CryptoPunks price surges to $200k, $PUNKS loaner Gondi accused of facilitating chandelier bids

As the floor price of CryptoPunks breaks through the $200k threshold, loan platform Gondi gets accused by traders of facilitating rafter bids online.

- CryptoPunks floor price breaks through $200,000 mark, reaching highest peak in 2025 so far.

- NFT lender Gondi accused of facilitating rafter bids, using PUNKS as collateral.

CryptoPunks loaner Gondi under fire

The NFT lending marketplace Gondi has come under fire due to allegations that the platform has been facilitating “private loans” used to boost chandelier bids for PUNKS.

One trader even accused the platform of letting one of its advisors, Gfunk, borrow ETH ( ETH ) using PUNKS tokens as collateral, including tokens staked in the PUNKS staking contract. Even though, the trader alleged that the staked PUNKS tokens did not belong to Gfunk.

“Gondi created a private loan for PUNKS tokens ahead of the 16 CryptoPunks auction. It was done so Gfunk (a Gondi Advisor) could borrow ETH against PUNKS tokens,” wrote Venture Capitalist for GM Capital and PUNKS collector Beanie on his X account .

In a screenshot he shared, the Gondi user vault held a repayment with 194 ETH in debt, occurring after a principal loan of 194 ETH in the same time period made one month ago.

On July 29, the floor price for the OG crypto collection of 10,000 unique CryptoPunks (6,039 male and 3,840 female) climbed well above the $200,000 threshold. This is the highest peak it has ever reached within 2025 alone. It now occupies to top spot among NFT sales on CryptoSlam, beating out Courtyard and Moonbird.

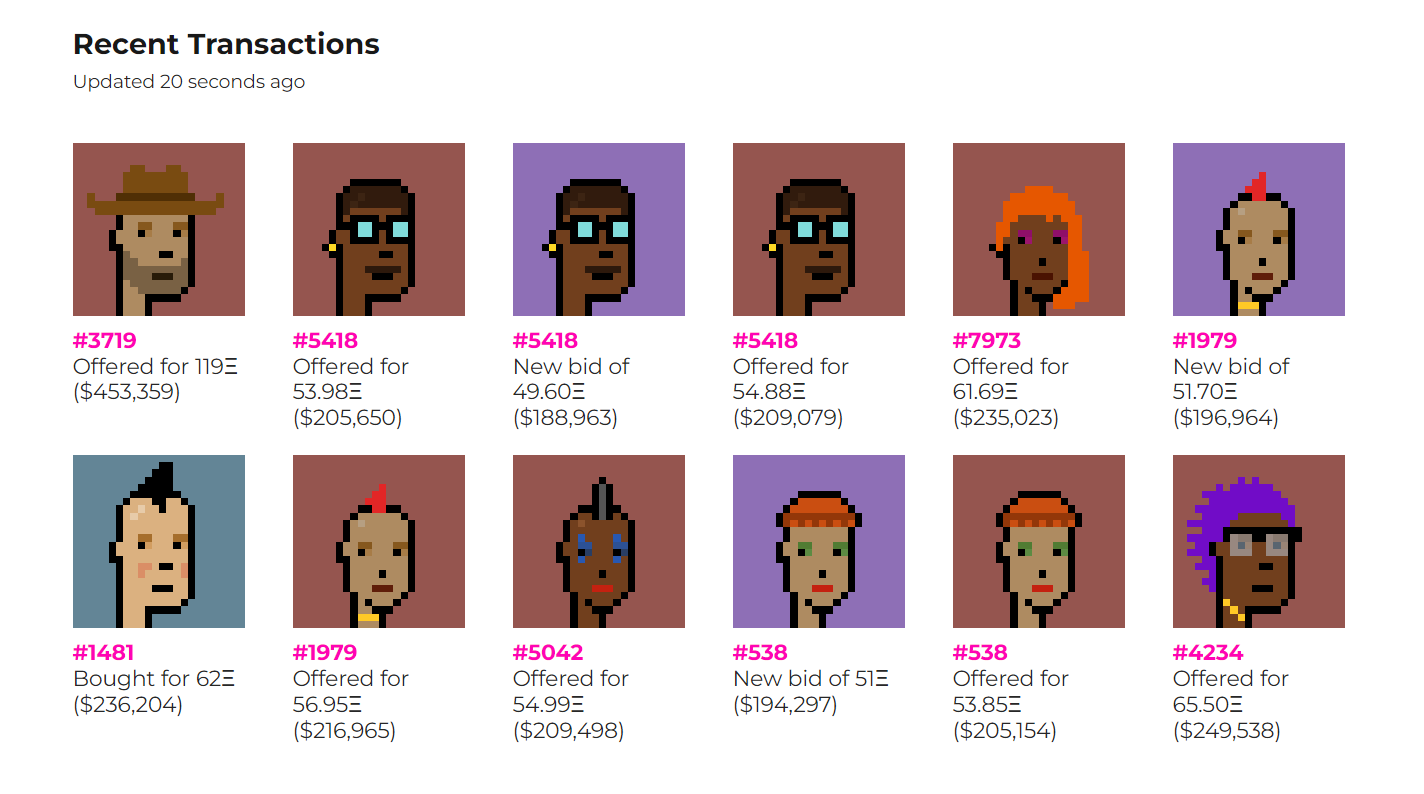

At press time, the floor price for PUNKS has gone up by 4.6% in the past 24 hours. The floor price is currently standing at 53.85 ETH or worth around $205,154 for one CryptoPunk, with many of the recently sold CryptoPunk NFTs rising in sales by 372.34% in the past day of trading.

According to data from CryptoSlam, 38 PUNKS were sold within the span of 24 hours, indicating a 375% increase in the number of transactions for the renowned Ethereum NFT . The value of sales made in the past 24 hours has amounted to $8.44 million.

CryptoPunks sales have surged following the recent floor price rising above $200,000 | Source: CryptoPunks

CryptoPunks sales have surged following the recent floor price rising above $200,000 | Source: CryptoPunks

“The collateral used included tokens from the PUNKS staking contract. This enabled Gfunk to get funds to run up the bid,” continued Beanie.

He described the alleged stunt as being similar to how AAVE ( AAVE ) operators were able to leverage staked tokens on its platform in order to facilitate a loan. Which should not have been possible considering the admin keys to Aave were burned.

This collateral backed loan occurred before the CryptoPunks #16 auction, presumably giving Gfunk ETH liquidity to actively bid or support the auction. So far, there have been no statements addressing the accusations.

However, the official account recently posted a “Notable Loan” for a Wrapped CryptoPunk #2545, which originated from a 100,000 USDC ( USDC ) loan.

“That’s 5 Punk loans today alone. Liquidity isn’t slowing down, it’s accelerating,” wrote Gondi on its official X account .

Echoing this sentiment, the floor price for the CryptoPunks NFT continues to climb, reaching its highest level since March 2024.

Floor price chart for CryptoPunks following a recent surge, July 29, 2025 | Source: CoinGecko

Floor price chart for CryptoPunks following a recent surge, July 29, 2025 | Source: CoinGecko

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: BTC Falls Below 94,000, AI "Judgment Day" and Macro "Settlement Day" Both Looming

Bitcoin and Ethereum prices have declined as the market adopts a risk-off approach ahead of the upcoming Nvidia earnings report and the release of the Federal Reserve minutes. Nvidia's earnings will influence the AI narrative and capital flows, while the Fed minutes may reinforce a hawkish stance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The Ali Qianwen app's initial launch faces a surge in traffic; the official response is "operating well, feel free to ask."

The public beta of the Qianwen app has been launched, with Alibaba introducing its personal AI assistant to the consumer market. The first day’s traffic exceeded expectations, and some users experienced service congestion. “Alibaba Qianwen crashed” quickly trended on social media, but the official response stated that the system is operating normally.

Another giant exits! The "Godfather of Silicon Valley Venture Capital" sells all Nvidia shares and buys Apple and Microsoft

Billionaire investor Peter Thiel has revealed that he has fully exited Nvidia, coinciding with rare simultaneous retreats by SoftBank and "Big Short" investor Michael Burry, further intensifying market concerns about an AI bubble.

How to evaluate whether an airdrop is worth participating in from six key dimensions?

Airdrop evaluation is both an "art and a science": it requires understanding human incentives and crypto narratives (art), as well as analyzing data and tokenomics (science).