VanEck CEO Declares Bitcoin as Digital Gold on Bloomberg

- VanEck CEO labels Bitcoin “digital gold” on Bloomberg live.

- Major institutional endorsement signals credibility for BTC.

- Potential market shifts as BTC hits record highs.

VanEck CEO Jan van Eck called Bitcoin ‘digital gold’ live on Bloomberg on August 1, 2025, underscoring Bitcoin’s role as a valuable digital asset.

VanEck’s endorsement positions Bitcoin as a prime digital asset, influencing market perception and encouraging further institutional investment.

VanEck CEO Jan van Eck declared Bitcoin as “ digital gold ” during a live Bloomberg segment. This reinforced Bitcoin’s narrative as a primary store of value. VanEck manages assets worth $133 billion, significantly credible in crypto investment.

Jan van Eck has led VanEck as a forerunner in crypto ETF development. His statement during the broadcast is seen as a major institutional endorsement. It positions Bitcoin at a forefront as a reliable store of value and confirms the belief that “ Bitcoin is digital gold .”

The immediate market reaction highlighted prospects for increased institutional involvement in Bitcoin. VanEck research indicated Bitcoin surged to all-time highs above $123,000, driven by factors like dollar weakness and legislative support.

Financial implications include potential capital flow into Bitcoin and related markets. The market’s response could drive more firms to recognize Bitcoin as a hedge against economic pressures and currency instability.

The historical precedent set by this assertion may lead to heightened interest from institutional investors. Similar endorsements have previously catapulted Bitcoin into the mainstream asset category with significant financial injections.

Potential outcomes include increased market stability for Bitcoin, further regulatory scrutiny, and technological innovations in the ecosystem. Historical data suggests that endorsements of this level often bolster investor confidence and expand crypto adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

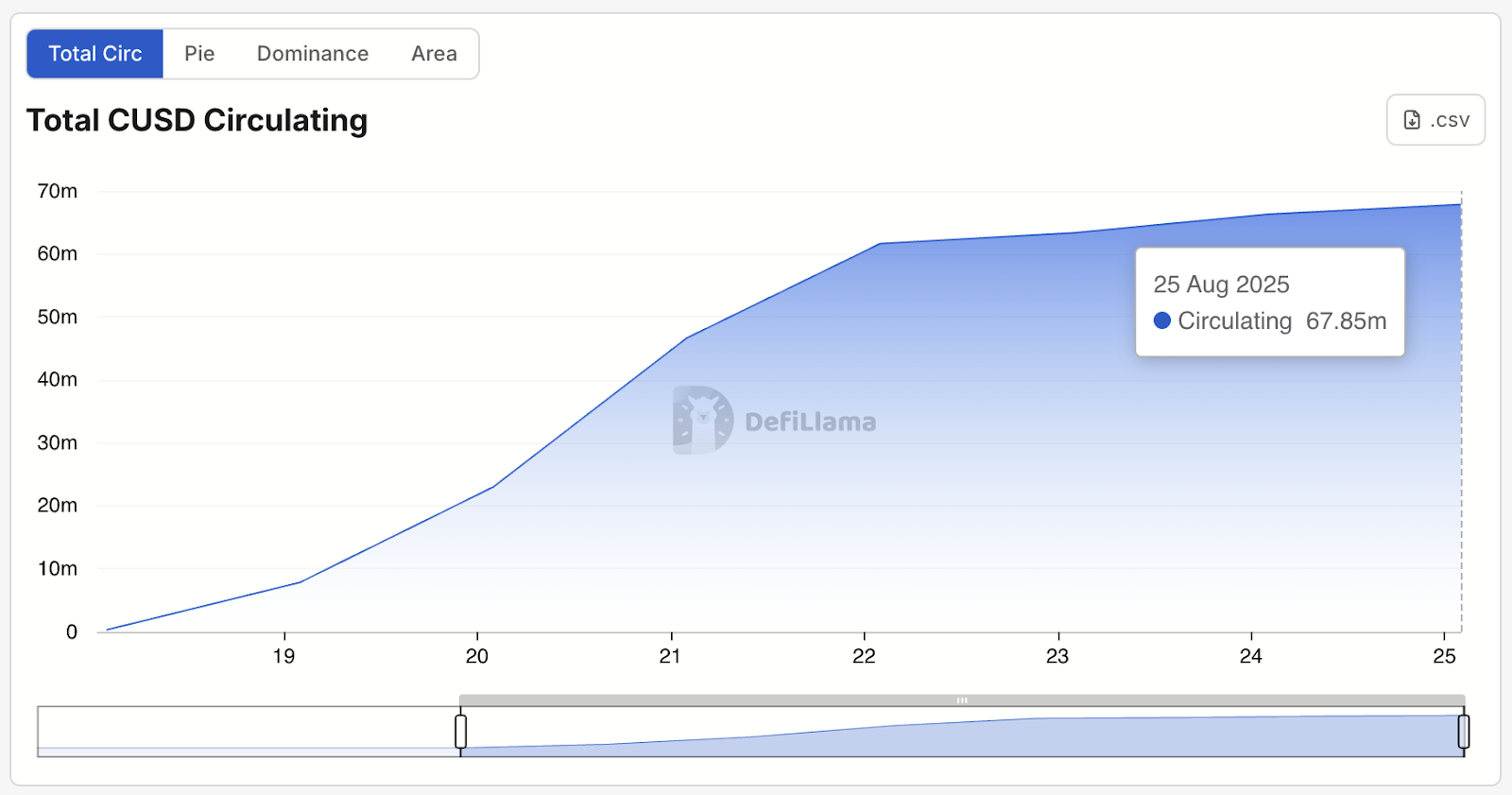

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Metaplanet Acquires 103 BTC, Strengthening Treasury Position