ARK Invest Bets on Ethereum, Acquires Bitmine in $174M Shift

- ARK Invest reallocates $174M from Bitcoin-linked assets to Ethereum-focused Bitmine.

- Bitmine acquisition positions ARK to benefit from Ethereum’s DeFi and NFT dominance.

- Strategic shift reflects growing institutional confidence in Ethereum’s long-term growth.

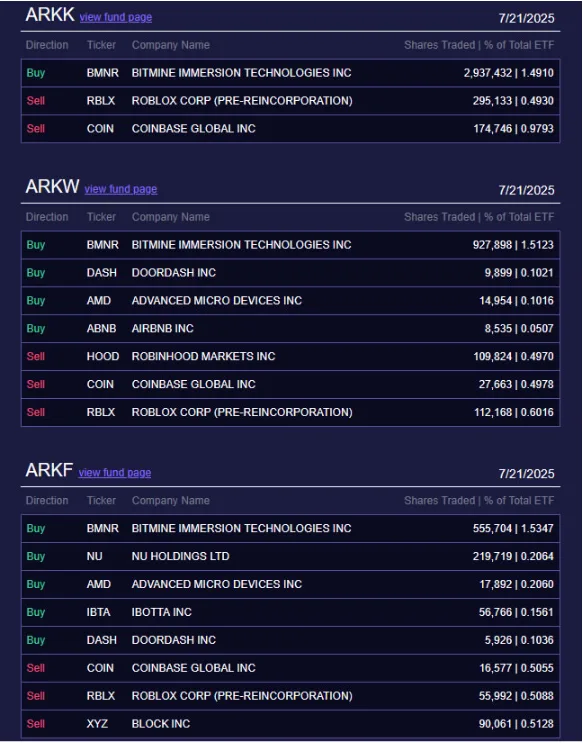

ARK Invest, under the leadership of Cathie Wood, has adjusted its portfolio by divesting from prominent Bitcoin-related holdings. The firm sold 218,986 shares of Coinbase, valued at approximately $90.5 million, from its ETFs. ARK has also sold 463,293 shares of the game Roblox, worth about $57.7 million. The move is in line with the institutional trend within the growing use of Ethereum’s smart contracts and decentralized finance.

Source:

ARK Invest

Source:

ARK Invest

The firm also divested 225,742 shares of its ARK 21Shares Bitcoin ETF (ARKB), valued at $8.7 million on July 16. This transaction marks ARK’s largest single-day share sale of ARKB since its June stock split. The sale followed ARKB’s rise to near-record highs, with the fund peaking at $39.3 post-split. Despite the size in volume, the sale’s dollar value was smaller than previous disposals, such as April’s $12 million ARKB offload.

Investment in Ethereum-Focused Bitmine

Following these divestments, ARK acquired a 1.5% stake in Bitmine, a firm specializing in Ethereum treasury management. This investment totals approximately $174 million across its ETFs, indicating a strategic realignment. Bitmine’s operations focus on Ethereum’s financial infrastructure, offering exposure to decentralized finance and blockchain services. This move positions ARK to benefit from the expanding Ethereum ecosystem.

Ethereum’s integration into financial services and growing adoption among institutions have boosted investor interest. Bitmine’s expertise in Ethereum treasury management provides ARK a targeted pathway into this ecosystem. As Ethereum remains central to decentralized applications and NFT infrastructure, its role in digital asset markets continues to grow. ARK’s investment reflects confidence in Ethereum’s potential over more established Bitcoin-related assets.

Ethereum Adoption and Broader Implications

Ethereum remains popular in both the business world and the field of finance. The flexibility of the network allows it to support smart contracts and DeFi services, and a variety of tokenized services. The institutional level demand for Ethereum assets is increasing because of its flexibility and technical abilities. Given that Ethereum has found its place in blockchain infrastructure, exposed blocks have precipitated more capital inflows.

The relocation of ARK accentuates this trend as it shifted its capital to a company that is deeply entrenched in Ethereum. Such investment in the Bitmine stocks shows strategic positioning on the long-term value and network effect of Ethereum. Its scalability and the ability to support various financial instruments make the Ethereum network attractive to progressive investors. The portfolio transition made by ARK can also be explained by the desire to diversify crypto investment outside of Bitcoin.

Related: Ark Invest Offloads $43.8M in Coinbase Shares Amid Rally

Ongoing Portfolio Adjustments

In addition to Bitmine and Ethereum, ARK made other changes through its ETF investments. ARK Next Generation Internet ETF (ARKW) also sold 34,207 shares of Coinbase and obtained funds of $13.3 million. It is the next in a chain of COIN share decreases by ARK, with past sales topping $4 million in the ARKK ETF (ARKK). The decline in COIN is based on the fact that Coinbase is still associated with Bitcoin trading volumes and volatility.

The other transactions include the sale of 58,504 Robinhood shares at a price of $5.6 million and the sale of 24,780 block shares, totaling $ 1.7 million. These changes indicate the active management of this exposure in terms of crypto and tech-related stocks at ARK.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."