Shiba Inu Price Falls 21% Despite High Retention Rate: Here’s What Caused It

Shiba Inu's recent 21% decline is attributed to fewer new investors entering the market, but its strong retention rate offers hope for a potential rebound if the $0.00001188 support level holds.

Shiba Inu (SHIB), one of the most popular meme coins in the cryptocurrency market, has been facing significant downward pressure recently. The altcoin has experienced a sharp 21% decline in the last 10 days, dropping to $0.00001210.

While the broader market has had its ups and downs, this particular decline is largely attributed to investor behavior rather than external market conditions.

Shiba Inu Loses Its Investors

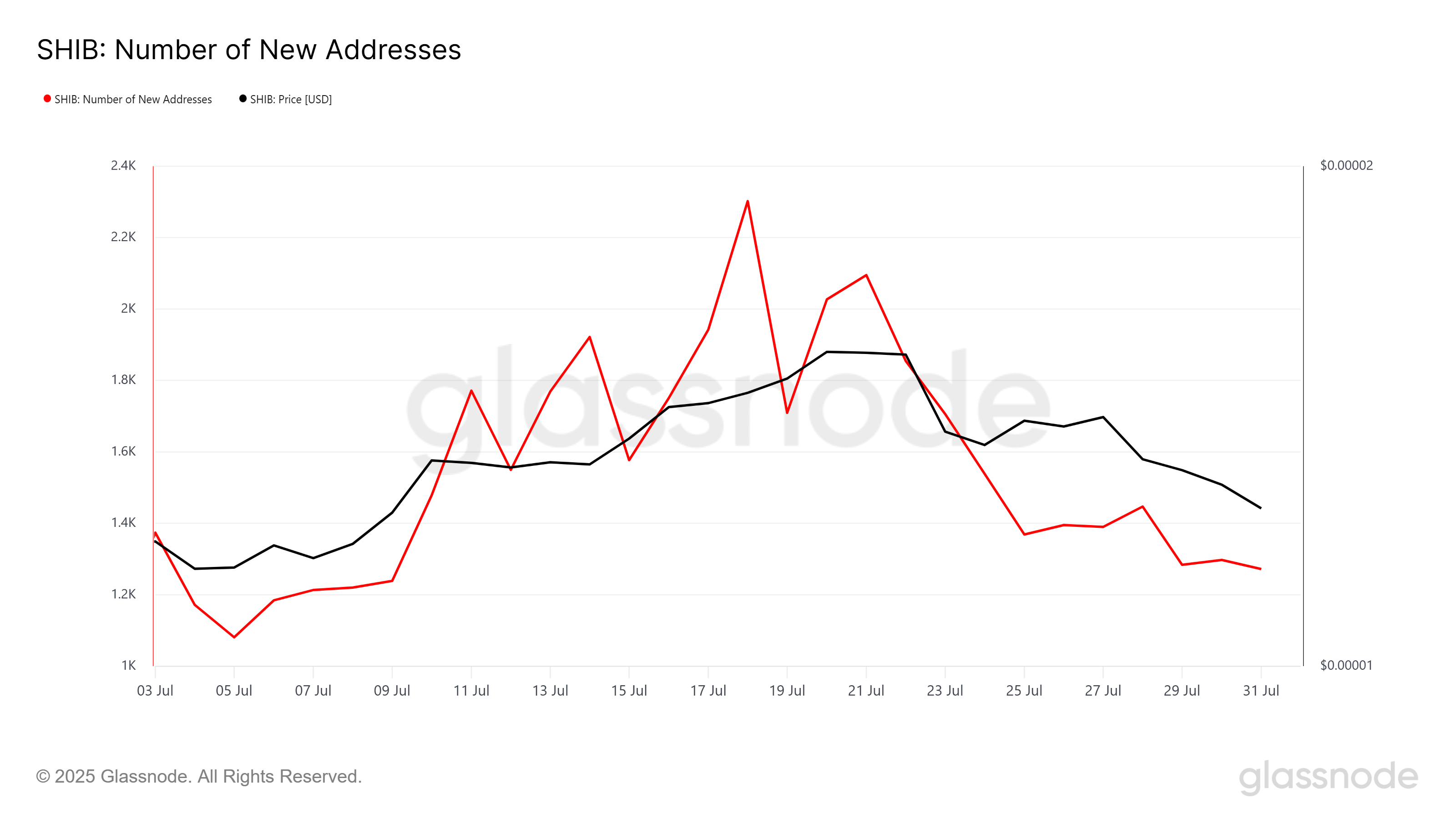

The drop in Shiba Inu’s price can be traced to a sharp decline in the number of new addresses interacting with the token. In the last 10 days, the number of new addresses has decreased by nearly 40%. This sudden exit of new investors indicates waning confidence in SHIB’s price potential, particularly after an extended rally earlier in the year.

This decline in new addresses signifies a lack of fresh investment into the asset, often a key indicator that a market has lost momentum. With fewer investors entering the market, there is less buying pressure, which inevitably impacts the price of Shiba Inu. The decreased interest from new holders has created a cloud of uncertainty over the token’s future price movement.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Shiba Inu New Addresses. Source:

Glassnode

Shiba Inu New Addresses. Source:

Glassnode

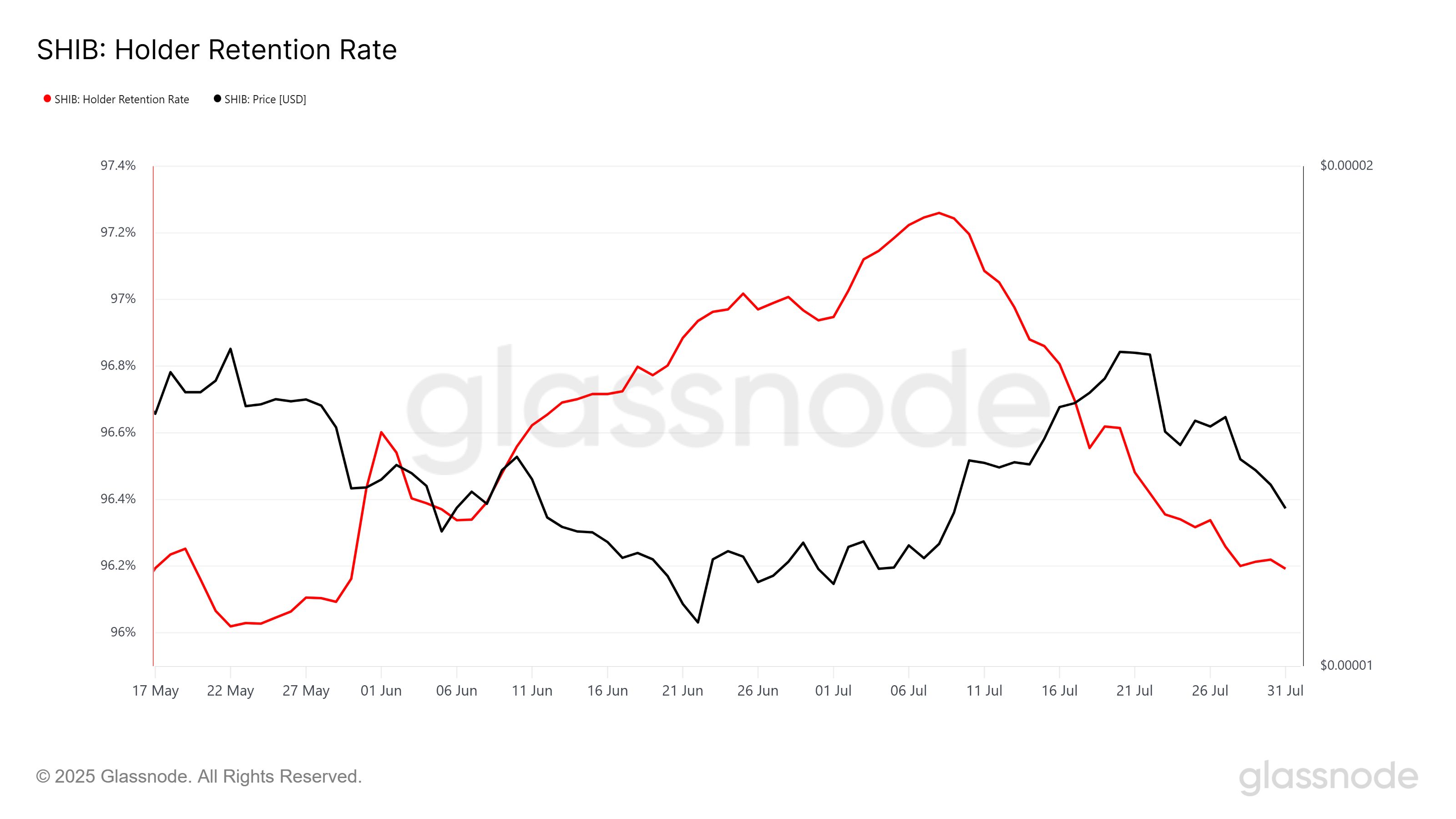

Despite the recent bearish momentum, Shiba Inu’s retention rate remains strong, standing at 96%. This means that a significant majority of those holding SHIB are choosing to HODL, rather than sell their positions. This level of investor retention suggests that there is still substantial belief in the long-term potential of Shiba Inu, and that there is no widespread fear or panic among existing holders.

Historically, a retention rate dropping below 80% would indicate a larger bearish sentiment, but SHIB is far from this point. This strong retention rate provides some reassurance for investors who may be concerned about the current market downturn.

Shiba Inu Retention Rate. Source:

Glassnode

Shiba Inu Retention Rate. Source:

Glassnode

SHIB Price Is Sliding On The Daily Chart

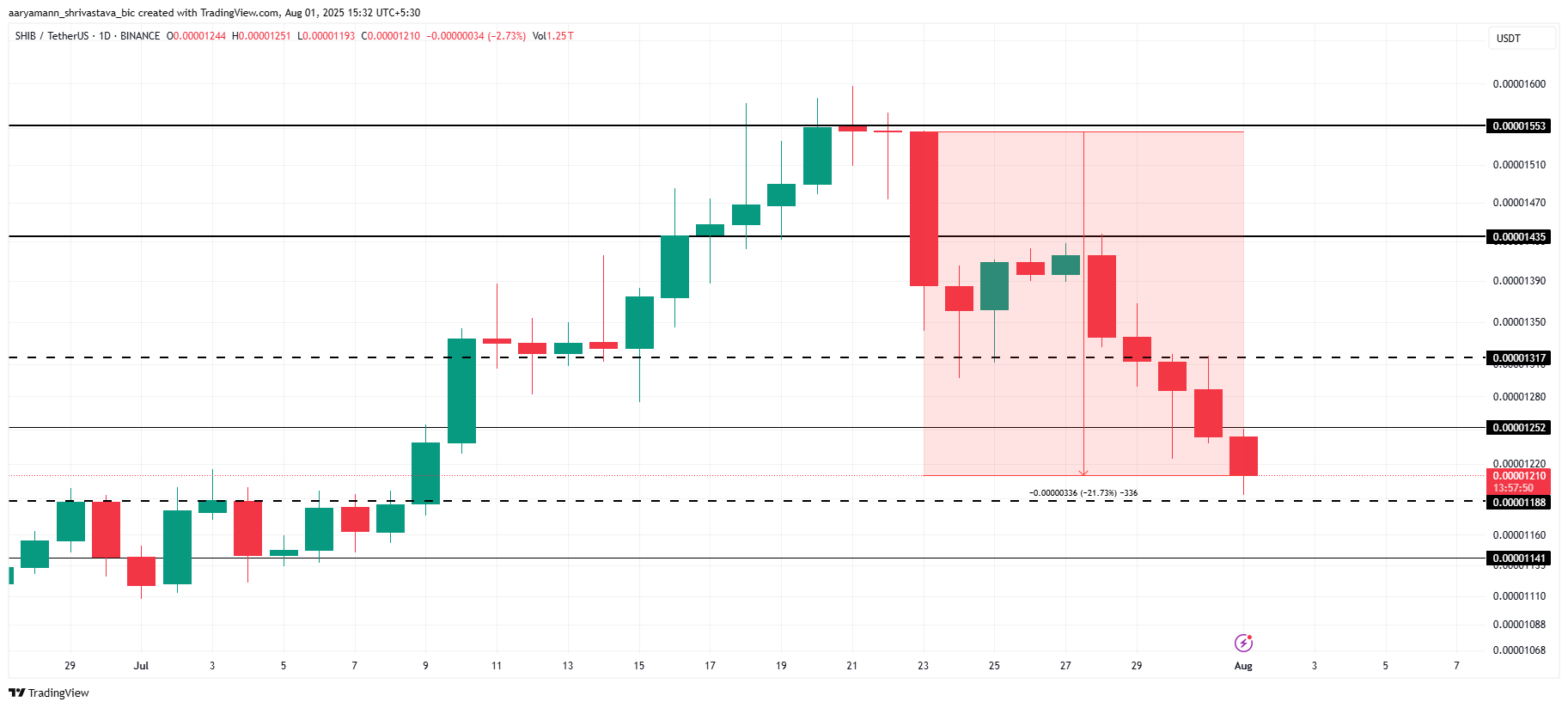

At present, Shiba Inu’s price is sitting at $0.00001210, down 21% over the last 10 days. The recent drop has been primarily driven by the sharp decline in new investors entering the market.

If this trend continues, SHIB could lose the critical support level of $0.00001188, pushing the price down to $0.00001141 or potentially lower. However, if SHIB manages to hold onto its $0.00001188 support level, there is a possibility of recovery.

Shiba Inu Price Analysis. Source:

TradingView

Shiba Inu Price Analysis. Source:

TradingView

A bounce from this level could push Shiba Inu’s price up to $0.00001317. Securing this level as support would create a bullish scenario, invalidating the bearish thesis and offering hope for further price growth in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.