Whale Bitcoin Inflows Surge by $17B in Four Days, Raising Market Caution

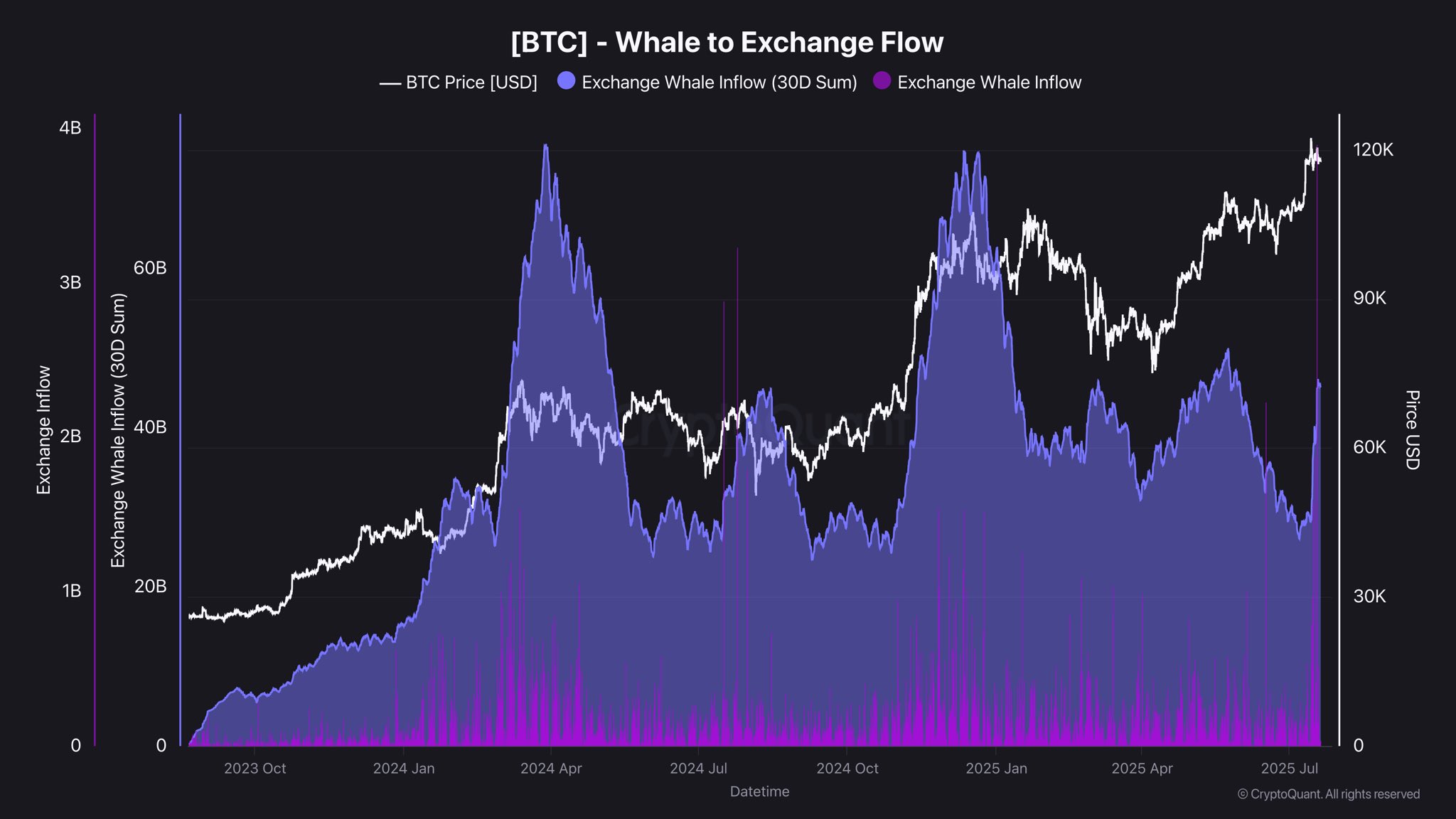

Bitcoin inflows to exchanges from large holders often referred to as “whales”, have seen a sharp uptick, signaling a possible turning point in market dynamics. According to on-chain data analyzed by CryptoQuant contributor Darkfost, the monthly average of whale inflows jumped from $28 billion to $45 billion between July 14 and July 18, a dramatic $17 billion rise in just four days.

Bitcoin inflows to exchanges from large holders often referred to as “whales”, have seen a sharp uptick, signaling a possible turning point in market dynamics. According to on-chain data analyzed by CryptoQuant contributor Darkfost, the monthly average of whale inflows jumped from $28 billion to $45 billion between July 14 and July 18, a dramatic $17 billion rise in just four days.

This surge is particularly noteworthy because, historically, similar spikes in whale inflows have often preceded major market corrections. In the last two bull market peaks, monthly inflows from whales surpassed $75 billion, coinciding with the beginning of significant price consolidations or even downturns.

Adding to the intrigue, the latest spike may be connected to a massive transaction involving 80,000 BTC. Analysts believe this could suggest that whales are taking advantage of Bitcoin’s recent all-time highs to lock in profits, a familiar pattern in overheated or overextended markets.

Whale Bitcoin Inflows Surge by $17B. Source: Darkfost

Whale Bitcoin Inflows Surge by $17B. Source: Darkfost

However, there may be a shift in sentiment. Despite the initial spike, daily inflow data has shown a notable decline in the days that followed. This drop could point to easing sell pressure from whales. If the trend continues, it may help support price stability and reduce the risk of a deeper correction.

As a result, market watchers are keeping a close eye on whale inflow trends. Historically, elevated inflows have indicated mounting selling pressure, while declining inflows have often signaled a cooling of that activity and potentially, a more balanced market.

Although the long-term implications of this latest movement remain uncertain, it underscores the influence of whale behaviour on Bitcoin’s short-term price direction. Investors are being urged to monitor these trends carefully in the days ahead, especially as the market digests recent volatility.

In a broader context, global brokerage firm FBS has released its mid-year analysis of the cryptocurrency market. The report highlights Bitcoin’s continued dominance throughout the first half of 2025 and outlines key macroeconomic trends expected to shape crypto performance in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.