Trump Media Allocates $2,4 Billion to Bitcoin, Expands Cryptocurrency Exposure

- Trump Media Strengthens Position with Billion-Dollar Bitcoin Purchase

- The company's crypto assets total more than US$3 billion

- Movement may impact institutional adoption of cryptocurrencies

Trump Media & Technology Group, linked to current US President Donald Trump, reported a $2,4 billion investment in Bitcoin, according to financial data for the second quarter of 2025. The Nasdaq-listed company brought its total assets to $3,1 billion following the acquisition.

The robust entry into Bitcoin marks a significant diversification strategy, reinforcing the company's presence in the cryptoasset sector. With this, the group joins the select group of corporations with large amounts of digital reserves, at a time of growing attention to the institutional role of cryptocurrencies.

In the same report, the company also revealed that it achieved positive operating cash flow of US$2,3 million for the first time, although it closed the period with a net loss of US$20 million. The information highlights a possible transition in the group's financial structure, with a greater focus on digital assets as part of the portfolio.

Despite the internal disclosure, there has been no official statement from executives or regulatory bodies regarding the investment. The market, however, is already beginning to consider the implications of this move on potential financial products, such as Bitcoin-based exchange-traded funds (ETFs), as well as adoption in digital wallets.

Trump Media's move was interpreted by analysts as a sign that cryptocurrencies are increasingly present in corporate strategies.

"Strategic investments in Bitcoin by major corporations like Trump Media indicate a growing acceptance of cryptocurrency into traditional business plans, potentially spurring further technological advancements and investment diversification."

The company's stance could also influence political and regulatory decisions in the United States, especially considering President Donald Trump's role in the current administration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

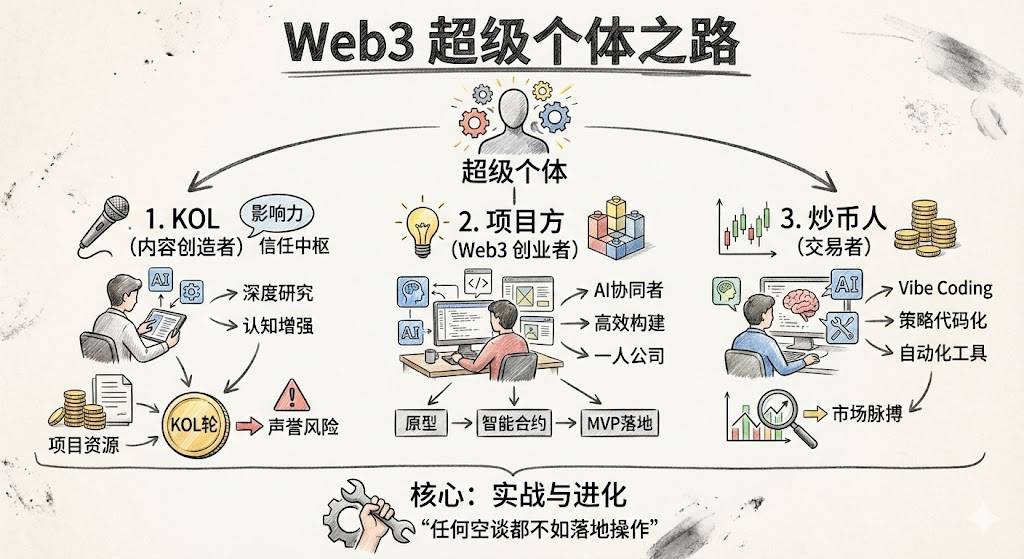

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.