Date: Tue, Aug 05, 2025 | 06:24 AM GMT

The cryptocurrency market is making a slight recovery from the latest sharp decline as the price of Ethereum (ETH) has bounced to $3675 from its recent low of $3357. Following this rebound, several altcoins have started moving higher — including Polygon (POL).

POL has returned to the green today with 7% daily gains, extending its monthly rally to 19%. Its chart is now displaying a key harmonic formation that could point to more upside ahead.

Source: Coinmarketcap

Source: Coinmarketcap

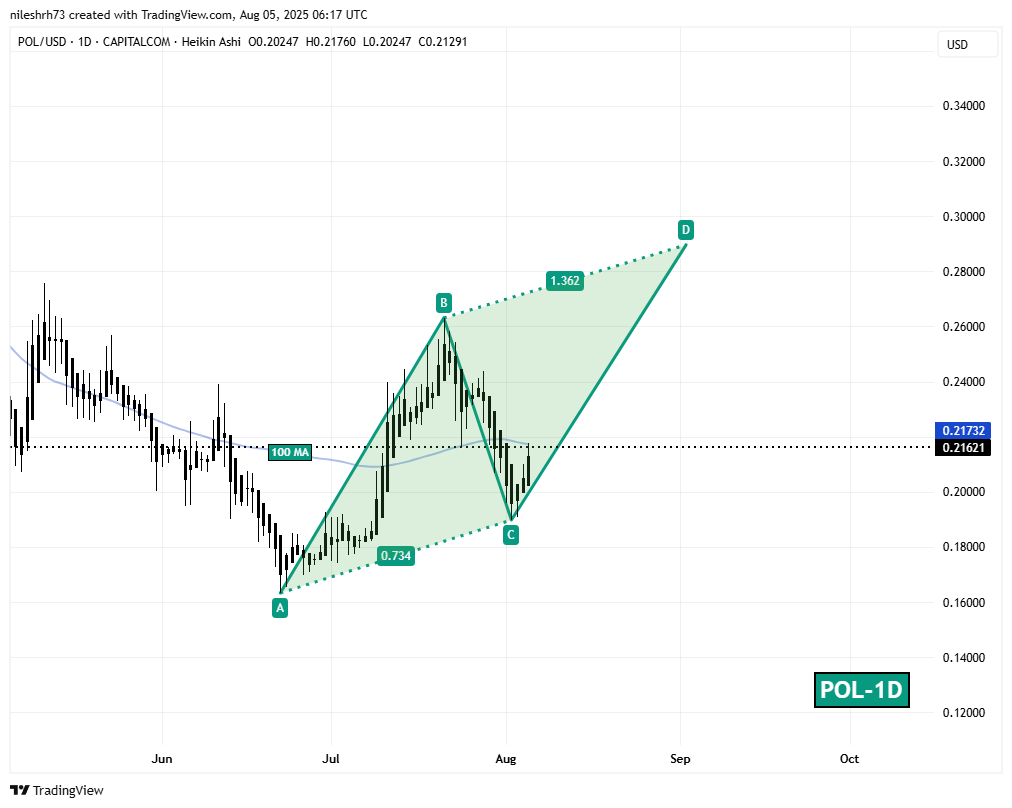

Harmonic Pattern Hints at Potential Bounce

On the daily chart, POL is shaping a Bearish ABCD harmonic pattern — a setup that, despite its name, can involve a strong bullish CD-leg before the final Potential Reversal Zone (PRZ) is reached.

The pattern began with a rally from Point A near $0.1633 to Point B, followed by a retracement to Point C around $0.1898, where buyers stepped back in. Since then, POL has rebounded and is now trading near $0.2161, indicating that the CD leg is underway.

Polygon (POL) Daily Chart/Coinsprobe (Source: Tradingview)

Polygon (POL) Daily Chart/Coinsprobe (Source: Tradingview)

The 1.36 Fibonacci extension of the BC leg — marking Point D — sits around $0.2896, which is the key target bulls are watching. Adding strength to the bullish case, POL is nearing the 100-day moving average (100 MA) at $0.2173. A decisive breakout above this resistance could validate the pattern and attract more momentum-driven buying.

What’s Next for POL?

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.