Cardano (ADA) Price Caught in Retail–Whale Crossfire: One Factor Could Decide Who Wins

Cardano’s price is stuck in a three-way battle as whales sell, retail holders stay bullish, and shorts bet on a breakdown. Here’s what could decide ADA’s fate.

Cardano price isn’t escaping the broader market’s sell-off. The Cardano price has dropped 7.6% in the past 24 hours, trimming much of its recent gains. Yet, on a monthly scale, ADA is still up 28.6%, leaving traders caught between optimism and fear.

Behind the scenes, a bigger battle is playing out: super whales are selling, retail holders are staying bullish, and short sellers are piling in on derivatives markets. With all three forces pulling ADA in different directions, one factor could ultimately decide who comes out on top.

Super Whales Trim Holdings as Network Activity Declines

On-chain data shows Cardano’s biggest wallets, holding from 1 billion ADA up to infinity, have cut their holdings from 5.43% in late June to 5.02% now, signaling a clear bearish tilt from major players. Even though the percentage dip doesn’t read much, even a half-a-percent drop is massive when it comes to whale holdings.

Super whales cut back on ADA holdings:

Santiment

Super whales cut back on ADA holdings:

Santiment

Adding to this pressure, active addresses on the Cardano network are sliding, per the monthly chart. Addresses are down over 40% since peaking on 18th July, at 42,000.

Cardano price and active addresses:

Santiment

Cardano price and active addresses:

Santiment

This drop coincided with the ADA price dip, as the peak preceded the local top of $0.92. The drop in addresses might be one of the reasons for the whale apathy.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Retail Stays Bullish While Short Pressure Builds

Despite whales trimming their stakes, retail traders remain confident, with netflows from exchanges staying negative for months, meaning more ADA is being withdrawn than deposited. Normally, this is bullish; it shows holders are accumulating, not selling.

Cardano price and increasing outflows:

Coinglass

Cardano price and increasing outflows:

Coinglass

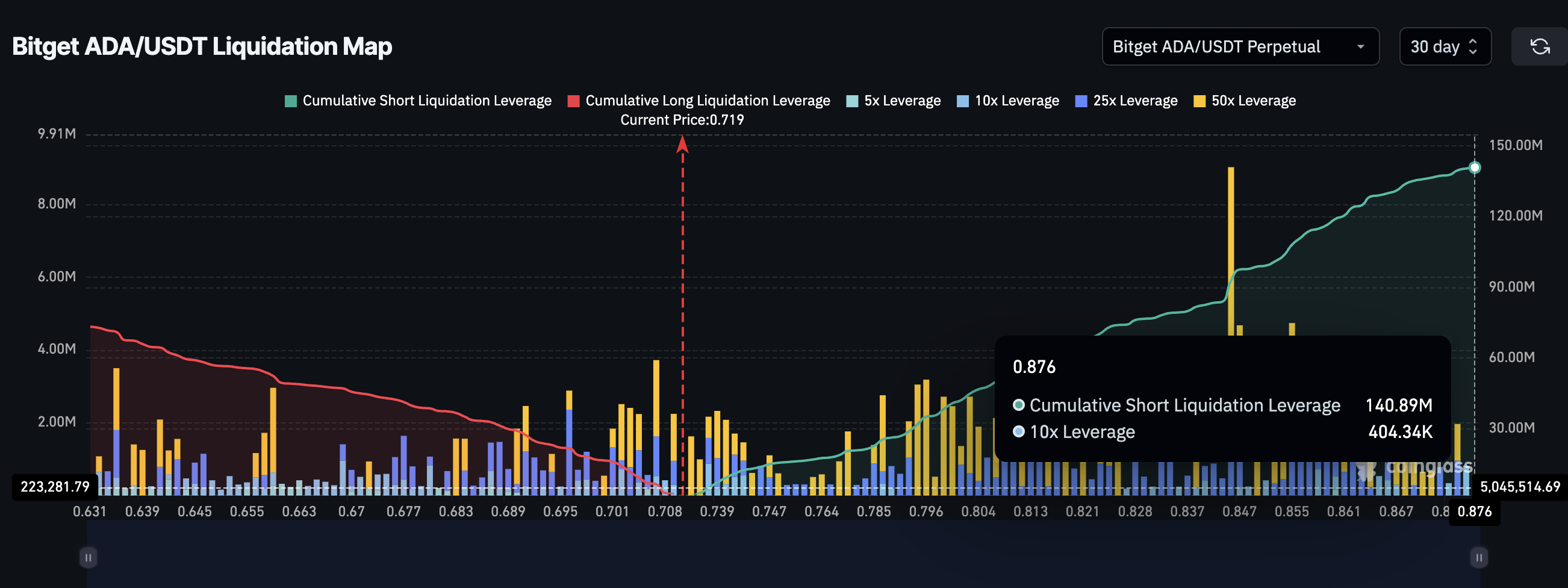

But derivatives traders are siding with the whales. Bitget’s 30-day liquidation map shows $141.7 million in short positions versus just $74 million in longs, a clear bet that ADA’s price has more room to fall. And these traders are clearly turning bearish. This explains the three-way battle: featuring whales, retail, and leverage traders.

Cardano 30-day liquidation map:

Coinglass

Cardano 30-day liquidation map:

Coinglass

If whale dumping continues, shorts could take control, driving ADA lower and forcing more liquidations. But a sudden short squeeze, led by retail sentiment, could flip the script, letting optimism win.

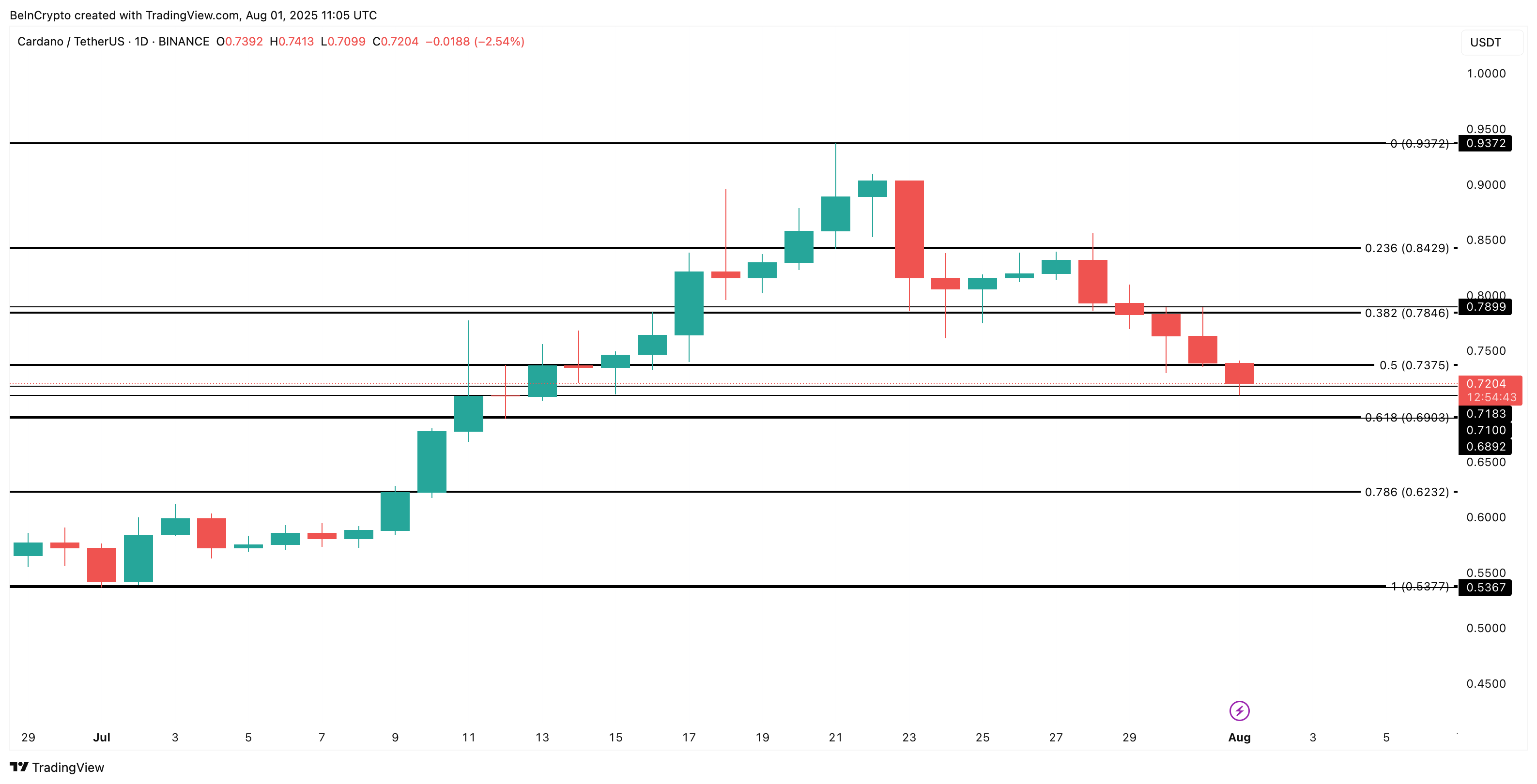

Key Cardano Price Levels in Focus

ADA is hovering near crucial support levels at $0.71 and $0.68. A breakdown could drag prices to $0.62, matching the bearish whale and short positioning. Based on the liquidation map, a drop to $0.62 will liquidate whatever long positions remain.

Cardano price analysis:

TradingView

Cardano price analysis:

TradingView

But if bulls reclaim $0.73 and $0.78, momentum could flip back to the upside, invalidating the bearish hypothesis. That could then set a push toward $0.84 and $0.93, in favor of retail. Also, that would liquidate the short positions.

For now, the market remains in a standoff, with whales trimming, retail holders clinging on, and derivatives traders waiting for a breakdown to profit. One factor, whether the short-heavy positioning triggers a squeeze or adds pressure, could soon decide who wins this battle for Cardano’s next big move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!

Interpretation of the CoinShares 2026 Report: Bidding Farewell to Speculative Narratives and Embracing the First Year of Utility

2026 is expected to be the "year of utility wins," when digital assets will no longer attempt to replace the traditional financial system, but rather enhance and modernize existing systems.

Crypto Market Plummets as Fed’s Hawkish Stance Stuns Traders

In Brief Crypto market lost 3%, market cap fell to $3.1 trillion. Fed's hawkish rate cut intensified market pressure and volatility. Interest rate rise in Japan further destabilized crypto prices globally.