Analyst: Traders Have Been Actively Closing Long Positions Since July 31, While Sellers Continue to Increase Short Positions

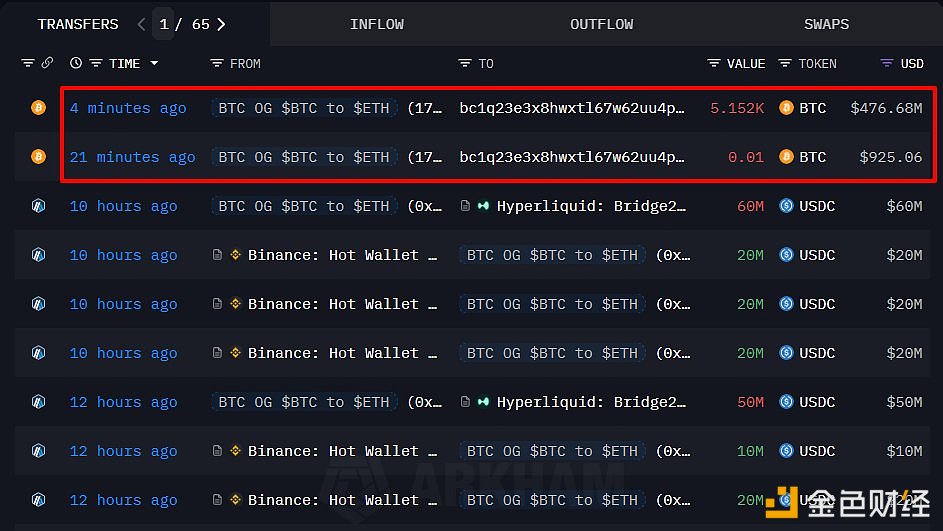

ChainCatcher reports that CryptoQuant analyst Axel stated on social media that since July 31, traders have been actively closing long positions, and the past 24 hours have seen a significant wave of selling in the futures market: when the price dropped to a local low of $112,000, the 6-hour net taker volume fell to an extreme level of -$175 million, reflecting a strong bearish stance.

As the market partially stabilized, the pressure on this indicator narrowed to -$78 million, with the negative gap shrinking by 2.2 times, but the overall market imbalance still favors the bears. Over the past 24 hours, open interest has increased to the $3.04 billion range, with sellers continuing to accumulate positions in an attempt to capitalize on bearish market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sources: Bank of Japan to pledge further rate hikes at next week's policy meeting, insiders say

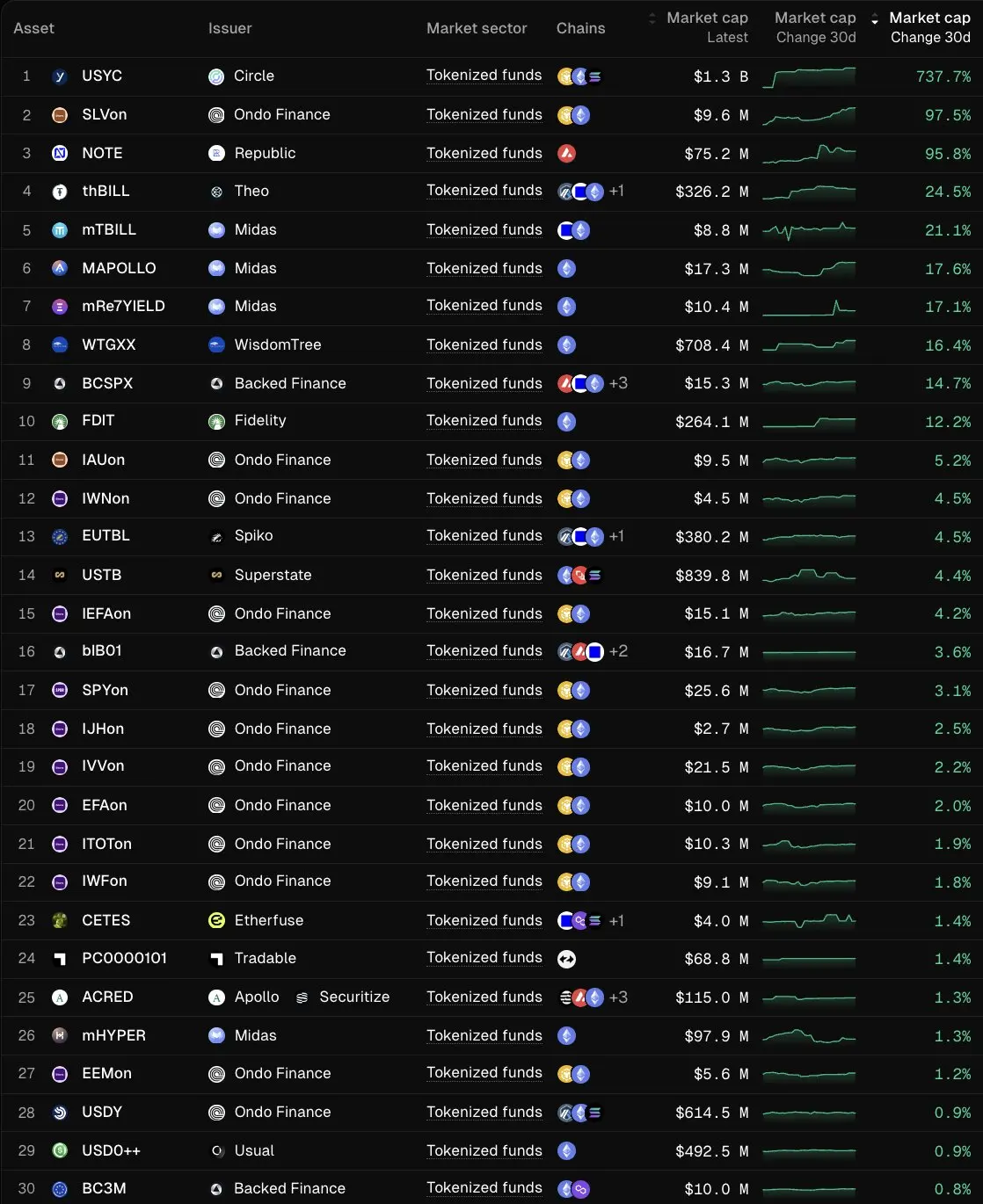

Circle CEO: Tokenized Fund USYC Sees 737.7% Market Cap Growth in the Past 30 Days

Data: Hyperliquid open interest reaches $7.73 billions, marking seven consecutive days of growth