Trump’s crypto-AI tsar David Sacks: AI job loss is ‘overhyped’

White House AI and crypto czar David Sacks has pushed back on growing fears that AI will wipe out large swathes of the workforce, arguing it still relies heavily on human supervision to generate real business value.

His comments come after Microsoft researchers unveiled a list of the 40 positions most likely to be replaced by AI, some of which are roles also found within the crypto industry.

But Sacks said the “AI job loss narrative is overhyped,” pointing out in a Saturday post on X that AI still needs to be prompted and verified to “drive business value.”

AI does the middle-to-middle work, while humans manage the end-to-end processes, he said.

Certain crypto jobs at risk, Microsoft study suggests

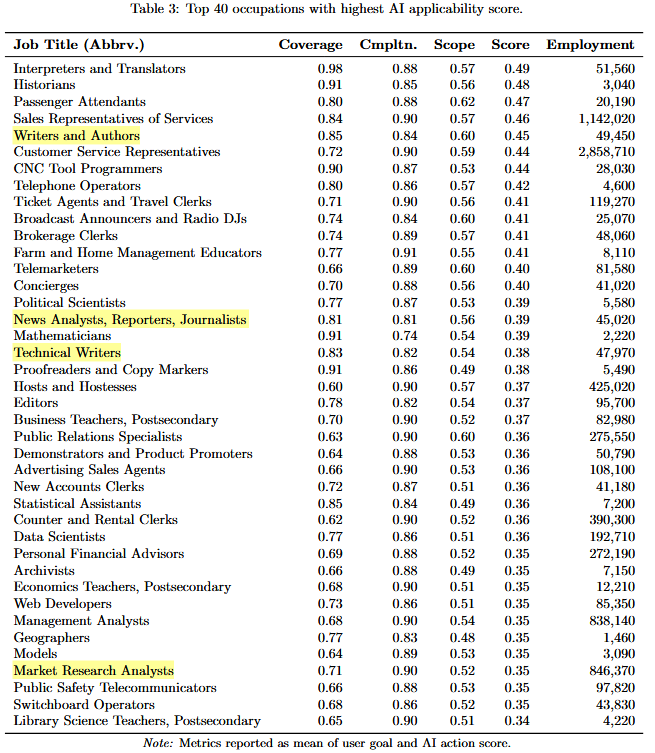

The Microsoft Research study found that knowledge-based occupations such as news analysts, reporters, journalists and technical writers are among the most impacted by AI in the future, roles that can also be found in the crypto industry.

Customer service representatives were also high on the list.

The Microsoft researchers analyzed 200,000 anonymized Microsoft Bing Copilot chats to study real-world AI use, finding it’s mostly applied to information-gathering, writing, advising and teaching.

They then assessed how effectively AI completes specific tasks to calculate an “AI applicability score” for various roles.

The reporting and writing roles received scores between 0.38 and 0.39, while the more href="https://cointelegraph.com/news/bitcoin-dip-making-perfect-bottom-says-analyst-will-btc-rally-to-148k" title="null">market research analyst and data scientist roles were on the lower end of the spectrum, between 0.35 and 0.36.

The study comes as the US Department of Labor reported just 73,000 new jobs added in July — far short of the 100,000 estimates by Dow Jones.

As for crypto, just 38 new positions were added to the CryptoJobsList.com board in July, while Remote3.co added 69.

Sacks in agreement with crypto entrepreneur

Sacks reached his conclusion after citing a post from former Coinbase chief technology officer, Balaji Srinivasan, who challenged some of the most prominent narratives about AI replacing human jobs.

Balaji argued that AI is still constrained: “Today’s AI is not truly agentic because it’s not truly independent of you,” he said, adding: “AI doesn’t take your job, it lets you do any job.”

If it replaces anything, it’s the job of the previous AI, Balaji said:

“For example: Midjourney took Stable Diffusion’s job, and GPT-4 took GPT-3’s job. Once you have a slot in your workflow for AI image generation, AI code generation, or the like, you just allocate that spend to the latest model. Hence, AI takes the job of the previous AI.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.