SEC Issues Interim Guidance Recognizing Some Stablecoins as Cash Equivalents

In a landmark move that could reshape how companies account for digital assets, the U.S. Securities and Exchange Commission (SEC) has issued interim guidance permitting certain U.S. dollar-backed stablecoins to be treated as cash equivalents on corporate balance sheets.

In a landmark move that could reshape how companies account for digital assets , the U.S. Securities and Exchange Commission (SEC) has issued interim guidance permitting certain U.S. dollar-backed stablecoins to be treated as cash equivalents on corporate balance sheets.

Reported by Bloomberg Tax on August 5, the update marks a significant shift in the SEC’s stance toward digital currencies and is part of a broader effort by the agency, under the leadership of SEC Chair Paul Atkins, to modernize cryptocurrency regulation. The newly issued guidance outlines strict qualifying criteria—only stablecoins that are fully backed by cash or short-term Treasury bills, maintain a consistent 1:1 peg with the U.S. dollar, and offer guaranteed redemption rights will be eligible for the favorable accounting treatment.

🚨JUST IN: SEC updates staff guidance on accounting rules for USD stablecoins: Bloomberg

This fresh new guidance suggests that stablecoins pegged to the U.S. dollar could receive cash equivalent classification, contingent on having guaranteed redemption mechanisms and value… pic.twitter.com/nfbCwpldrz

— Greg Acero (@4Acezz) August 5, 2025

By meeting these conditions, the stablecoins are considered to carry a similar risk profile to traditional cash equivalents such as money market funds. However, the policy explicitly excludes algorithmic stablecoins, yield-bearing tokens, and any digital assets not directly tied to the dollar.

The SEC’s updated stance marks a notable departure from its earlier restrictive policies, which had previously discouraged many traditional financial institutions from engaging with stablecoins due to accounting uncertainties.

This move aligns closely with recent legislative developments—particularly the July passage of the GENIUS Act , signed into law by President Trump. The Act mandates public audits and reserve requirements for regulated stablecoins, officially designating them as a distinct financial instrument—neither a security nor a commodity. As a result, major issuers like Circle (USDC) and Tether (USDT) are now navigating a more defined regulatory landscape.

Despite this progress, the SEC noted that the current guidance is temporary and will likely be followed by formal rulemaking under its ongoing “Project Crypto” initiative. The project aims to establish clearer classification standards for digital assets and enhance corporate disclosure requirements.

Market observers remain cautious, however, pointing to unresolved issues around transparency, redemption risk, and the potential misuse of stablecoins in illicit financial flows. Questions also linger regarding the treatment of complex or non-U.S. stablecoin structures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PhotonPay wins the Adam Smith Award for its innovative foreign exchange solutions, reshaping the global forex management landscape

How does PhotonPay collaborate with JPMorgan Kinexys to leverage blockchain technology for 24/7, automated global fund allocation?

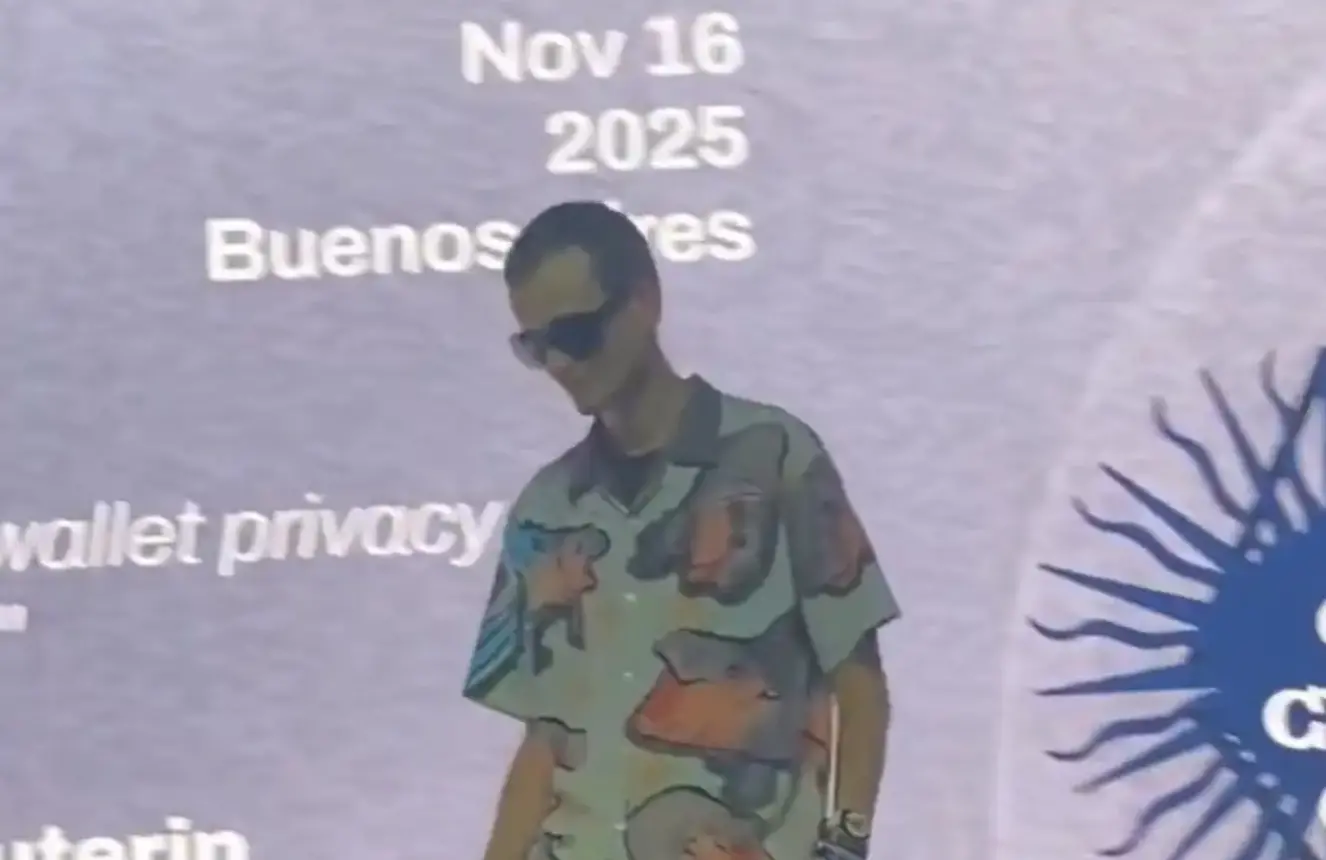

Compliant privacy: What is the latest Ethereum privacy upgrade, Kohaku?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."

Danny Ryan: Wall Street needs decentralization more than you think, and Ethereum is the only answer

A former Ethereum Foundation researcher provided an in-depth analysis during the Devconnect ARG 2025 talk, explaining how eliminating counterparty risk and building L2 solutions could enable the management of 120 trillion in global assets.

Crypto Freeze: A Complete Technical Analysis of BTC and ETH