Bitcoin Retreats to $118 After Failing to Break Resistance

- Bitcoin price today is $118.235, down 1%

- Altcoins like SUI and XRP extend losses

- Crypto market cap drops to $3,94 trillion

Bitcoin's price today, July 19, 2025, is at $118.235, down 1% in the last 24 hours. The market's leading cryptocurrency is struggling to overcome the $120.000 resistance after a failed attempt to consolidate above that level.

Earlier this week, BTC reached $123.000, marking a new all-time high, driven by strong institutional inflows and market optimism. However, the rally lost momentum following the release of US consumer price index (CPI) data, which generated uncertainty and encouraged profit-taking.

With the correction, Bitcoin fell to $117.000 before recovering slightly. Its market cap is now around $2,35 trillion, and its dominance over altcoins remains below 60%.

Altcoins, which had been following BTC's upward trend, also began to experience sharp declines. SUI led the losses among large-cap assets, followed by HYPE, XLM, ADA, SOL, and LINK. Ethereum lost support at $3.700 and is currently trading below $3.600.

XRP, which had recently broken its all-time high by surpassing $3,60, has given back much of its gains and now remains just above the $3,40 level.

Dogecoin and Ethereum Classic (ETC) stood out from the broader movement, managing to avoid significant losses and maintaining a certain stability.

As a result, the total cryptocurrency market value has fallen by about $100 billion since its recent peak, reaching $3,94 trillion this Friday. The overall decline reflects a pause in the rally that had been sustaining gains in recent weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

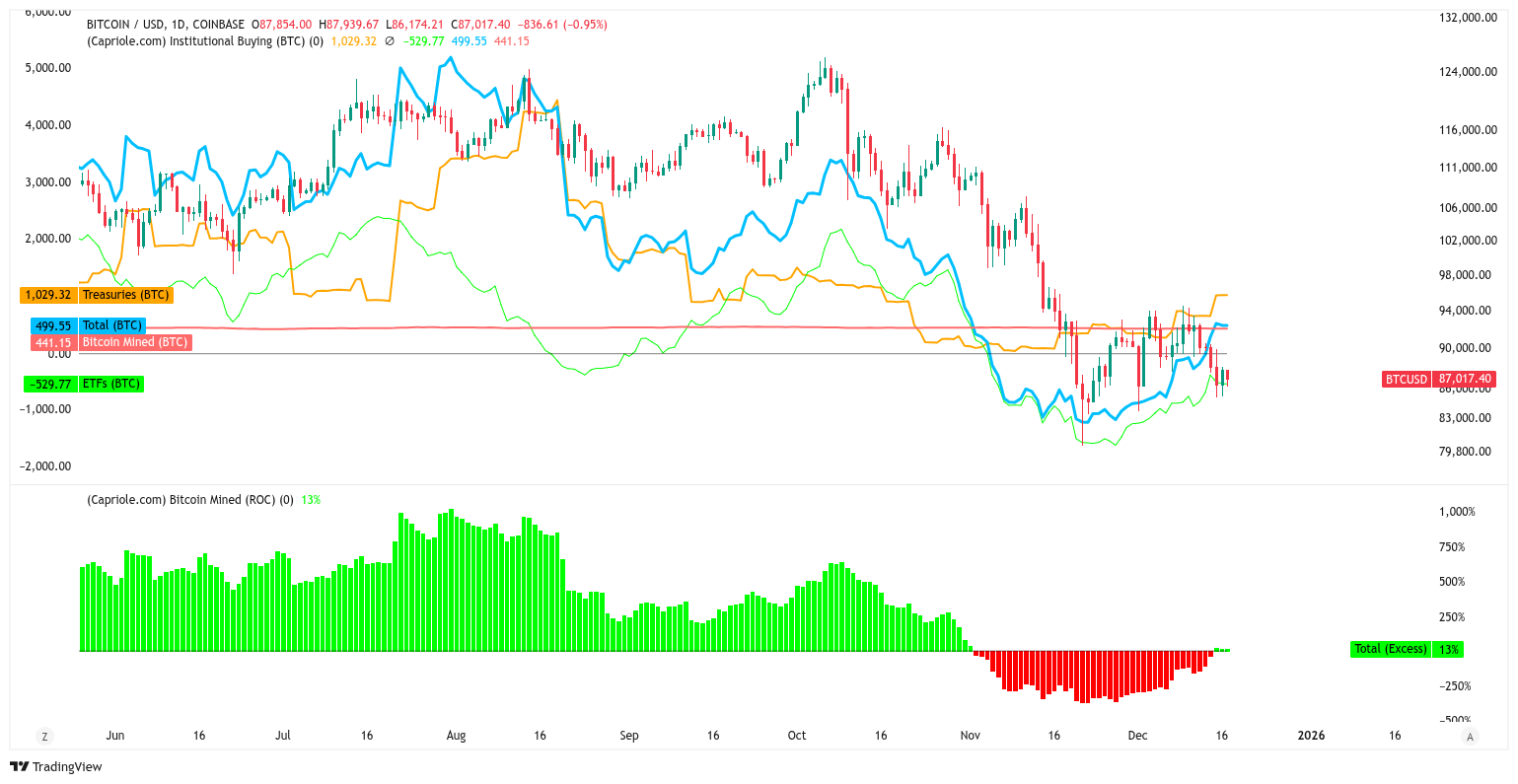

Bitcoin institutional buys flip new supply for the first time in 6 weeks

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets