Life of Pi Coin Could Get Easier If One Key Divergence Plays Out

Pi Coin is showing early signs of recovery after a steep decline. A hidden bullish divergence, easing bear momentum, and rising sentiment may offer bulls a narrow window; if key resistance breaks.

While the rest of the crypto market searches for coins pushing all-time highs, the Pi Coin (PI) price has been busy doing the opposite, notching fresh lows, one after another. The PI token is down 1.2% in the past 24 hours, and nearly 25% over the last month. The latest all-time low? Just yesterday.

However, some technical signals now indicate that the PI price may be approaching a short-term reversal. One particular divergence on the chart, paired with weakening sell pressure and rising sentiment, could be the turning point.

Bears Losing Their Edge as Bull-Bear Power Shifts

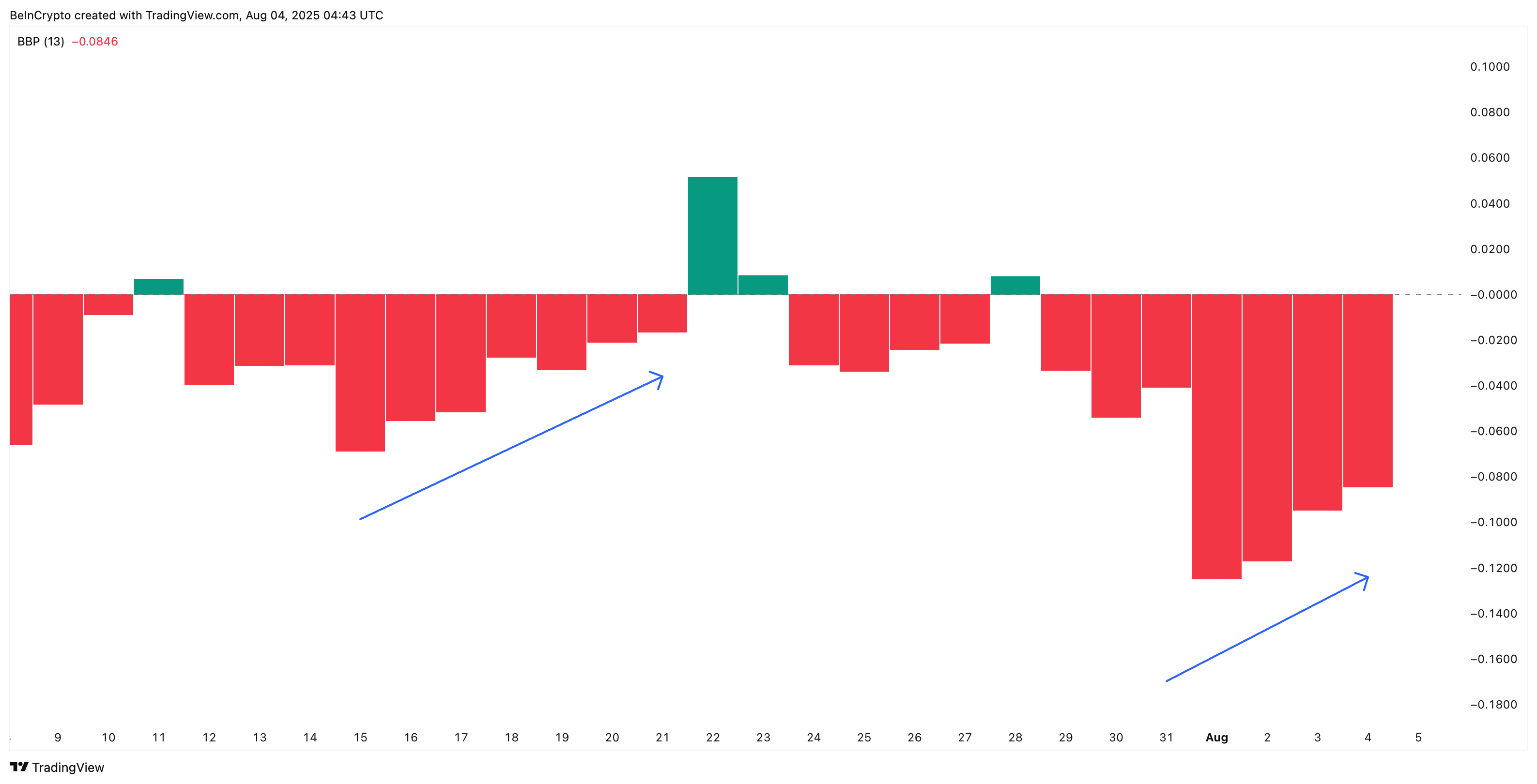

Sellers have had firm control over PI’s trend for weeks. That’s why the Bull-Bear Power (BBP) indicator is important right now. When bearish strength starts fading after an extended downtrend, it can often signal that sellers are running out of steam.

That’s what the chart is beginning to show. BBP has been rising since August 1, shifting from a deeply negative zone to a less aggressive print, similar to what happened between July 15 and 21. Back then, the fading bearish momentum preceded a move from $0.45 to $0.52.

PI price and weakening bearish strength:

PI price and weakening bearish strength:

The Bull-Bear Power indicator tracks the difference between the highest price and a short-term moving average to show whether bulls or bears are currently in control.

Supporting this is social dominance, which measures how much of the crypto conversation is about PI. Between August 1 and 3, PI’s social dominance formed a three-day streak of higher highs, just like it did between July 15 and 23. That earlier stretch aligned with a local price bottom and led to that surge to $0.52.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin price and social dominance:

Pi Coin price and social dominance:

The alignment of sentiment and weakening bearish strength now adds weight to the idea that the PI price may be preparing for another leg up.

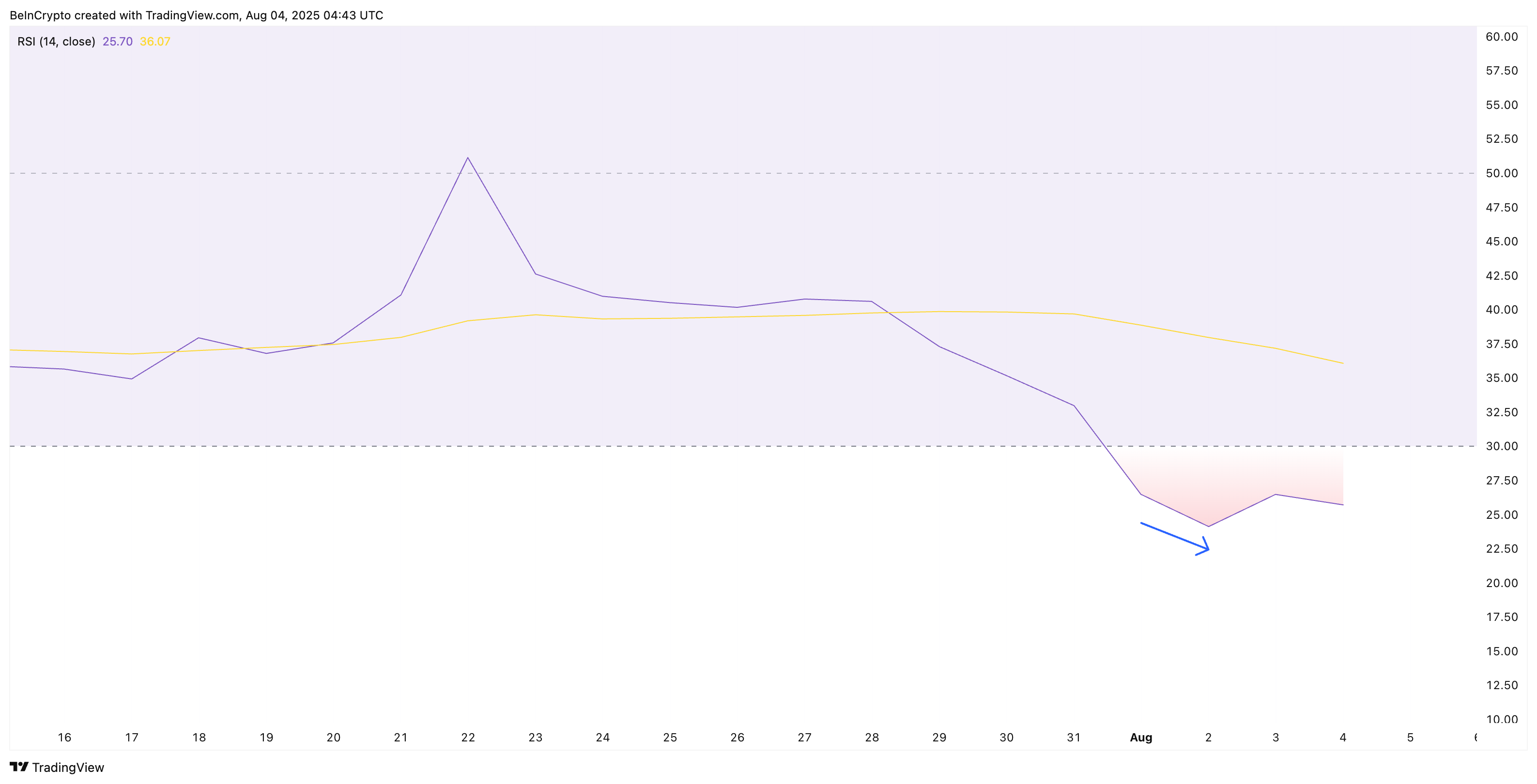

RSI Shows Bullish Divergence, But Pi Coin Price Needs to Respond

The Relative Strength Index (RSI) is currently at 23.37, indicating oversold territory. But beyond the number, the pattern it’s forming matters more.

PI’s price recently made a higher low, while the RSI made a lower low. This setup is known as a hidden bullish divergence, and it’s often seen before local bottoms.

PI RSI divergence:

PI RSI divergence:

At first glance, a falling RSI might seem bearish. But when price doesn’t follow it lower, that’s usually a sign that downside momentum is weakening, even as sellers try to push. It shows that supply pressure is failing to drag the price further, which can be a bottoming signal.

Still, this kind of RSI divergence alone doesn’t confirm a bounce, especially when PI Coin’s price is declining. It is more like a subtle early sign.

For that, the price needs to move through the resistance.

RSI is a momentum oscillator that tracks the speed and change of price movements. Readings below 30 often signal an oversold asset with potential for reversal.

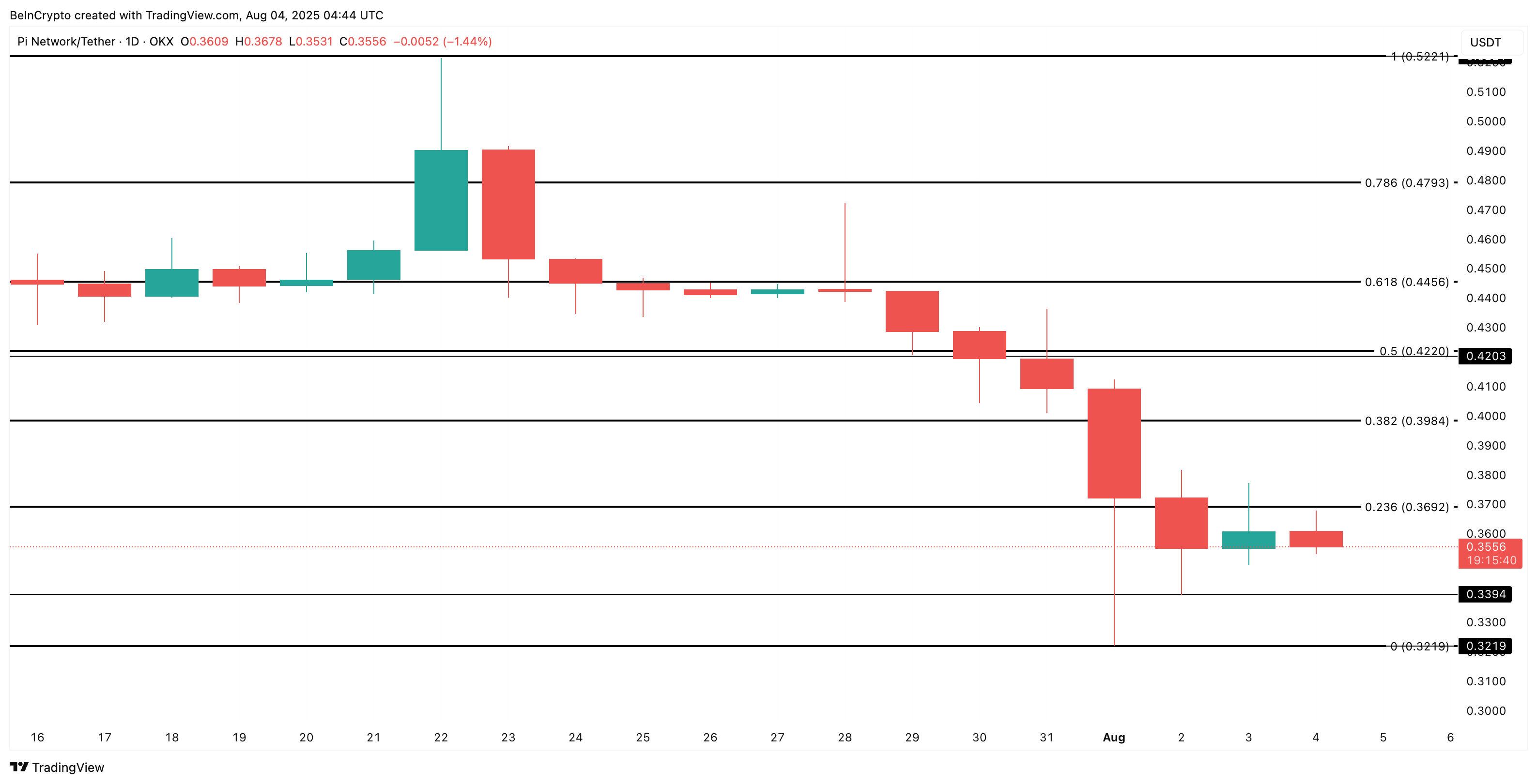

PI Price Must Clear $0.369 to Signal Breakout

The Pi Coin price is currently trading around $0.35. Based on the Fibonacci retracement drawn from the July 22 high ($0.52) to the July 31 low ($0.32), the next major resistance lies at $0.36, followed by $0.39, and $0.42.

Pi Coin price analysis:

Pi Coin price analysis:

A daily close above $0.39 would be the first sign that the bulls are back in control. But if PI breaks below $0.32, the bullish divergence setup would be invalidated, and the trend may continue lower.

Until then, Pi Coin’s chart may still look heavy, but for the first time in weeks, there’s reason to believe its trajectory could shift. However, this probable shift needs to be backed by an improvement in RSI (possibly a higher high or a lower high) and a further dip in bearish pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Refuting the AI bubble theory! UBS: Data centers show no signs of cooling down, raises next year's market growth forecast to 20-25%

The structural changes in the cost of building AI data centers mean that high-intensity investment will continue at least until 2027, and AI monetization has already begun to show signs.

The Base-Solana Bridge Dispute: "Vampire Attack" or Multichain Pragmatism?

The root of the contradiction lies in the fact that Base and Solana occupy completely different positions in the "liquidity hierarchy."

Stable TGE tonight: Is the market still buying into the stablecoin public chain narrative?

According to Polymarket data, there is an 85% probability that its FDV will exceed 2 billion USD on the day after its launch.

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.