Mag 7 Plans to 'FOMO' Into $650B Tech Investment Despite Trump's U.S. Manufacturing Push

While President Donald Trump's tariff war aims to spark a manufacturing boom at home, corporate America's spending focus remains firmly on "bits" rather than "bricks and mortar."

This contrast is evident in the spending patterns of the Magnificent 7 (Mag 7) stocks – a group comprising large-cap tech companies, including Alphabet (parent company of Google), Amazon, Apple, Meta Platforms (parent company of Facebook and Instagram), Microsoft, Nvidia, and Tesla.

These firms are expected to cumulatively spend an astonishing $650 billion this year on capital expenditure (capex) and research and development (RD), according to data tracked by Lloyds Bank. That amount is larger than what the U.K. government spends on public investments in a year, the bank noted in a Thursday note.

If that number alone doesn't impress you, consider this: the total economy-wide investment spending on IT equipment and software has continued to surge this year, accounting for 6.1% of GDP, while both private fixed and fixed non-residential investment, excluding IT, have shrunk for consecutive quarters.

FOMO and AI

According to Lloyds' FX Strategist Nicholas Kennedy, the decline in investments across other sectors of the economy could be due to several reasons, including the fear of missing out (FOMO) on the artificial intelligence (AI) boom.

"There might be some explanations other than a crowding out by IT spending and political/trade uncertainties that you could call on; the building boom that was triggered by Biden's CHIPS act, which boosted structures, has faded, for instance. There is also a FOMO effect at work, firms encouraged to divert investment resources from what they traditionally do towards fashionable AI-related projects. So they're just spending elsewhere," Kennedy said in a note to clients.

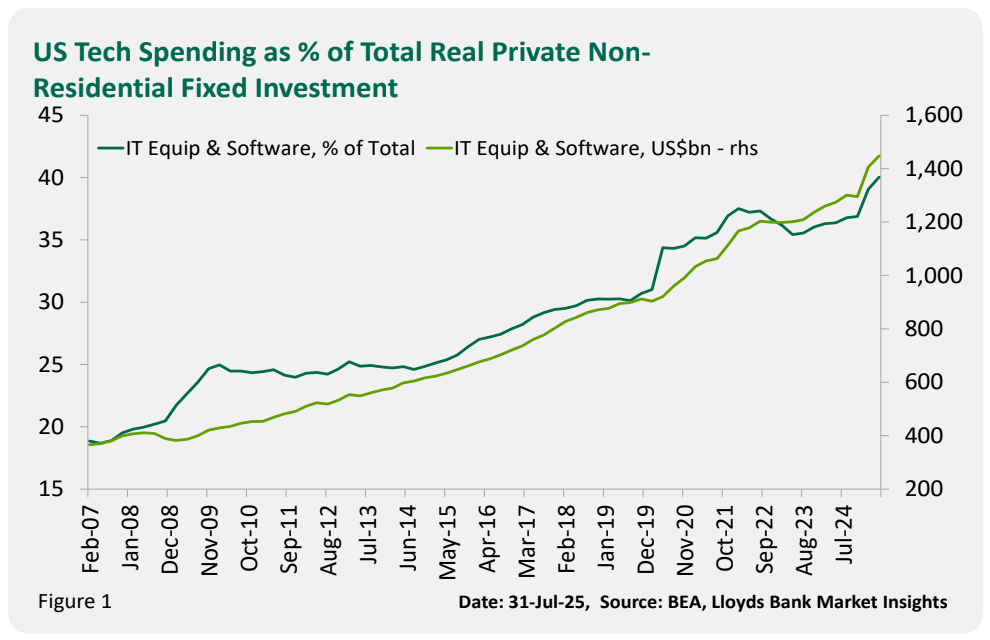

The chart indicates that U.S. corporate spending on IT equipment and software has increased to $1.45 trillion, representing a 13.6% year-over-year rise. The tally makes up over 40% of the total U.S. private fixed investment.

The U.S. second-quarter GDP estimate, released by the Bureau of Economic Analysis early this week, showed that private fixed investment in IT increased by 12.4% quarter-on-quarter.

Meanwhile, investment in non-IT sectors or the broader economy fell by 4.9%, extending the three-quarter declining trend.

From 'bricks' to 'bits'

This continued dominance of "bits" spending in corporate America should calm the nerves of those worried that the administration's focus on manufacturing may suck capital away from technology markets, including emerging avenues like cryptocurrencies.

Bitcoin and NVDA, the bellwether for all things AI, both bottomed out in late November 2022 with the launch of ChatGPT and have since enjoyed incredible bull runs, demonstrating a powerful correlation between technology's rise and the crypto market.

"Whether that [AI spending boom] generates a return is another matter, but it does reshape plans towards bits from bricks," Kennedy said.

Moreover, the crypto market has also found a significant tailwind in the form of a favourable regulatory policy under Trump. The administration has demonstrated its pro-crypto bias through the signing of several key pieces of legislation aimed at clarifying regulatory oversight for digital assets and stablecoins, including measures that have garnered bipartisan support. Additionally, the administration has made strategic appointments to financial regulatory bodies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ’rallies are for selling‘: Top 3 arguments from BTC market bears

XRP bulls grow louder: What will spark the breakout toward $2.65?

Bitcoin gives up $90K at US open as two-week exchange outflows near 35K BTC

Refuting the AI bubble theory! UBS: Data centers show no signs of cooling down, raises next year's market growth forecast to 20-25%

The structural changes in the cost of building AI data centers mean that high-intensity investment will continue at least until 2027, and AI monetization has already begun to show signs.