Bitcoin is trading above $113,000 following a 2.09% dip, with realized profits reaching $8 billion during April’s surge past $100,000, indicating a consolidation rather than a reversal.

-

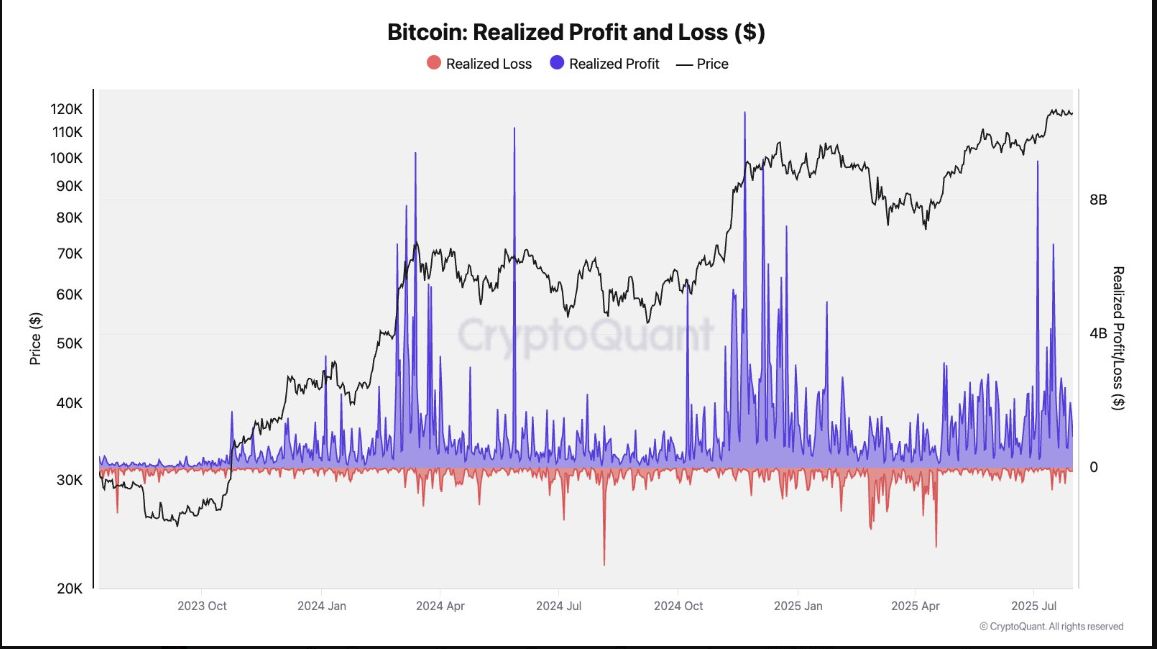

Bitcoin realized profits peaked at $8 billion amid the April 2025 rally above $100K.

-

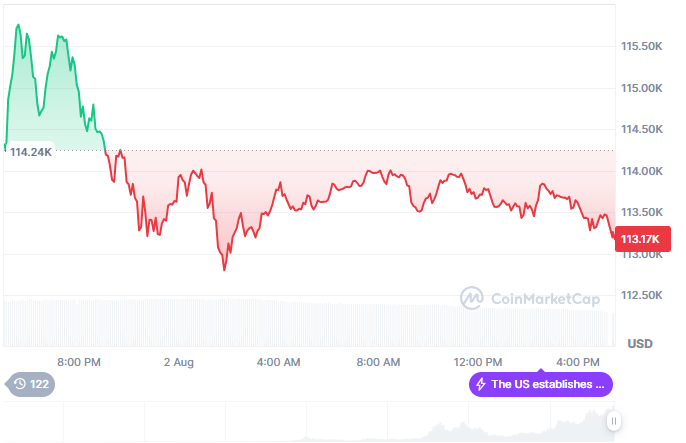

BTC experienced a 2.09% decline in 24 hours as traders secured gains near the $114K resistance level.

-

Realized losses increased in Q1 2025, reflecting exits from late-stage rally participants.

Bitcoin trades above $113K after a 2.09% dip; realized profits hit $8B during April’s surge past $100K. Stay updated with COINOTAG’s latest crypto insights.

-

Bitcoin maintains strong price levels above $113,000 despite recent profit-taking, underscoring market resilience.

-

Realized profits reached historic highs, signaling active trader engagement during key breakout phases.

-

COINOTAG analysts note that the current price dip is a healthy consolidation, not a bearish reversal.

Bitcoin’s recent price action highlights significant profit realization and market stability, reflecting ongoing bullish momentum.

Price Movement Follows Elevated Realized Profit Levels

Bitcoin holders have cashed in profits at some of the highest levels recorded in this bull market. Analyst Cas Abb’s calculations reveal realized profits nearing $8 billion during major breakouts. Notably, profit-taking intensified during March and April 2024 when Bitcoin surged to $70,000, and again in April 2025 as prices surpassed $100,000.

Source: X

Between August 2023 and July 2025, Bitcoin’s value increased over fivefold, reaching nearly $120,000. The brief rally pushed prices above $114,000 before retracing to around $113,000, which now acts as a minor support zone. Meanwhile, the $115,000 level serves as local resistance.

Realized Losses Emerge in Volatile Price Zones

Realized losses, represented by red spikes on CryptoQuant charts, remained low throughout most of the uptrend. However, from February to April 2025, these losses became more pronounced, indicating some traders exited at lower prices during temporary pullbacks.

Cas Abbé explains that this recent price dip is a pause within a strong upward trend rather than a panic sell-off. The red spikes may reflect short selling by weaker hands, while the overall market momentum remains bullish.

Technical and On-Chain Indicators Suggest Consolidation Phase

Data from CoinMarketCap shows a 25.16% decline in 24-hour trading volume and a 2.09% drop in Bitcoin’s price. The volume-to-market-cap ratio stands at 2.86%, suggesting stable trading conditions despite reduced activity.

Source: CoinMarketCap

Short-term price action has shifted sideways between $113,000 and $114,500. There are no signs of irrational selling, and the decline in realized profits may indicate increased holding behavior. A breakout above $120,000 with minimal profit-taking could propel Bitcoin higher, while a surge in profits at that level might trigger renewed consolidation near $110,000.

What is Driving Bitcoin’s Recent Price Consolidation?

Bitcoin’s recent consolidation is driven by elevated realized profits and cautious trader behavior. After reaching historic profit levels, traders are taking gains, causing minor price pullbacks. However, technical and on-chain indicators suggest this is a healthy pause within an ongoing bullish trend rather than a reversal.

How Do Realized Profits and Losses Affect Bitcoin’s Market Dynamics?

Realized profits represent the value traders secure by selling at higher prices, while realized losses indicate exits at lower prices. Elevated realized profits often lead to short-term pullbacks as traders take gains. Conversely, rising realized losses during volatile periods may reflect weaker hands exiting, which can temporarily increase price volatility but does not necessarily signal a trend change.

Frequently Asked Questions

What caused Bitcoin’s realized profits to peak at $8 billion in April 2025?

Bitcoin’s realized profits peaked due to significant price surges past $100,000, prompting traders to secure gains during this historic rally phase.

How does Bitcoin’s current consolidation affect future price movements?

This consolidation stabilizes the market, allowing traders to reassess positions. If Bitcoin breaks above $120,000 with low profit-taking, it could signal further upward momentum.

Key Takeaways

- Realized profits peaked at $8 billion during Bitcoin’s April 2025 surge past $100,000.

- Recent 2.09% price dip reflects profit-taking near resistance, not a trend reversal.

- Technical and on-chain data indicate a consolidation phase with stable trading conditions.

Conclusion

Bitcoin’s trading above $113,000 amid elevated realized profits highlights a robust market with healthy consolidation. The interplay of profit-taking and stable on-chain indicators suggests continued bullish momentum. Investors should watch key resistance levels for potential breakout opportunities as the market evolves.