Analytics Firm Warns of Leverage Build-Up in Ethereum Amid Rallies, Says Momentum Awakening for One Solana Challenger

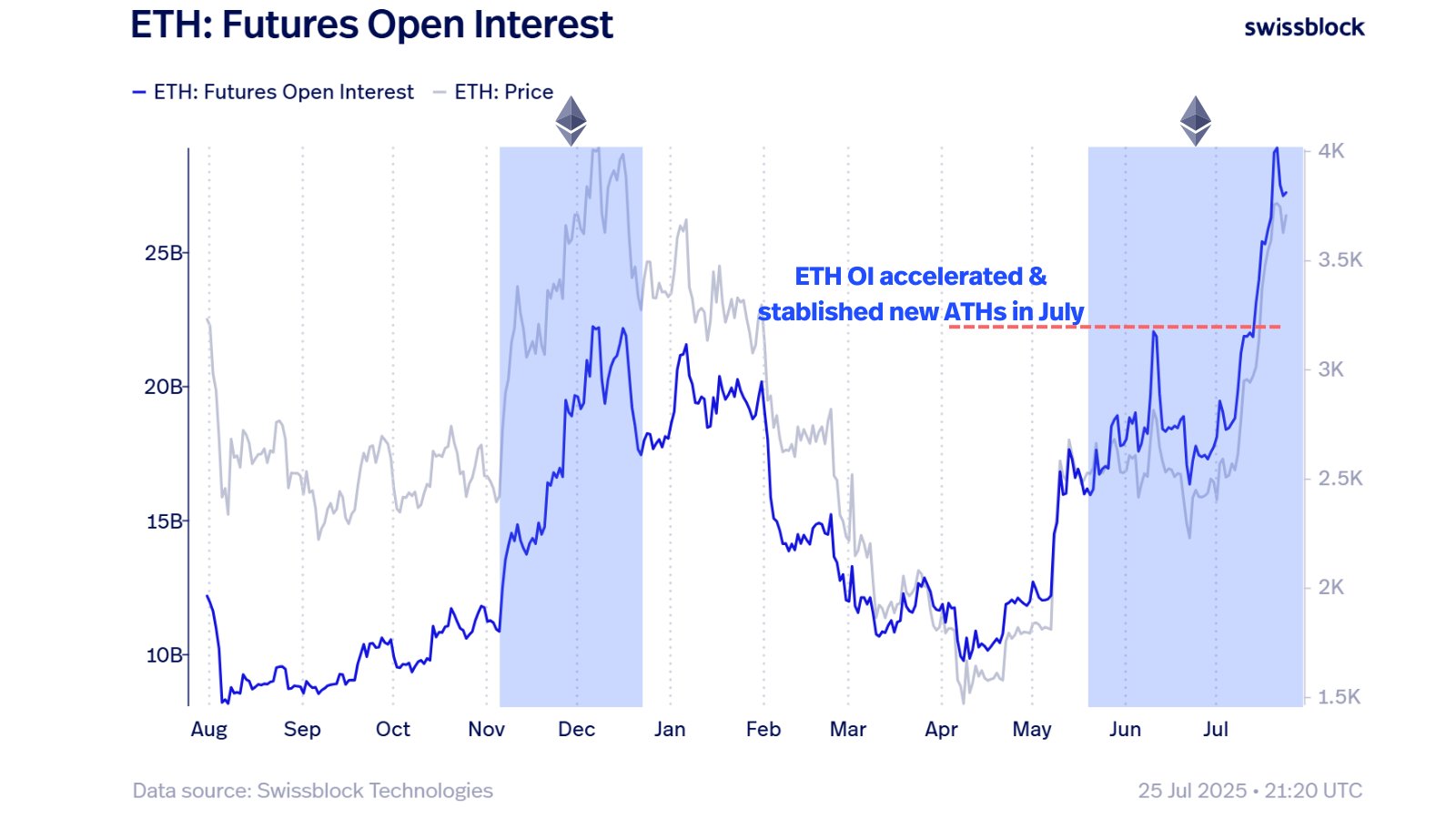

A market intelligence firm is warning traders that leverage is building up in Ethereum ( ETH ), creating volatility risk for bulls.

In a new thread on the social media platform X, the crypto analytics platform Altcoin Vector says that leverage risk is building within the second-largest digital asset by market cap despite ETH’s most recent price rise being backed by the spot market and exchange-traded funds (ETFs).

“ETH Futures OI (open interest) just hit a new ATH (all-time high) – double since May – and price is climbing with it. Unlike late 2024, this rise is backed by ETF inflows and spot momentum, but… OI at historic levels is a double-edged sword. Conviction is back, but leverage risk is building.”

Source: Altcoin Vector/X

Source: Altcoin Vector/X

Ethereum is trading for $3,771 at time of writing, a fractional increase on the day.

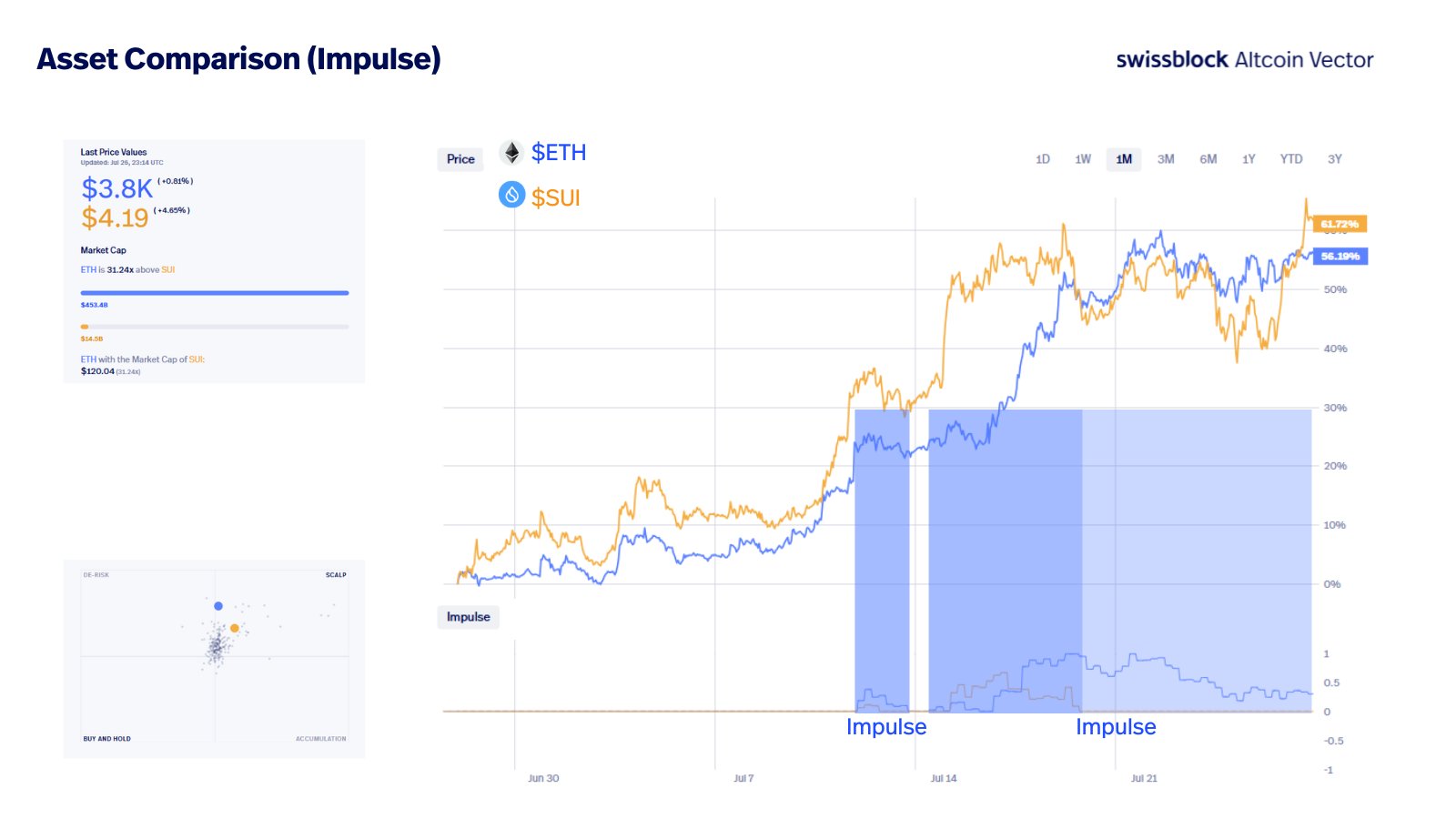

Moving on to Solana ( SOL ) challenger Sui ( SUI ), Altcoin Vector says that the layer-1 chain looks like it’s picking up momentum that could lead it to outperform Bitcoin ( BTC ) en route to a $5 price tag and beyond.

“ETH is leading, even outpacing BTC – but this phase of rotation is about spotting alts that don’t just catch up… they outperform. SUI fits that bill. High-beta, strong trader interest, and just pumped +10% in 24h. Momentum is awakening. Impulse hasn’t fully kicked in yet – when it does, $5 target is just the beginning.”

Source: Altcoin Vector/X

Source: Altcoin Vector/X

SUI is trading for $4.22 at time of writing, a 5.2% increase on the day.

Concluding its analysis with the top crypto asset by market cap, Altcoin Vector says that BTC’s latest dip shouldn’t be a concern.

“Bitcoin’s drop isn’t a breakdown, it’s a healthy correction. Structure remains bullish. Optimal signal was cooling but now shows the first signs of recovering momentum. BTC is holding above support, though we could still test $112,500. Momentum paused, but trend is intact.”

Source: Altcoin Vector/X

Source: Altcoin Vector/X

BTC is trading for $119,503 at time of writing, a fractional increase during the last 24 hours.

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...