Will Bitcoin Fall to $100,000? Arthur Hayes Thinks So

BitMEX co-founder Arthur Hayes attributes his bearish Bitcoin and Ethereum outlook to weak global credit expansion and a looming U.S. tariff bill.

BitMEX co-founder Arthur Hayes has forecasted a sharp downturn for the crypto market, predicting that Bitcoin could fall to $100,000 and Ethereum to $3,000.

His warning follows a combination of macroeconomic pressures and weak credit creation across global economies.

Crypto Market Hit by $372 Million Losses Following Hayes’ Warning

In an August 2 post on X (formerly Twitter), Hayes attributed his prediction to the upcoming US tariff bill, expected in the third quarter. He also pointed to broader economic challenges as a contributing factor.

Additionally, the BitMEX co-founder pointed out that no major economy is expanding credit quickly enough to boost nominal GDP. According to him, this could lead to a correction in the cryptocurrency market.

Y? US Tariff bill coming due in 3q … at least the mrkt believes that after NFP print. No major econ is creating enough credit fast enough to boost nominal gdp. So $BTC tests $100k, $ETH tests $3k. Come see my @WebX_Asia Tokyo keynote Aug 25 for more info. Back to the beach.

— Arthur Hayes (@CryptoHayes) August 2, 2025

Hayes’ bearish stance seems to align with the broader market sentiment. The total cryptocurrency market capitalization has dropped by more than 3% in the last 24 hours, now standing at $3.76 trillion.

According to BeInCrypto data, Bitcoin experienced significant volatility during the last 24 hours, dipping from nearly $114,000 to a multi-week low of $112,113. However, it has slightly recovered to $113,494 as of press time.

Ethereum followed a similar trend, falling from over $3,500 to $3,373, only to regain some ground.

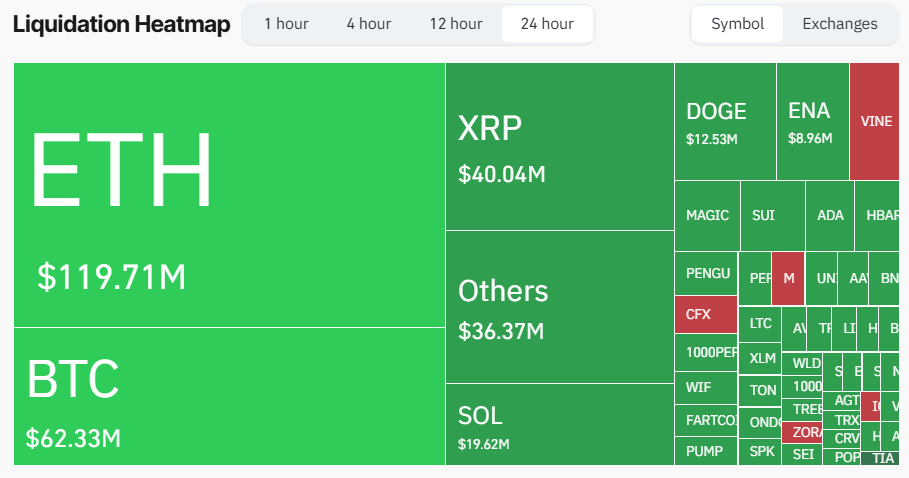

This sharp market downturn has triggered nearly $372 million in liquidations over the past 24 hours, affecting more than 115,000 traders.

Crypto Market Liquidation. Source:

CoinGlass

Crypto Market Liquidation. Source:

CoinGlass

Long traders, betting on a market rebound, dominated the liquidation volume, accounting for around $322 million of the losses.

On the other hand, Short traders, who expected further price declines, saw only $65 million in liquidations.

Across assets, Ethereum led the liquidation sweep, with around $119 million liquidated, followed by Bitcoin at $62 million.

Despite the pullback, Eric Trump, son of US President Donald Trump, encouraged Bitcoin and Ethereum investors to take advantage of the lower prices. He suggested that now is a good time to buy the dip.

Let me say it again: ₿uy the dips!!! $BTC $ETH

— Eric Trump (@EricTrump) August 2, 2025

Notably, his previous advice to purchase Bitcoin during price corrections saw the asset rise by 15%, while Ethereum increased by 20%.

Investors now hope that Trump’s current call will similarly mirror the positive market outcomes of the past.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stunning Bitcoin Price Prediction: Could BTC Really Hit $1.42 Million by 2035?

NEAR Supported on Solana: A Revolutionary Cross-Chain Leap for Users

Bitwise Sees Solana Hitting Records in 2026: Major Rally Incoming?

Intuit USDC Integration: A Revolutionary Step for Crypto Tax and Accounting