Bitget Daily Digest(8.5)|Fed’s Daly Says Rate Cuts Are Near, Potentially More Than Twice This Year; ETH ICO Whale Stops Year-long Selling, Starts Accumulating; Verb Technology Plans $558M Private Pla

Daily Outlook

-

Spectral (SPEC): Around 3.62 million tokens to be unlocked today, representing 17.57% of current circulating supply.

-

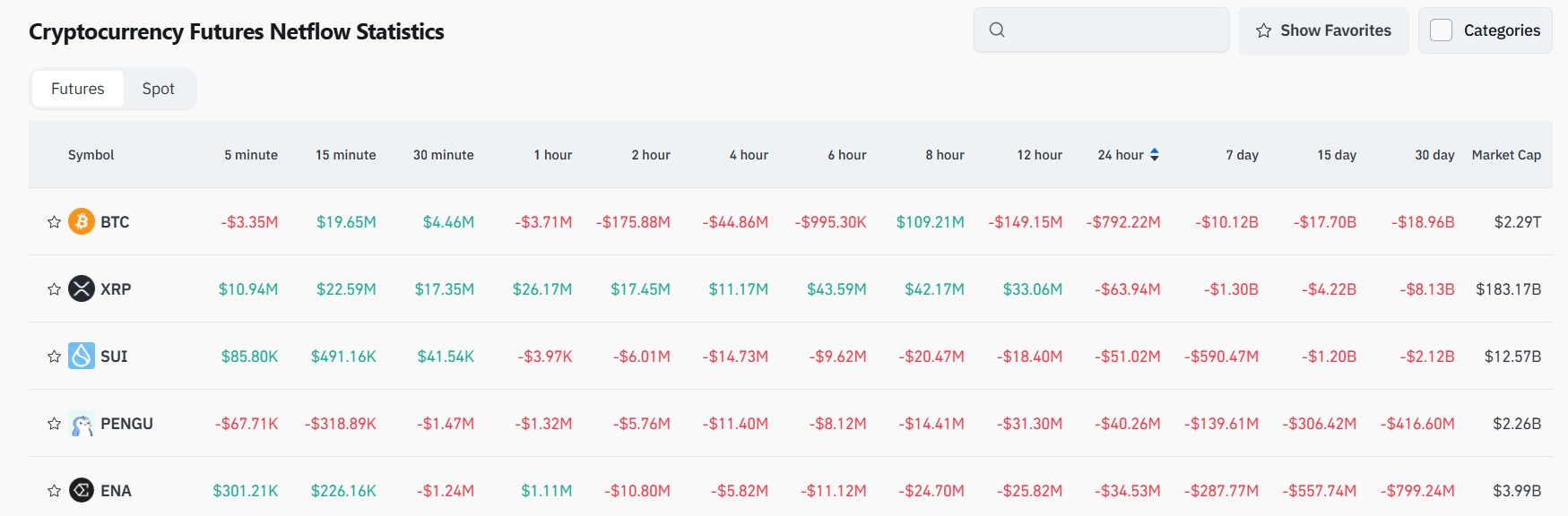

Ethena (ENA): Around 172 million tokens to be unlocked, equal to 2.70% of circulating supply.

-

US June Trade Balance: Data to be released today, previous figure: -$71.5 billion.

Macro & Hot Topics

1. Fed’s Daly: Rate Cuts Are Approaching, More Than Two Cuts Possible This Year2. Hyperliquid Achieves All-Time High Trading Volume in July, Nearing $32B

3. Verb Technology Announces $558M PIPE, Plans First Listed TON Treasury Company

4. ETH ICO Whale Switches from Selling to Accumulating, Adds 13,600 ETH in Three Weeks

Market Performance

Institutional Views

-

Greeks.Live: “ETH breaking $4,000 in the next two months will be key to sustaining the bull market.” Source

-

CryptoQuant: “We expect two more rate cuts this year, which should provide two more major upside opportunities in this cycle’s bull market.” Source

News Highlights

-

CME FedWatch: Odds of a September Fed rate cut rise to 94.4%.

-

WSJ: White House to issue executive order to penalize banks discriminating against crypto companies and conservatives.

-

Fed’s Daly: Rate cuts likely imminent, with odds of more than two cuts this year.

-

Trump: Vows to significantly raise tariffs on Indian goods.

-

France’s Right-wing Party: Proposes using surplus nuclear energy to mine Bitcoin.

Project Updates

-

BONK: Burned 300B tokens early this morning.

-

PUMPFUN: Testing “Rewards” on its website, volume incentives coming soon.

-

Sky: Repurchased 16.55M SKY tokens with 1.39M USDS in the past week.

-

SharpLink Gaming: Increased ETH holdings by 18,680 to total 498,884 ETH.

-

Solana: Launches Seeker mobile device in 50+ countries/regions.

-

Hyperliquid: July trading volume hits all-time high, near $32B.

-

WOOFi: Burned over 2M WOO tokens.

-

Cardano: Community approves “IOE Roadmap.”

-

Lido Co-Founder: Contributor team to be reduced by about 15%.

-

SEC vs Ripple: Legal experts say SEC response in the XRP case due in days.

X Trends

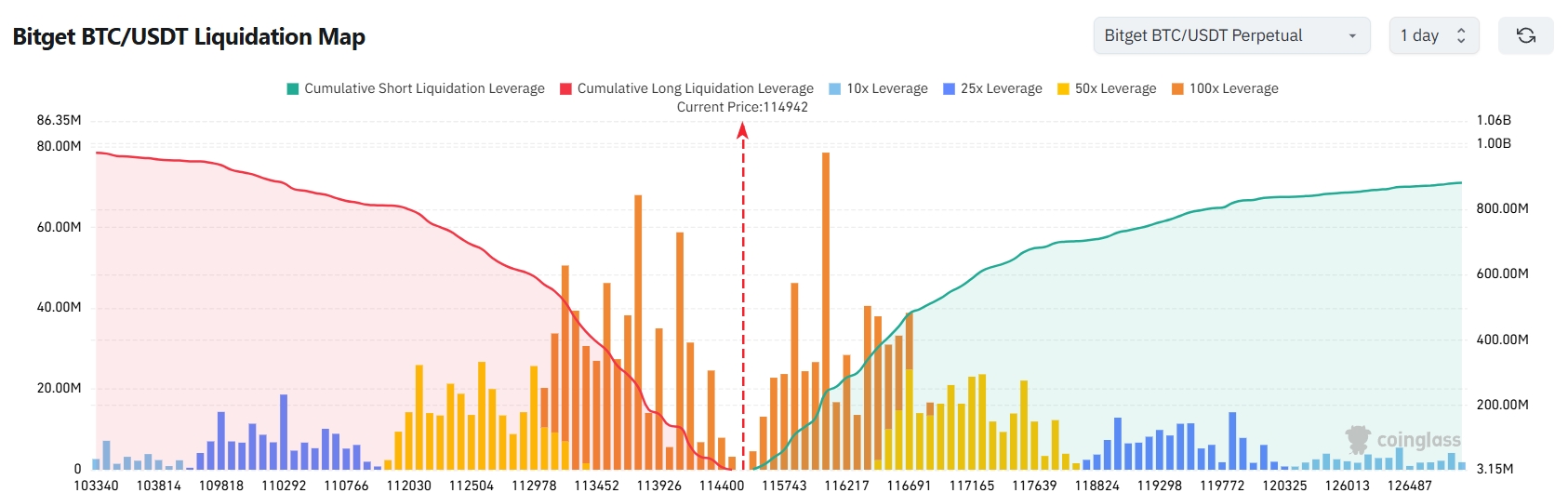

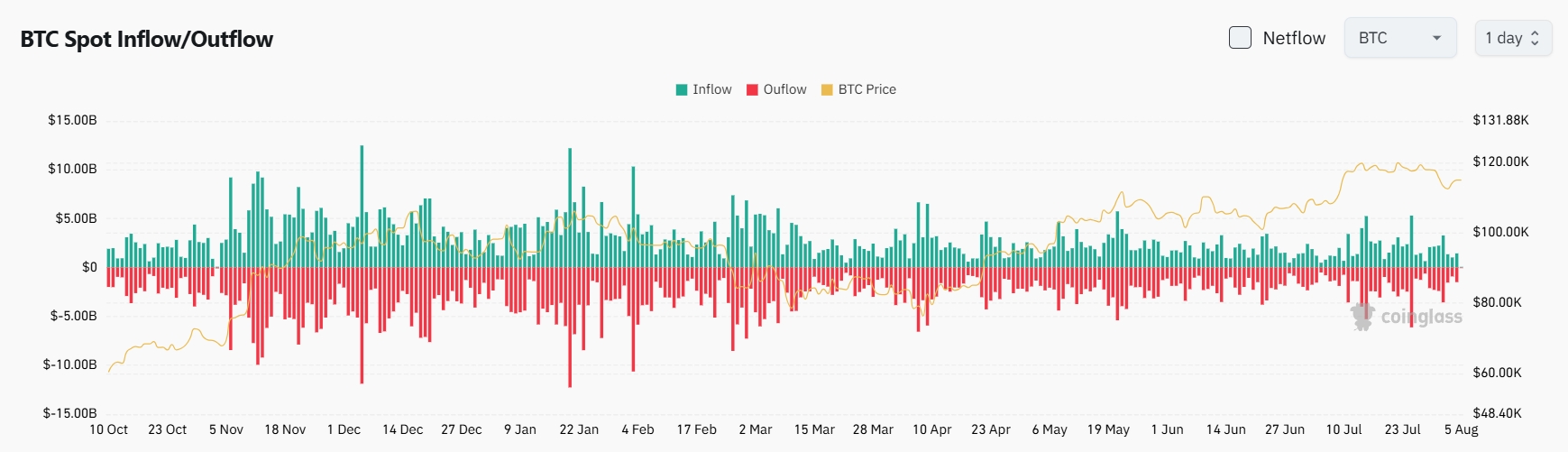

1. Crypto_Painter: BTC Spot Premium Drops, Bearish Sentiment Rising, but Technicals Remain Pressured

2. Millionaire Eric: Don’t Chase Breakouts—The Real Buy is on the Retest

3. AB Kuai.Dong: Ethereum in Institutional Accumulation Mode as SEC and Wall Street Backing Rises

4. Phyrex: US Stocks Recover as Trump’s Aggressive Policies Gain Focus; BTC Stable, All Eyes on September FOMC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...