Key takeaways

- CFX is down 2% in the last 24 hours and risks dropping below $0.20 soon.

- The coin rallied to a high of $0.27 last week amid growing adoption buzz in China.

CFX dips 2% after outperforming the market

CFX, the native coin of the Coinflux blockchain, is underperforming despite the broader crypto market rallying over the last few hours. The coin has lost nearly 2% of its value in the last 24 hours and risks dropping below $0.20 soon.

This poor performance comes after the coin rallied by 14% last week, hitting a high of $0.27. Its rally comes as analysts predict the coin’s adoption in China as the country warms up to stablecoins.

Reports suggest that Conflux is prepping an offshore-yuan stablecoin, which could make it one of the first stablecoin projects in China. The buzz contributed to CFX adding over 190% to its value over the last 30days.

While CFX has performed excellently over the last few weeks, the coin is still 87% down from the all-time high of $1.70 it achieved four years ago.

CFX could drop below $0.20 soon

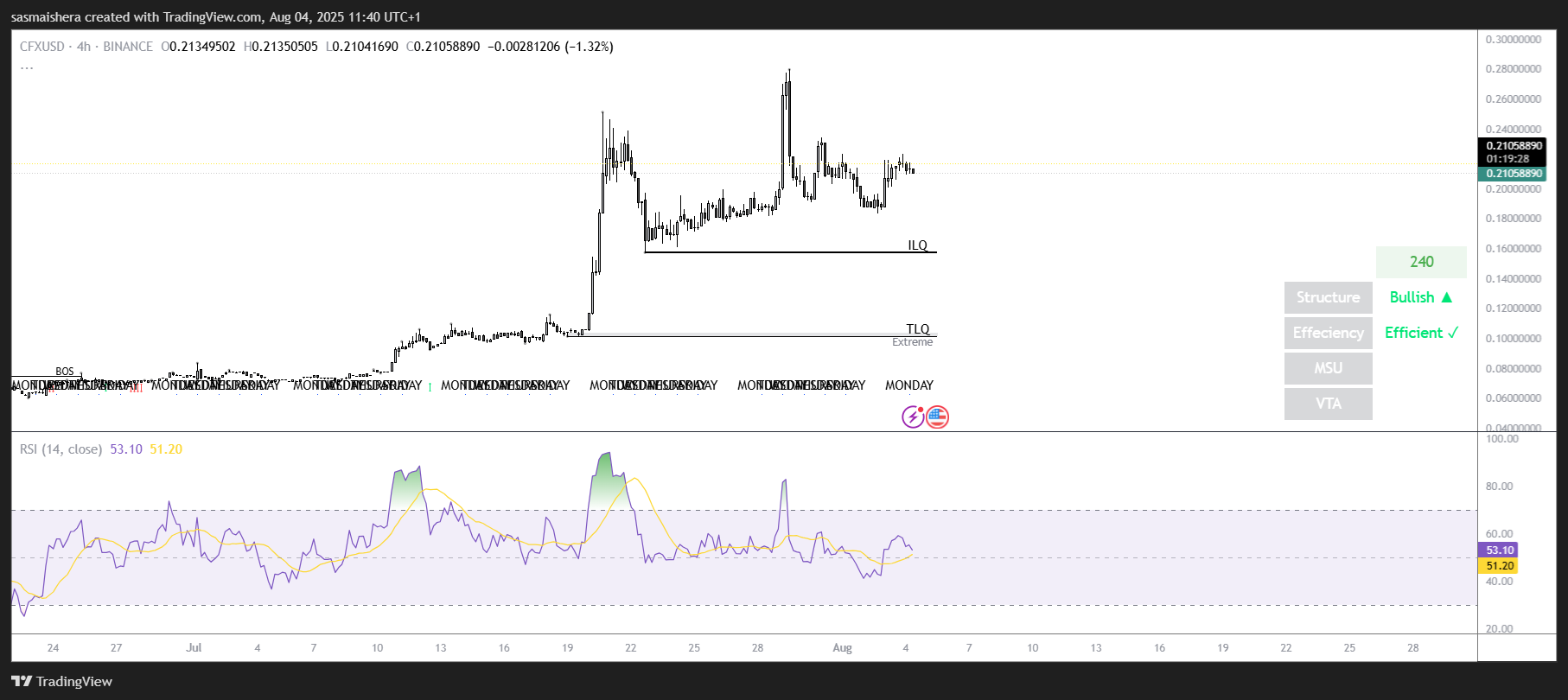

The CFX/USD 4-hour chart is bullish and efficient, as CFX has been performing excellently over the last few weeks. However, the coin could undergo further correction before rallying higher.

The technical indicators remain bullish, suggesting that buyers are in control. The RSI of 52 shows a fading bullish momentum, while the MACD lines are also approaching the neutral zone.

At press time, CFX is trading at $0.2097. If the correction persists, CFX could retest the Inducement Liquidity (ILQ) at $0.159 in the coming hours or days. Failure to defend this level could see CFX drop to the major support level at $0.102.

However, the CFX/USD pair is bullish and could resume its rally soon. If the bullish momentum returns, CFX could take out last week’s high of $0.2789 before hitting the $0.30 mark for the first time since April 2024.