Bank of England Joins European Regulators in Warning of Dollar Risks

According to Jinse Finance, three sources have revealed that the Bank of England has asked certain banks to test their resilience against potential shocks to the US dollar. This move is the latest sign of how the Trump administration’s policies are eroding confidence in the US as a cornerstone of global financial stability. President Trump has broken with longstanding US policies in areas such as free trade and defense, forcing policymakers to reconsider whether emergency access to US dollars can still be relied upon during periods of financial stress. One insider stated that, following similar requests from European regulators, the Bank of England has asked some banks to assess their US dollar funding plans and the extent of their reliance on the dollar, including short-term needs. Another source said that in recent weeks, a UK-based global bank was asked to conduct internal stress tests, including scenarios where the US dollar swap market could completely dry up. One of the sources noted that, given the US dollar’s dominant role in the global financial system and banks’ dependence on it, no bank could withstand such a shock for more than a few days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

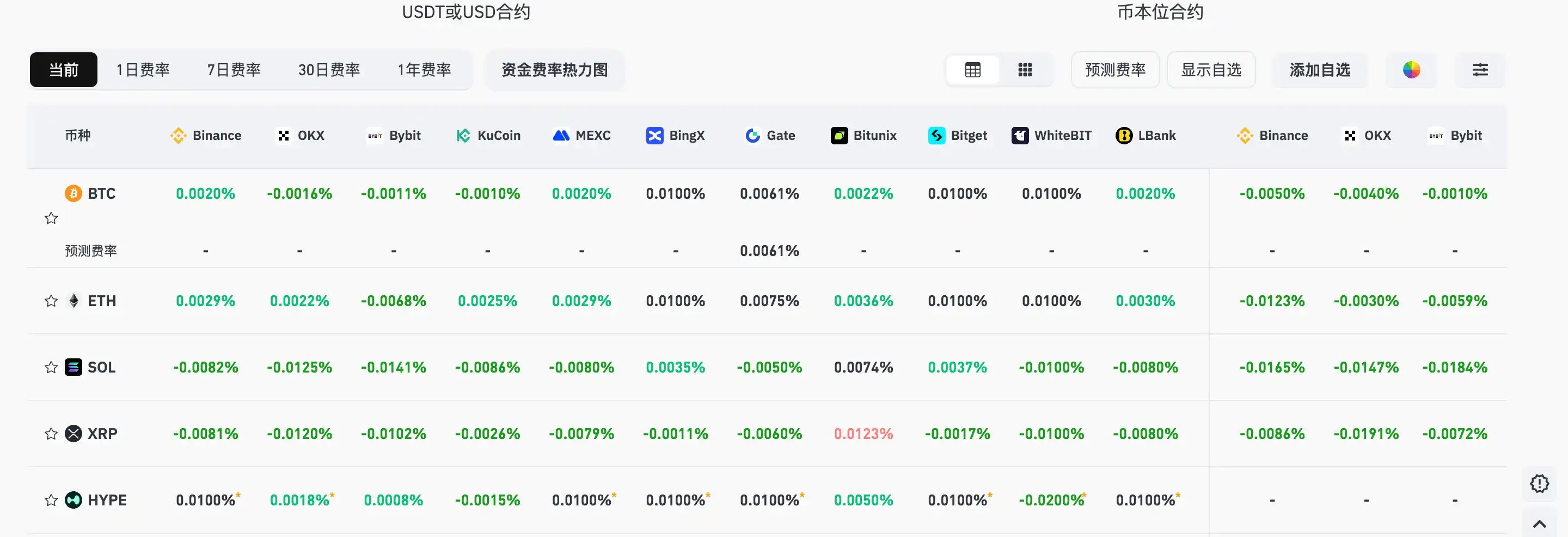

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.