XRP OI Up 38%: Where Will Price Go?

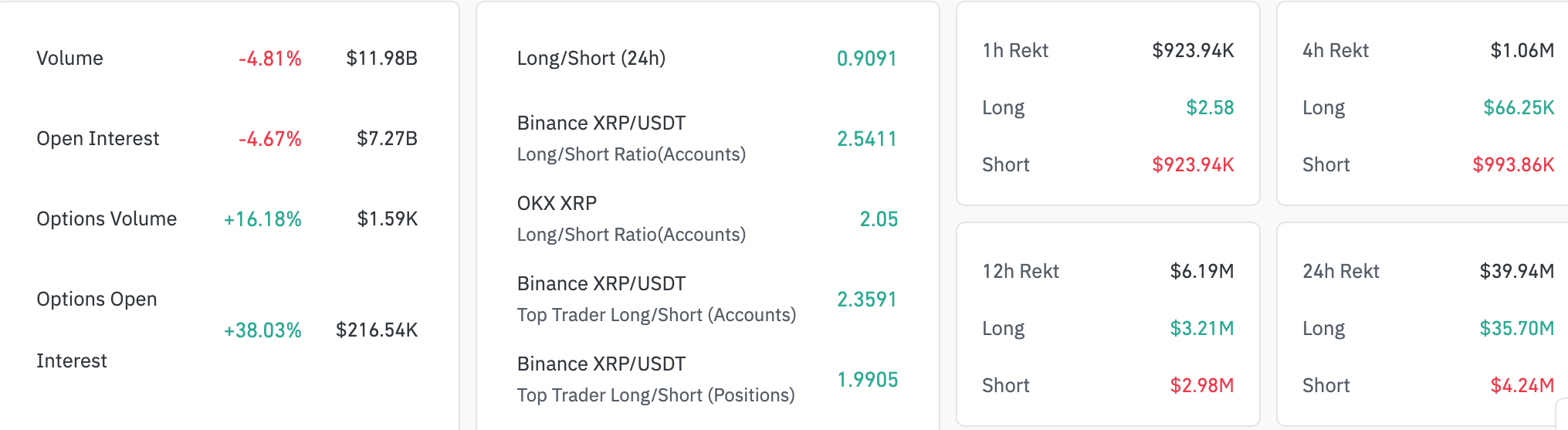

On Sunday, XRP Open Interest soared 38.03%, according to CoinGlass data.

Despite recent price volatility, XRP investors have shown a strong commitment to the asset, with $7.24 billion currently allocated to its futures market.

This level of open interest suggests that many traders are maintaining their positions in anticipation of a potential rebound. The increase in open interest reflects a growing expectation that XRP may recover from its recent downturn.

Alongside futures activity, XRP’s spot trading volume has also risen 12%, according to data by CoinMarketCap.

This indicates that traders could be taking advantage of the dip to accumulate the token.

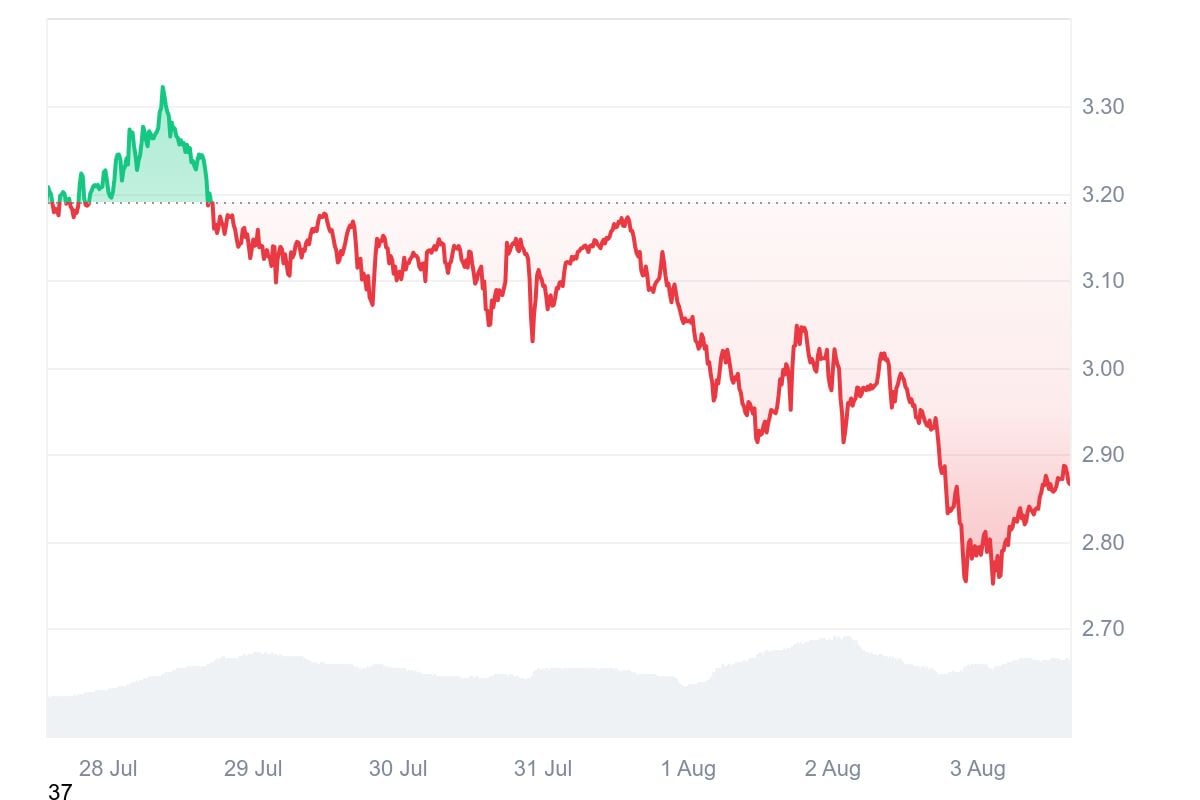

XRP price down 9.5%

Over the past week, XRP’s price has declined by 9.5%, with the majority of losses occurring on Friday and through the weekend.

The sell-off was triggered in part by disappointing U.S. employment data from the Bureau of Labor Statistics.

The July jobs report revealed that only 73,000 positions were added and included a downward revision of 258,000 jobs across May and June. This sparked a wave of risk-off sentiment across financial markets.

As a result, major cryptocurrencies also suffered. Bitcoin dropped 4% to $112,158, while Ethereum and other altcoins, including XRP, followed suit.

It is also possible that the current XRP price drop is due to unconfirmed rumors of crypto ban in China, which appeared on X this Sunday. As reported by U.Today, several prominent social media accounts started sharing news of China banning cryptocurrency trading and mining.

According to popular crypto analyst Ali Martinez, XRP has recently shown a sell signal on the 3-day chart. In his post on X, he highlighted $2.40 as the next key support level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing