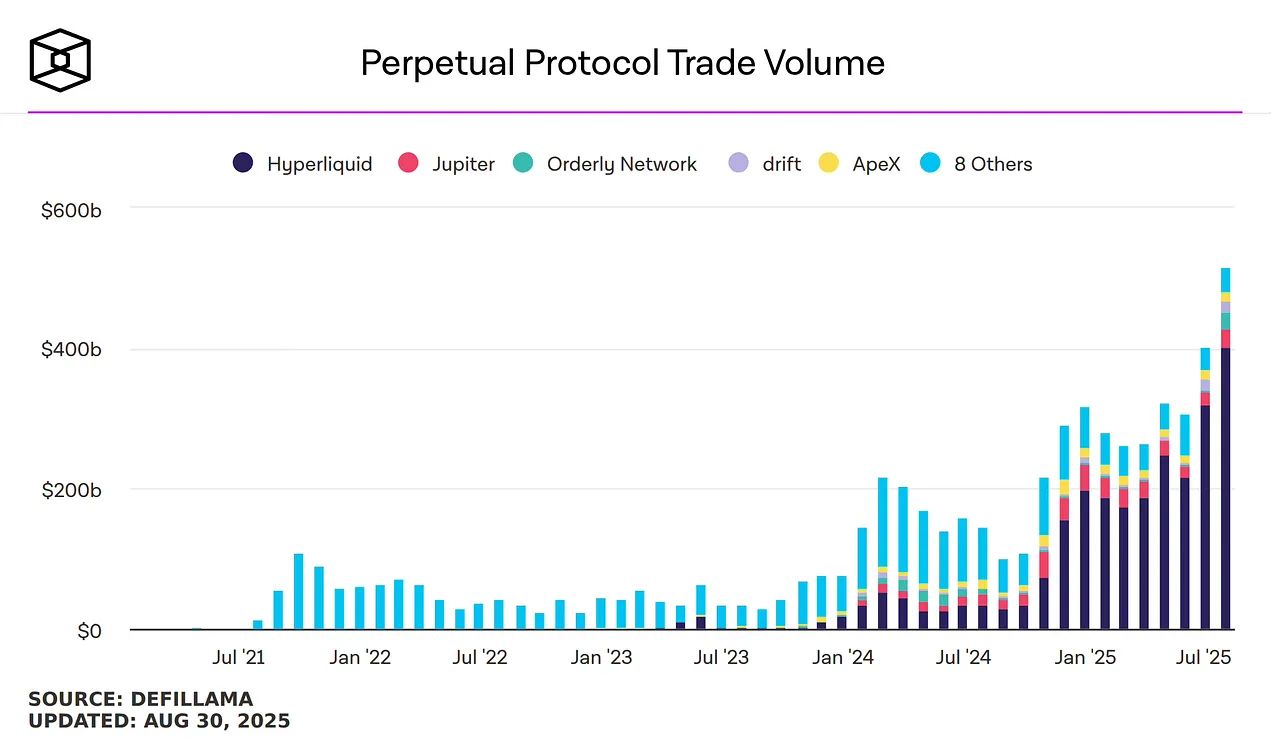

Trading volumes increased sharply, rising by 62.9% in a day. Technical indicators continue to show bullish momentum, reinforcing belief in further price increases. The potential staked ETH ETF could attract more institutional investors, enhancing market dynamism.

While community reactions vary, the overall sentiment remains positive, although some concerns linger about the Ethereum Foundation’s asset management. The ongoing effects of this interest will be closely watched as stakeholders gauge long-term implications.

The financial landscape is evolving, with institutional interest aligning with regulatory shifts. As a golden cross appears on Ethereum’s daily chart, speculation persists about broader impacts on the crypto market.

Eric Jackson, Founder, EMJ Capital, – “Ethereum’s price outlook is gaining renewed attention as Eric Jackson, founder of EMJ Capital, forecasts a potential surge to $1.5 million per ETH. This projection is driven by the anticipated approval of staking exchange-traded funds (ETFs) and the expanding role of crypto commerce.”

Anticipated regulatory developments in the form of a staked ETH ETF are expected to establish regulated advantages for institutional investors, further supporting Ethereum’s upward trajectory. With these dynamics, Ethereum is positioned for potentially significant financial outcomes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (September 6)

Hyperliquid airdrop project ratings: Which ones are worth participating in?

A wealth of valuable information on the best airdrops coming in the second half of 2025!

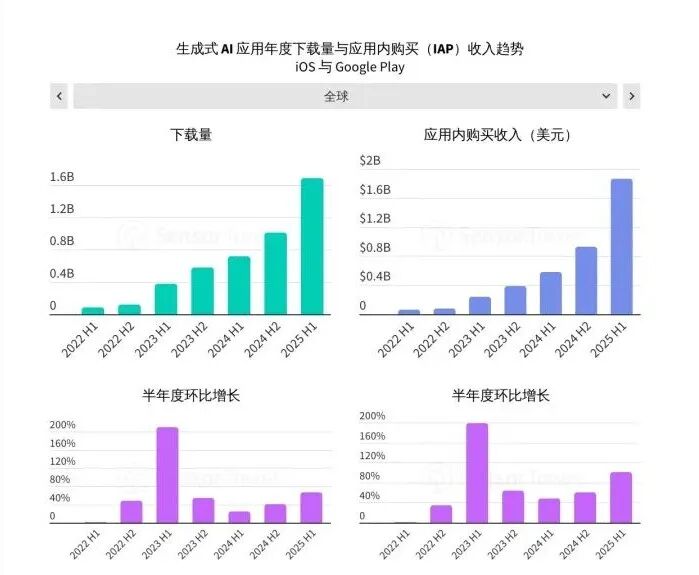

Sensor Tower H1 AI Application Report: Young Male Users Still Dominate, Vertical Apps Face Disruption Pressure

Asia is the largest market for AI application downloads, while the US market leads in AI in-app purchase revenue.

Ten-Year Advice from a16z Partner: In the New Cycle, Just Focus on These Three Things

Persist in doing the difficult but correct things for a bit longer.