Date: Mon, Aug 04, 2025 | 06:10 AM GMT

The cryptocurrency market is showing signs of recovery after the recent sharp sell-off, with Ethereum (ETH) bouncing back to $3,532 from its recent low of $3,357. This renewed momentum is spilling over into the altcoin market — and one standout to watch is Algorand (ALGO).

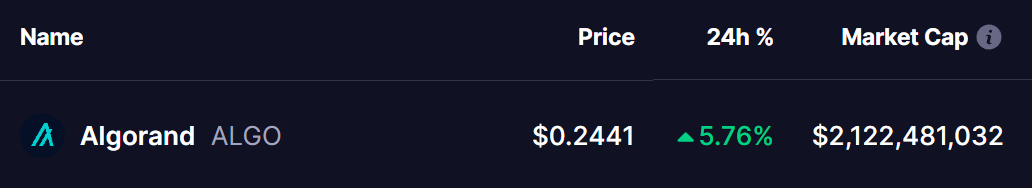

ALGO is up around 5% today, but beyond the short-term bounce, what’s grabbing attention is the chart — which is now revealing a striking bullish fractal pattern eerily similar to a past setup that led to a major rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

Zooming in on the daily chart, ALGO seems to be repeating a late 2024 fractal — a pattern that previously led to a massive 333% move.

Last time, ALGO broke out of a large falling wedge, followed by a smaller wedge breakout, reclaimed both the 50-day and 200-day moving averages, and then pulled back slightly to retest the 200 MA — holding firm before launching higher. That entire sequence is marked by the first green circle on the chart.

Algorand (ALGO) Fractal Chart/Coinsprobe (Source: Tradingview)

Algorand (ALGO) Fractal Chart/Coinsprobe (Source: Tradingview)

Fast forward to now, and the price action is showing an almost mirror reflection.

ALGO has again broken above a long-standing falling wedge, followed by a second mini wedge breakout, reclaimed its 50 & 200 MAs, and is currently undergoing a healthy pullback — once again landing in the same price zone as its previous launchpad (circled again on the current chart).

What’s Next for ALGO?

The immediate focus is on the 200-day moving average, now sitting near $0.2335 — a level ALGO has just reclaimed. If this support holds and buyers step in, the fractal suggests a potential breakout move toward the ascending trendline — possibly targeting the $1 area, representing a ~300% upside from current prices.